|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Trend 07/10

Gold Trend 07/10

2021-10-07 @ 13:32

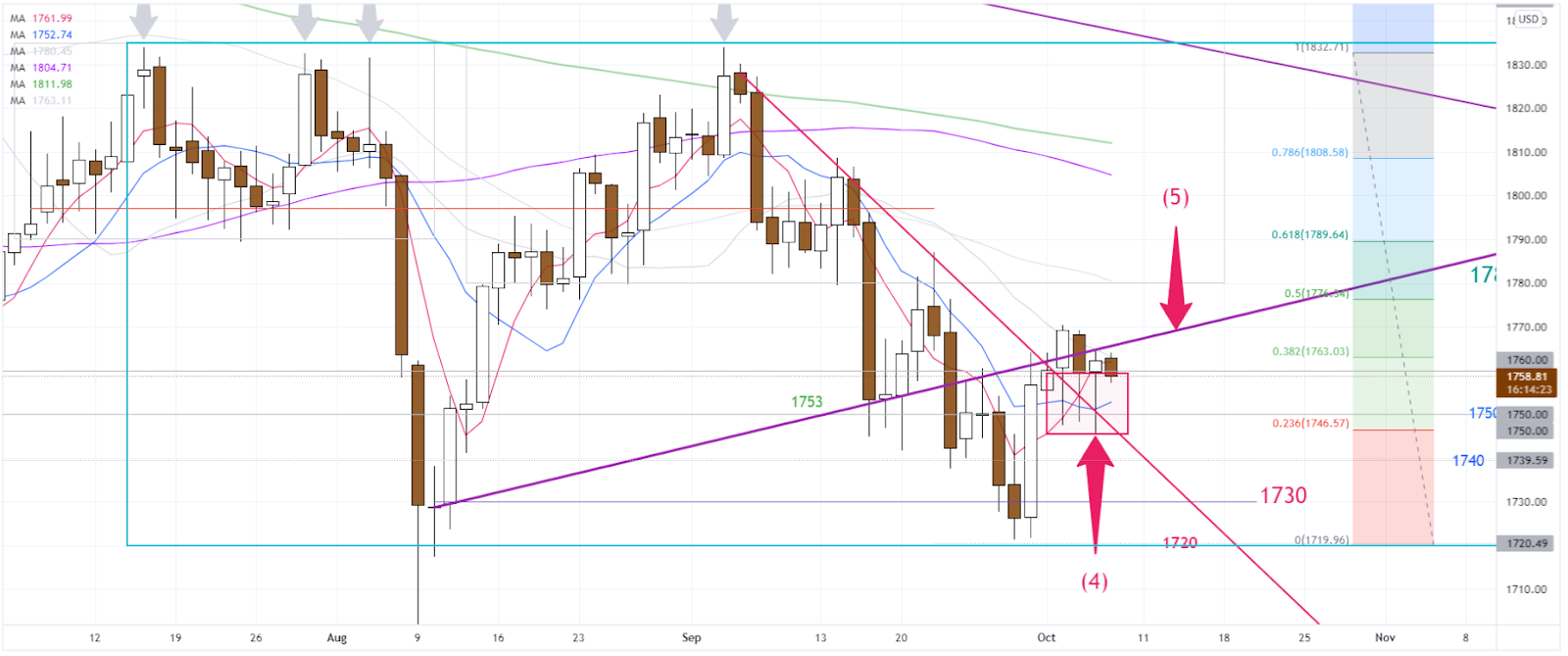

Gold slipped slightly yesterday. The intraday movement was quite similar to the previous trading days. The price basically had fallen during the Asian/European session and rallied from the bottom during the US session. Once again the market was able to close above 1760 yesterday, ended at 1762.

The gold price has been trading within 1746-64(1) in the past 24 hours, In line with our expectation yesterday. The upward momentum has slowed down further, as the support lines have shifted from (3.1) to (3.1) and now the lastest (3.3). While the price is maintaining its path with 1746-64(1), there is no clear direction on the 1-hour. Until the price breaks out from the range(1), range-bound will be the primary strategy.

The gold price has been testing the lows in the past 3 trading days, but the market is able to rebound every single day during the US session. Support below 1760(4) is quite obvious. The next jump will begin once the price breach the resistance line(5). In case the market turns south, 1745 will be the support level to pay close attention to.

S-T Resistances:

1770

1764

1760

Market price: 1759

S-T Supports:

1755

1750-21

1744-45

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.