|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Trend 08/10

Gold Trend 08/10

2021-10-08 @ 13:34

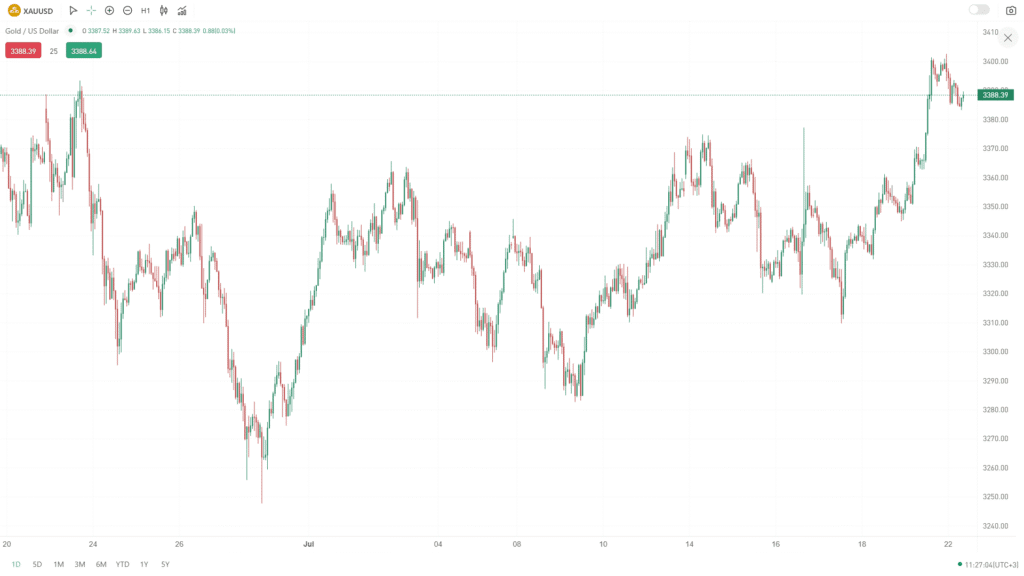

Gold traded in a relatively tight range yesterday. The market had opened near 1764 early in the Asian session and jumped to the day-high at 1766 at the European session. The price slipped at the US session. The day ended near 1754, down by USD 7.

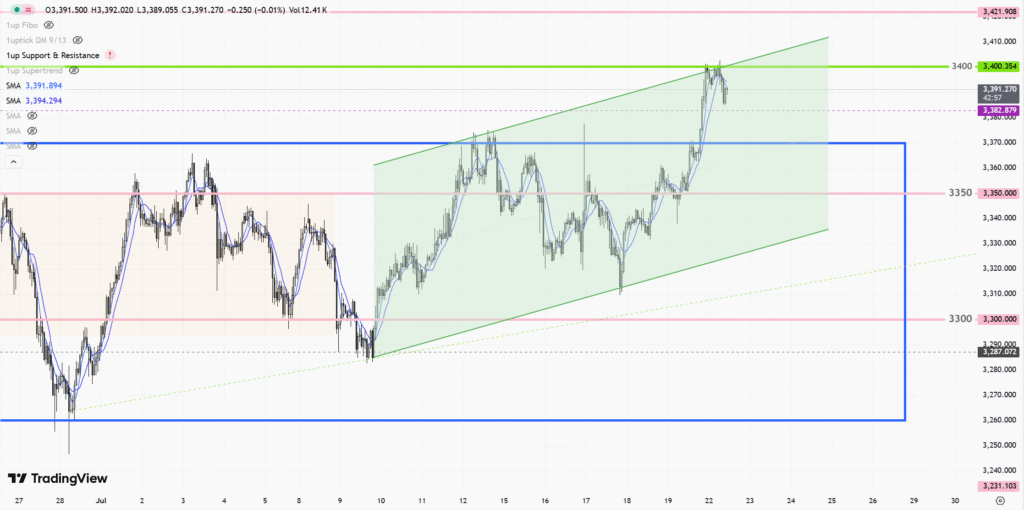

The structure hasn’t changed much, can’t see any new indications on the 1-hour chart. Overall the price is still range-bounding within 1746-64(1), waiting for the US employment figures for the breakout.

It is the first time this week the gold price close below 1760(2), a sign of the trend turning weak. If no surprises from the US employment figures tonight, the gold price may start to consolidate lower.

S-T Resistances:

1770

1764

1760

Market price: 1757

S-T Supports:

1755

1750-21

1744-45

Risk Disclosure: Gold Bullion/Silver (“Bullion”) trading carries a high degree of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. This article is for reference only and is not a solicitation or advice to trade any currencies and investment products . Before deciding to trade Bullion you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment or even more in extreme circumstances (such as Gapping underlying markets) and therefore, you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading Bullion, and seek advice from an independent financial advisor if you require. Client should not make investment decision solely based on the point of view and information on this article.