|

| Gold V.1.3.1 signal Telegram Channel (English) |

黃金與道瓊斯處於上升三角形:外匯交易洞察

黃金與道瓊斯處於上升三角形:外匯交易洞察

2024-12-30 @ 07:03

了解外匯交易中的上升三角形

上升三角形是技術分析中的一個強大工具,尤其適用於外匯交易。這種型態的特徵是水平阻力線與向上傾斜的支撐線,顯示出上升趨勢可能會持續。在本文中,我們將深入探討上升三角形的細節,並透過近期在黃金和道瓊市場的實例來進一步了解其應用。

上升三角形的關鍵要素

– **水平阻力線**:這是一條平線,代表三角形的上邊界,價格多次嘗試突破但無法成功。

– **向上傾斜的支撐線**:這條線代表三角形的下邊界,價格在此獲得支撐並持續向上。

如何交易上升三角形

交易上升三角形的核心在於等待價格突破水平阻力線。以下是具體步驟:

1. **確認型態**:尋找水平阻力線與向上傾斜的支撐線構成的型態。

2. **等待突破**:當價格突破阻力線時,建立多頭(買入)倉位。

3. **設置止損**:將止損單設置在上一次的重要低點之下,以控制風險。

4. **設定獲利目標**:根據預期的趨勢延續來確定獲利目標。

近期實例:黃金與道瓊

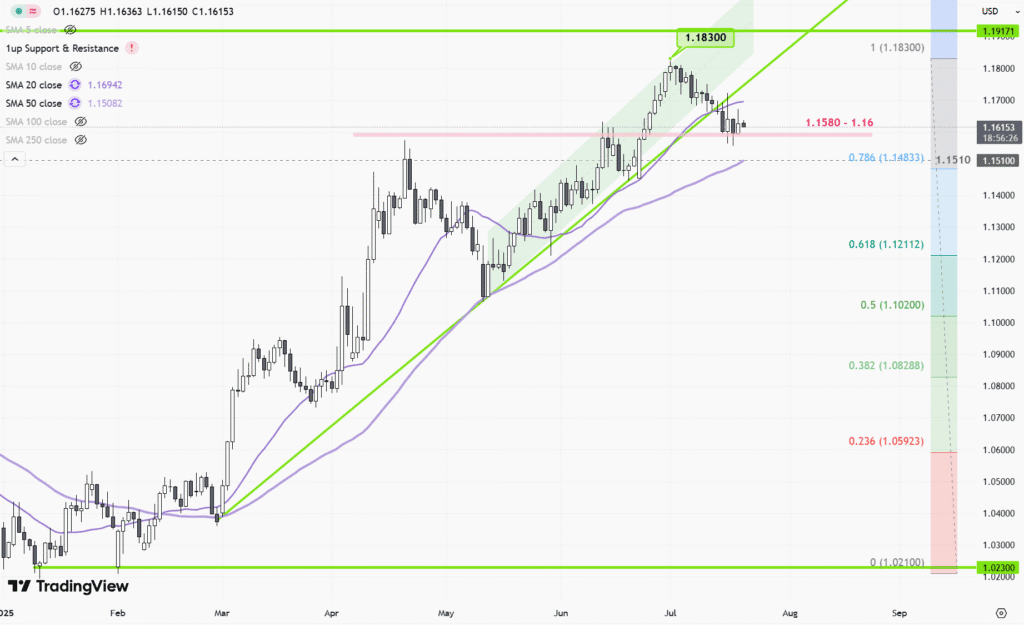

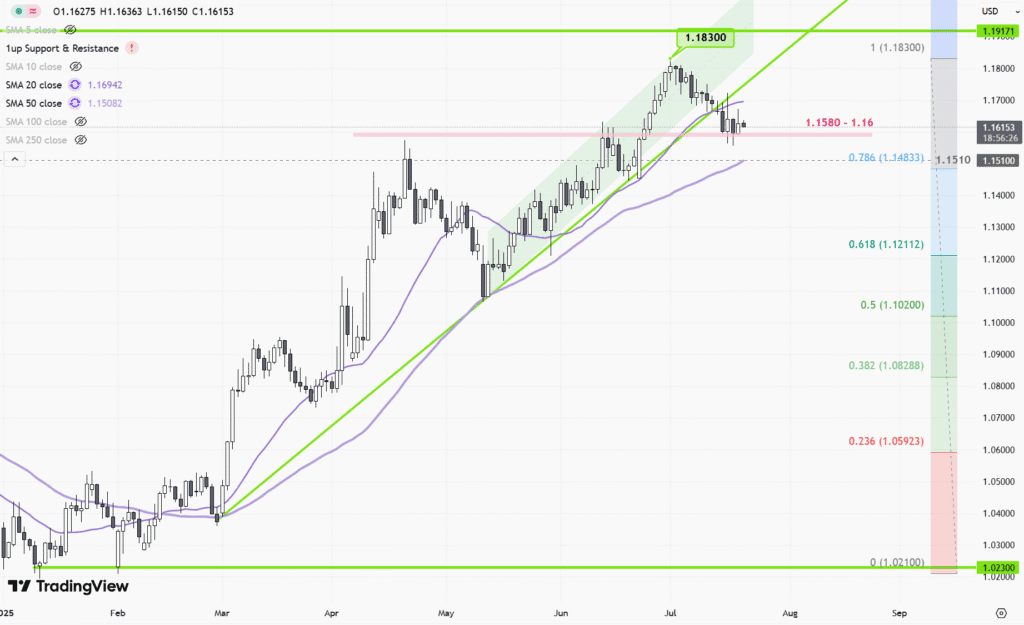

近期,黃金與道瓊的市場走勢出現了上升三角形,暗示潛在的上漲動能。

– **黃金**:在先前因下降三角形突破失敗而大幅下跌後,黃金價格現已反彈,並形成了上升三角形。關鍵的阻力區間在 $2,355 至 $2,375 之間。如果日線收盤價能突破 $2,375,將確認看漲趨勢。

– **道瓊指數**:與黃金類似,道瓊指數也形成了上升三角形,顯示出上漲趨勢可能持續。交易者應關注指數突破阻力線的時機,考慮建立多頭倉位。

交易上升三角形的策略

以下是幾種交易上升三角形的常見策略:

– **停損訂單(Stop Order)**:在上升三角形高點之上設置買入停損訂單,一旦突破立刻進場買入。

– **突破並收盤**:等待價格突破並穩定收盤於高點以上,以降低假突破的風險。

– **支撐線回測**:當價格回測向上傾斜的支撐線並確認趨勢延續時,再進場建立多頭倉位。

額外見解

– **市場波動性**:在波動較大的市場中,上升三角形特別有用,能幫助交易者辨別潛在的趨勢延續。

– **突破確認**:可結合其他指標(如 RSI 相對強弱指數)來確認突破,有助於降低假信號的風險。

透過了解並熟練運用上升三角形,在外匯交易中,您將更有機會抓住市場趨勢,實現穩定的回報!