|

| Gold V.1.3.1 signal Telegram Channel (English) |

Eurozone Faces Unprecedented Uncertainty as ECB Cuts Growth Forecasts

2025-03-19 @ 11:30

ECB’s de Guindos: Economic Uncertainty Surpasses COVID-19 Levels

The European economy is facing an era of extreme uncertainty, surpassing even the volatility experienced during the COVID-19 pandemic. This alarming revelation comes from European Central Bank (ECB) Vice President Luis de Guindos, who attributes the heightened instability to shifting trade policies and geopolitical tensions, particularly concerning the U.S. administration’s stance on global trade.

Trade Tensions and Their Economic Impact

The aggressive trade policies pursued by the United States pose a significant challenge for the eurozone. De Guindos fears that the introduction of new tariffs and the ongoing trade disputes could disrupt global economic stability. Key concerns include:

- Potential tariffs on EU exports: The uncertainty surrounding whether the U.S. will impose tariffs on European goods raises concerns for the eurozone’s export sector.

- Lower investment levels: Businesses remain hesitant to commit to new investments due to unpredictable trade policies and economic conditions.

- Weakening of global trade: Trade tensions could lead to a slowdown in international commerce, impacting European exporters and manufacturers.

This economic unpredictability is expected to weigh down the eurozone’s growth prospects significantly.

ECB Lowers Growth Forecasts

Amidst these economic headwinds, the ECB has revised its growth projections downward:

- 2025 Growth Projection: Revised to just 0.9%

- 2026 Growth Projection: Adjusted to 1.2%

The lowered forecasts largely stem from weak exports and reduced investment. Despite these setbacks, the ECB remains optimistic about inflation trends. De Guindos reaffirmed that inflation is on track to settle at the ECB’s 2% target by late 2024 or early 2025.

Monetary Policy Adjustments: ECB Cuts Rates

To counter the slowing economy, the ECB has begun easing monetary policies. In March 2025, interest rates were reduced by 25 basis points, resulting in the following:

- Deposit facility rate: 2.50%

- Main refinancing rate: 2.65%

- Marginal lending rate: 2.90%

These cuts aim to make borrowing more affordable for businesses and households, with the hope of stimulating economic growth. However, ECB officials acknowledge that the lingering effects of past rate hikes still impact credit markets.

Consumer Confidence Remains Weak

Despite positive momentum in real wages and lower interest rates, consumer spending has not picked up as expected. The reasons for this cautious spending behavior include:

- Uncertain economic outlook: Consumers remain wary due to fears of a trade war or a broader geopolitical conflict.

- Weaker business sentiment: Companies are hesitant to expand operations or hire more workers given the uncertain climate.

- Lingering inflation concerns: While inflation is stabilizing, energy prices remain elevated, adding strain to household budgets.

Consumer confidence remains a crucial ingredient for economic recovery, but ongoing uncertainties are preventing a strong rebound in spending.

Increased Defense Spending: Economic Opportunities and Risks

European governments, particularly Germany, are ramping up defense spending, which could provide a moderate boost to economic activity. However, de Guindos warns that financing such expenditures through debt issuance could lead to:

- Higher bond yields: Increased government borrowing may push long-term bond yields higher.

- Pressure on fiscal sustainability: Higher debt levels could strain national budgets, potentially leading to tougher fiscal decisions in the future.

While defense spending contributes to economic growth, it also raises concerns regarding financial stability in the long run.

Market Reaction and Future Outlook

Following the ECB’s latest rate cut, financial markets responded with mixed signals:

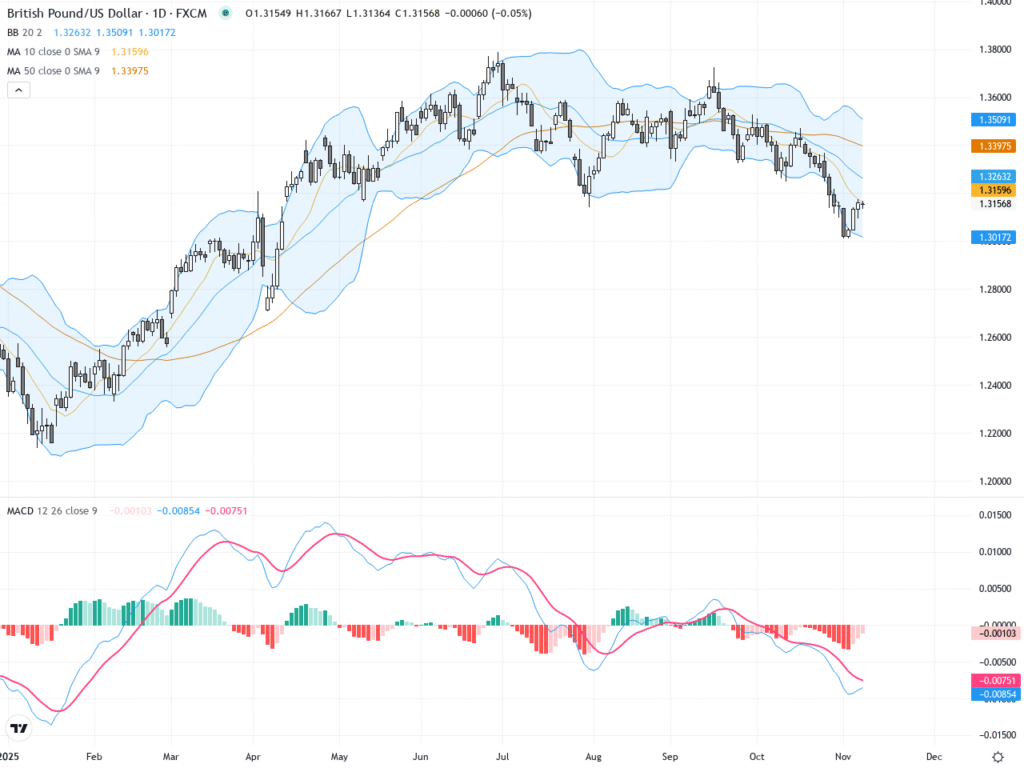

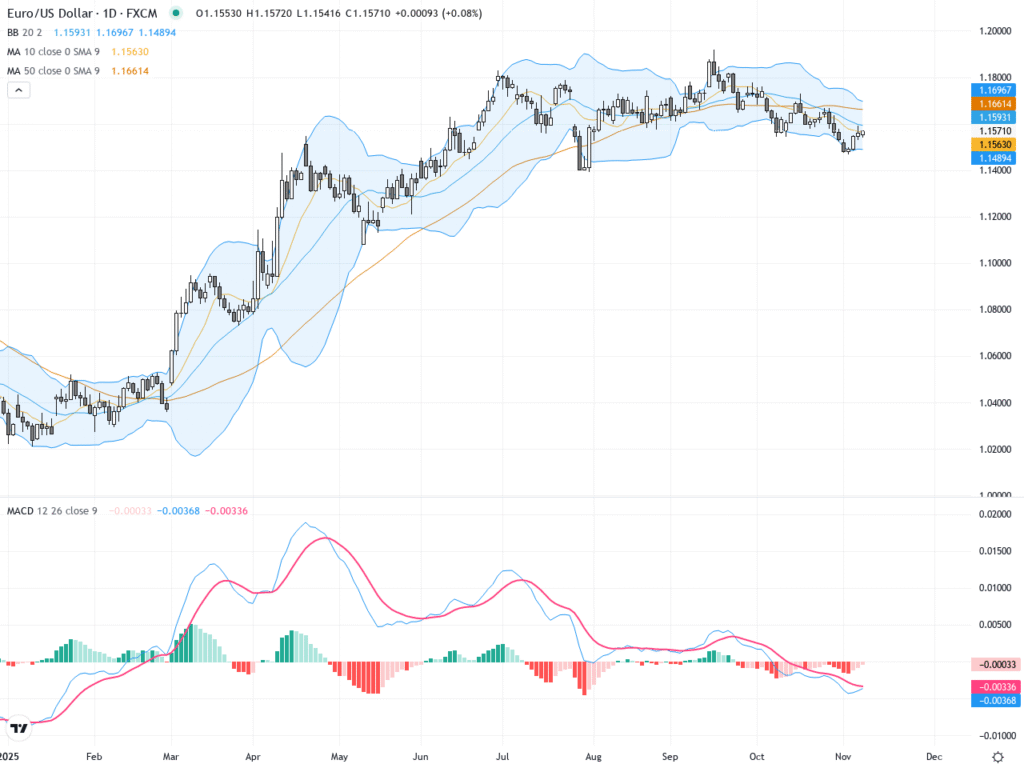

- The euro strengthened against the U.S. dollar, as investors interpreted the move