|

| Gold V.1.3.1 signal Telegram Channel (English) |

Copper Prices Soar to Record Highs Amid US Tariff Uncertainty

2025-03-26 @ 19:02

US Copper Prices Near Record Highs Amid Tariff Threats and Economic Shifts

Copper prices have surged to near record levels, fueled by a mix of geopolitical tensions, supply concerns, and rising global demand. Investors are closely monitoring the situation as factors like US tariff threats, China’s economic stimulus, and a weakening US dollar contribute to the rally in copper futures.

Tariff Threats and Supply Chain Concerns

A key driver behind the recent surge in copper prices is the potential for new US tariffs on copper imports. US President Donald Trump issued an executive order under Section 232 of the Trade Expansion Act, triggering speculation that tariffs could soon be imposed. This uncertainty has led to a 12% jump in copper futures prices since the announcement.

Notable impacts of the tariff threats include:

- A scramble among suppliers to ship copper to the US before any import duties take effect

- Reduced copper availability in other markets due to pre-emptive stock movements

- Exacerbation of existing supply constraints caused by a lack of mineral investment and limited refinery capacity

These factors contribute to supply chain disruptions, intensifying market volatility as investors assess the potential repercussions of new trade policies.

China’s Economic Stimulus and Growing Demand

China remains at the center of the global copper market, both as a major producer and consumer. The country’s latest economic stimulus package has played a substantial role in driving prices higher.

Key measures boosting copper demand include:

- A national GDP growth target of 5%

- Policies aimed at boosting domestic consumption and industrial expansion

- Economic data showing 4% growth in retail sales and increased industrial output

With China’s infrastructure and technology investments requiring massive copper consumption, global demand remains on the rise.

The Role of Copper in Green Energy and AI

Copper’s importance extends beyond traditional industrial uses. Its role in renewable energy, electric vehicle (EV) production, and artificial intelligence (AI) technologies has significantly increased demand.

Industries contributing to copper’s price surge include:

- Renewable energy: Solar panels and wind turbines require extensive copper wiring.

- Electrification of transportation: Increased production of EVs has led to a higher demand for copper-based components.

- AI and computing: Data centers and high-performance computing require substantial copper infrastructure.

With these industries projected to grow exponentially, copper’s long-term demand outlook remains strong.

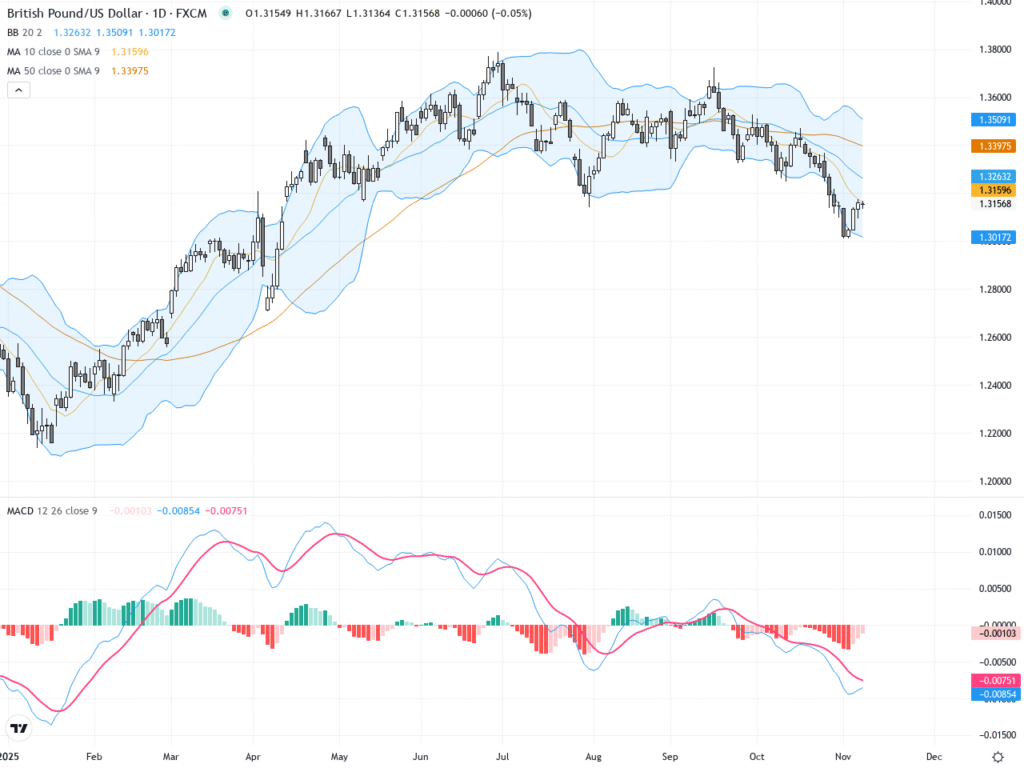

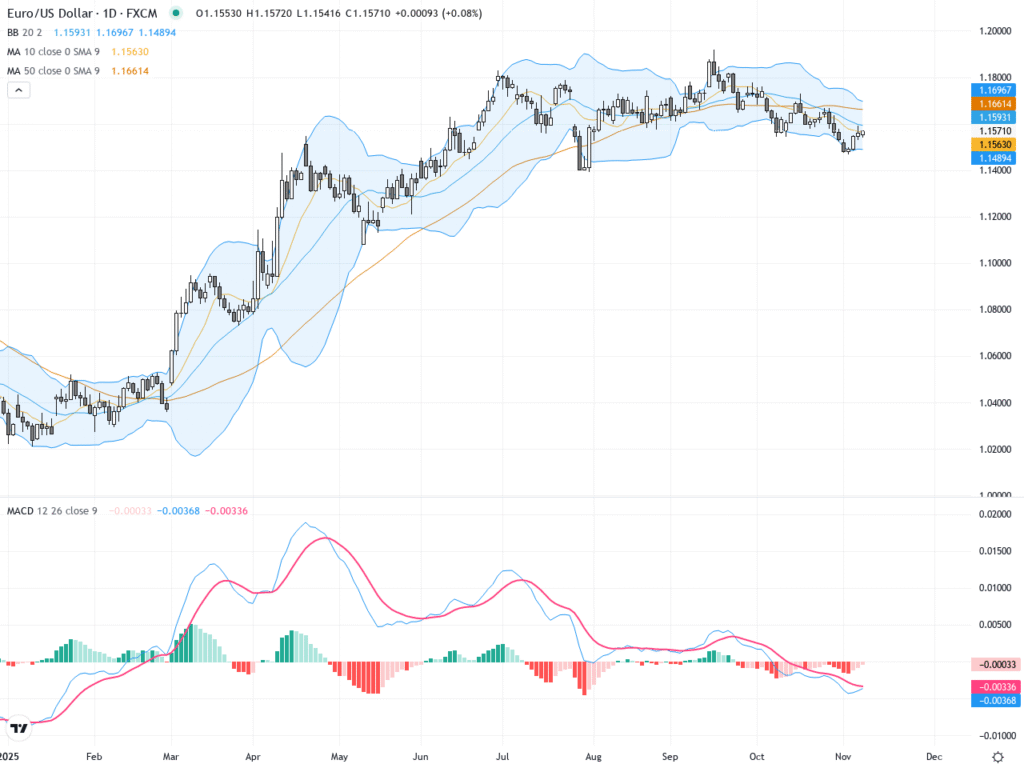

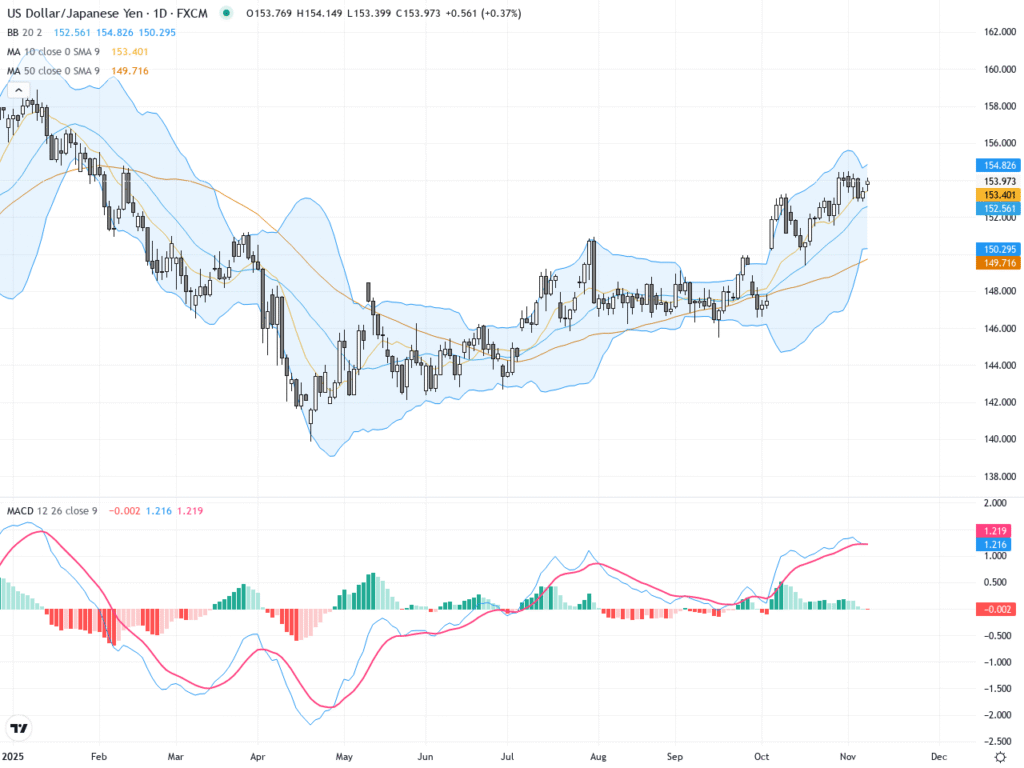

US Dollar Weakness Propels Commodity Prices

Another factor driving copper prices higher is the weakening US dollar. The US dollar index has declined by 4% in 2024, making dollar-priced commodities like copper more expensive for holders of other currencies.

Key reasons behind the dollar’s decline include:

- Widening global trade tensions

- Risk-off sentiment in currency markets

- Investors shifting focus toward commodities and other safe-haven assets

This currency movement has further accelerated copper’s price appreciation, as global buyers are forced to pay more for the metal.

Market Volatility and Investor Reactions

The timeline for potential US tariffs against Canada and Mexico has been unclear, adding to market uncertainty. This uncertainty has driven risk-averse investing behaviors, leading to:

- Increased gold prices as investors seek safe-haven assets

- Greater volatility in commodities, including copper futures

- Massive trading gains, with copper prices rising up to 5% in recent sessions

Currently, copper futures have reached up to $5.15 per pound before slightly pulling back to $5.12 per pound in the Asian trading session. With ongoing economic and political uncertainties, market participants remain on edge, closely watching regulatory developments and global economic trends.