|

| Gold V.1.3.1 signal Telegram Channel (English) |

Fed Rate Cuts 2025: Impact on Markets, Mortgages, and Inflation

2025-03-11 @ 13:01

Fed Rate Cuts and Their Implications for 2025: An Updated Perspective

The Fed’s Rate Cut Outlook for 2025

The Federal Reserve’s monetary policy remains a focal point for investors and businesses alike. Market expectations indicate that the Fed will likely **implement rate cuts later in 2025** rather than any immediate adjustments.

A key development in the past year was the **three consecutive rate cuts between September and December 2024**, reducing the federal funds rate by a full percentage point. Since January 2025, the Fed has **held a neutral stance** on interest rates.

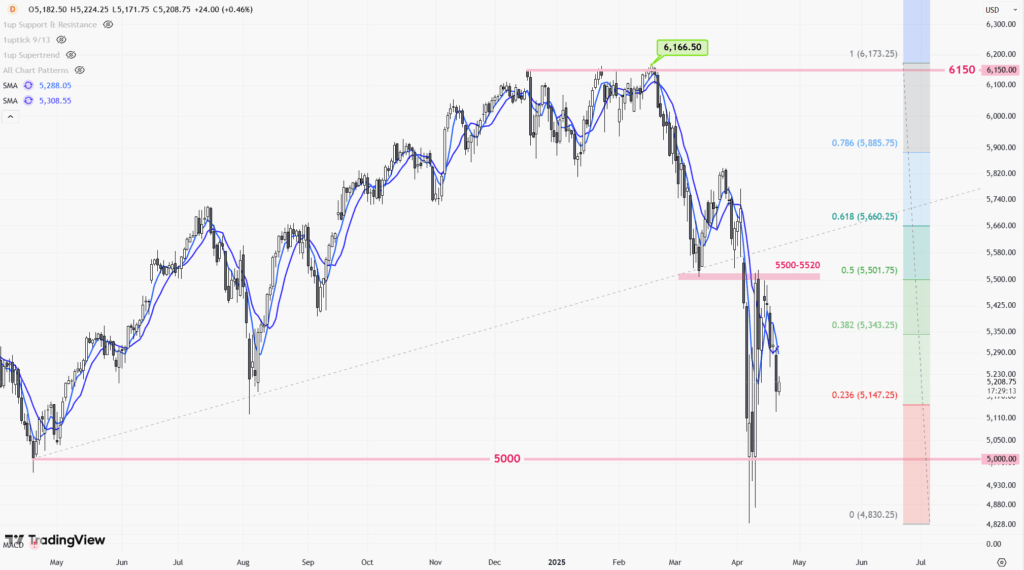

Current financial market trends predict at least **two rate cuts by the end of 2025**, with the June 18 Fed meeting widely anticipated as a potential starting point. However, the **median view of the Federal Open Market Committee (FOMC) members** suggests only **50 basis points of rate cuts** throughout the year, meaning **interest rates will remain relatively high for longer** due to persistent inflation and a **strong labor market**.

Mortgage Rate Trends in Light of Fed Policy

Historically, Fed rate cuts lead to a decline in mortgage rates, but this relationship is **not always direct**. Mortgage rates fluctuate based on multiple factors, **not just the Federal Reserve’s benchmark rate**.

With expectations of **gradual rate cuts**, there has been a slight **decline in 30-year mortgage rates**. However, these reductions will likely be **modest rather than significant**.

Forecasts from bank economists at the **American Bankers Association Economic Advisory Committee** suggest the following:

- 2025 Mortgage Rate Projection: 6.9% on average

- 2026 Mortgage Rate Projection: 6.5% on average

These projections reflect the **Federal Reserve’s restrictive stance** and ongoing concerns about **inflationary pressures**.

Economic and Inflation Concerns for 2025

The economic outlook for **2025 points to continued growth**, but several risk factors could affect stability:

- Real Economic Growth: Forecasted at 2.1% for both 2025 and 2026.

- Inflation Pressures: Expected to remain above the Fed’s 2% target.

- Key Risks: Policy changes, trade uncertainties, and Federal Reserve adjustments.

Analysts from **Morgan Stanley Research and Goldman Sachs** highlight that **inflation will remain elevated** in 2025. Factors such as **Trump administration tariffs and tighter immigration policies** could push **Core PCE inflation to 3%**. Additionally, the Consumer Price Index (CPI) has already shown signs of rising inflation, hitting an **annual rate of 3% in January 2025**.

The Influence of Trade Policy on Inflation and Growth

Trade policy remains a **major factor affecting inflation and economic growth** in 2025. The implementation of **tariffs on key trading partners** could significantly impact policy decisions:

Deloitte’s forecast outlines two possible outcomes:

- Moderate Tariffs: Lead to modest inflation increases and limited economic impact.

- Strong Tariffs: Could drive inflation higher and force the Fed to consider tightening monetary policy before easing again.

The **shifting trade policies** and regulatory uncertainties make **business planning increasingly complex**, particularly with recent tariff suspensions and reinstatements.

With market volatility and evolving Fed policies, **investors and businesses must stay alert** as these economic factors shape **financial trends in 2025**.