|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Trend 23/09

Gold Trend 23/09

2024-09-23 @ 16:59

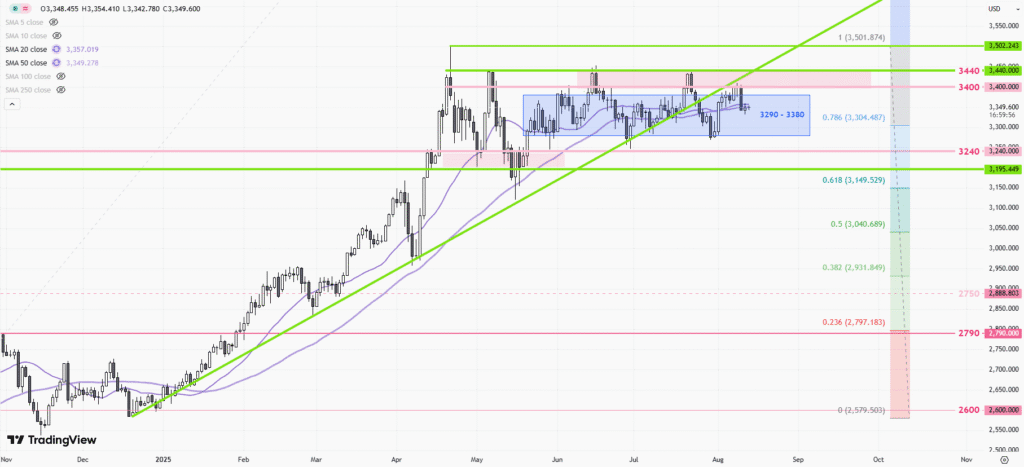

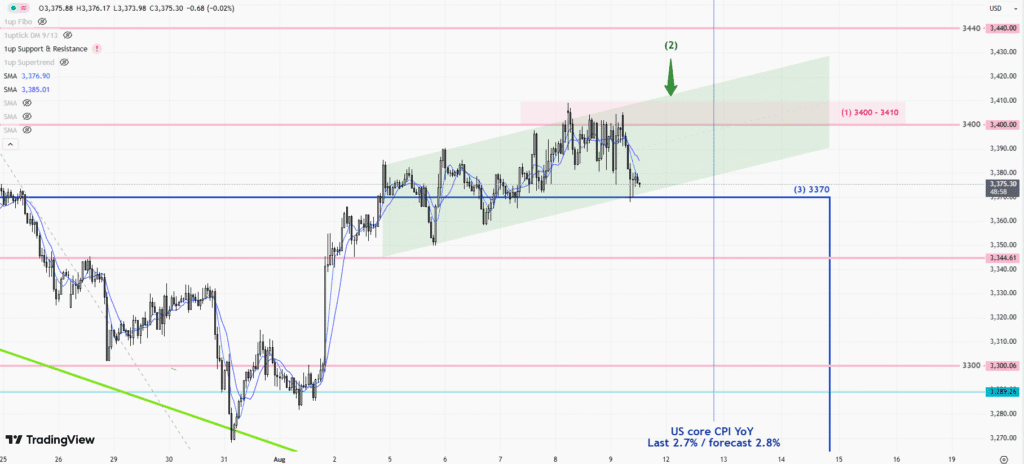

The uptrend has restarted since the gold prices broke out from the range of 2480-2530(1) two weeks ago. There was some S-T profit-taking after the US Fed announcement, however, the prices managed to clear the S-T resistance(3) before the weekend, hitting a new all-time high.

Before the US Fed. meeting, the market was merely expecting a 25 basis points cut, and the extra 25 basis points cut surprised everyone. Now the market needs additional time to price in this new factor, so gold prices are likely to keep going up in the S-T. Recently, people are more focused on how the U.S. economy is doing rather than inflation figures. This week, keep an eye on the U.S. 2Q GDP report coming out on Thursday. The PCE inflation data on Friday might not have a very big impact on gold prices.

1-hr Chart(above) > Gold prices have been running in an uptrend channel(2) in the past two weeks. While the price is hanging around its recent highs, there are no previous supports or resistances to reference from. However, remember the gold has been trading sideways between 2472-2530(4) in early September. Seems that each break-out is running the same range, around 56 dollars. After surpassing (4.1) last Friday, the first target for this week could be set at approximately 2646-50 (4.2), 1:1 ratio.

Daily Chart(above) > The upward momentum of gold prices is accelerating, and the upward support has shifted from (5) to (5.1). There is no obvious reversal signal on the daily chart, the buy-low strategy continues.

P. To