|

| Gold V.1.3.1 signal Telegram Channel (English) |

US Retail Sales Plunge in January Amid Cold Weather and Inflation

2025-02-17 @ 13:01

U.S. Retail Sales Drop in January: Cold Weather and Consumer Confidence Weigh on Spending

U.S. Retail Sales Experience Largest Decline in Nearly a Year

U.S. retail sales fell by 0.9% in January, marking the steepest monthly drop in almost a year. The decline raises concerns about consumer spending, which plays a crucial role in driving the U.S. economy. Economists attribute the dip to multiple factors, including extreme winter weather and waning consumer confidence.

How Harsh Winter Weather Impacted Retail Spending

One of the primary reasons behind the slowdown was severe cold weather, which forced Americans to stay indoors and reduced foot traffic in key retail segments. Several industries felt the impact, including:

- Auto dealerships (-2.8%) faced sluggish demand due to poor road conditions and reduced consumer visits.

- Furniture and home improvement stores also saw a decline, as fewer shoppers were willing to brave the weather.

- Online sales surprisingly dropped -1.9%, possibly indicating logistical challenges with deliveries and delayed purchases.

Despite the overall downturn, sales at general merchandise stores and restaurants experienced an increase, suggesting that consumers continued to spend in certain sectors.

Consumer Confidence Takes a Hit

Beyond weather challenges, declining consumer confidence played a significant role in January’s weak sales data. Recent surveys from both the Conference Board and the University of Michigan indicated that Americans may be growing more cautious about their financial outlook. Uncertainty regarding inflation, wages, and economic stability could contribute to more conservative spending habits.

Additionally, Los Angeles wildfires disrupted economic activity in some regions, further contributing to a slowdown in consumer spending.

Economic Outlook: What This Means for Growth

While retail sales slipped, the job market remains relatively strong. The unemployment rate remains at a low 4%, accompanied by steady wage growth. However, a slowdown in consumer spending could signal weaker economic growth in the first quarter of the year. Economists are closely monitoring spending patterns to assess whether this decline is temporary or part of a larger trend.

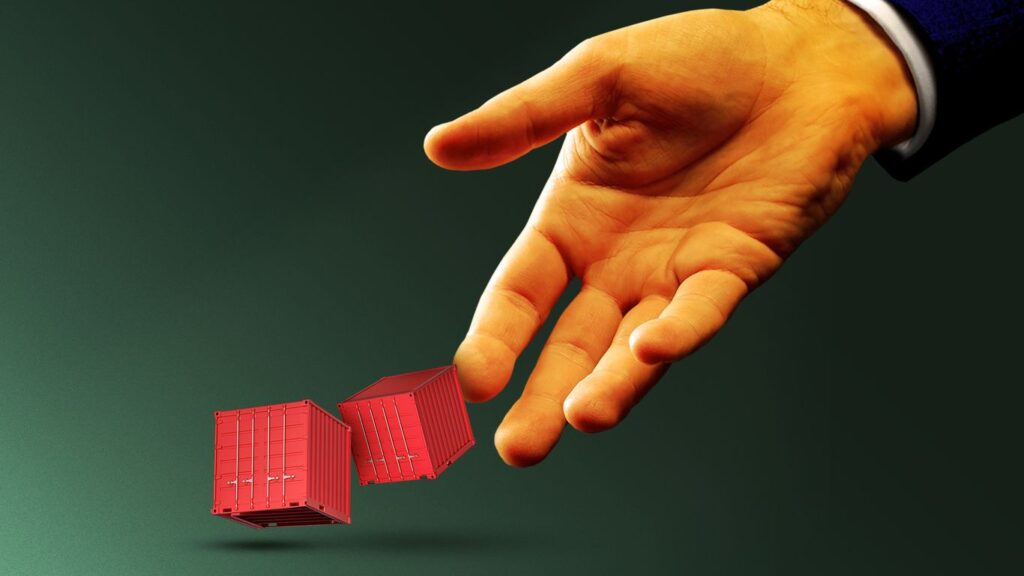

Inflation and Tariffs Pose Additional Risks

Another key factor affecting retail sales is inflation, which ticked higher in January. Rising egg prices pushed inflation upward, pinching household budgets. Meanwhile, possible new tariffs proposed by former President Trump could further impact consumer prices and retail supply chains, making goods more expensive and potentially reducing demand even further.

Retailers Face Growing Challenges

Several retailers are struggling amid shifting consumer behavior and broader economic pressures:

- Joann has filed for Chapter 11 bankruptcy and plans to shut down over 500 locations.

- Liberated Brands and other retail chains continue to face financial difficulties as consumers remain cautious about discretionary spending.

Retailers may need to adapt to evolving consumer preferences and broader economic conditions to stay competitive in the challenging market.