|

| Gold V.1.3.1 signal Telegram Channel (English) |

Nasdaq Crash: Tech Stocks Lose $1.1 Trillion in Market Meltdown

2025-03-11 @ 14:31

“`html

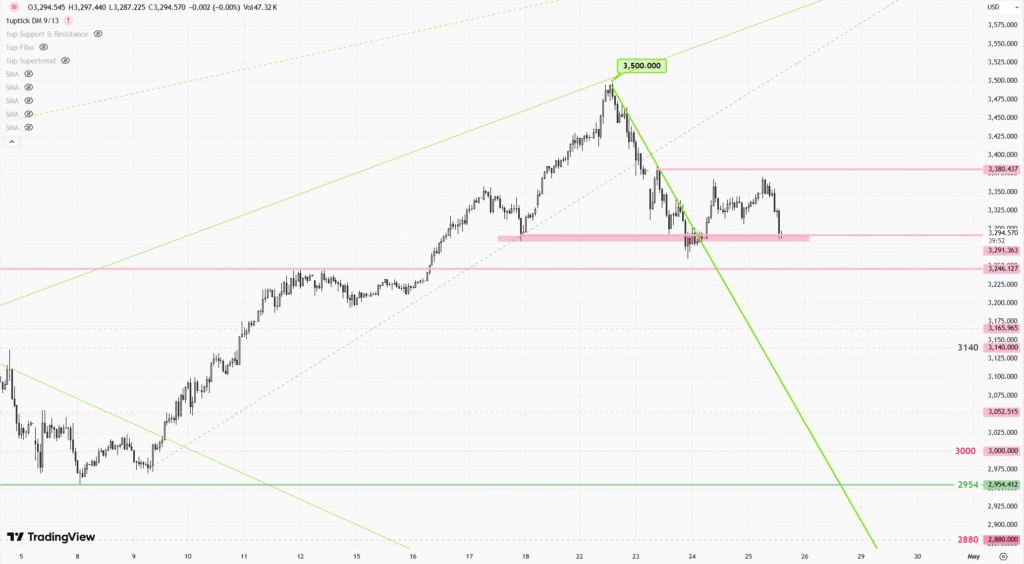

Nasdaq-100 Loses Over $1.1 Trillion as Tech Sell-Off Worsens

Market Performance: A Brutal Week for Tech Stocks

The past week saw a significant market downturn, with the Nasdaq-100 (NDX) and Nasdaq Composite (NDAQ) indices officially entering correction territory. Here’s a look at the numbers:

- Nasdaq-100 (NDX) fell by 3.27%.

- Nasdaq Composite (NDAQ) declined by 3.45%.

- S&P 500 dropped 3.10%, marking its worst weekly performance since September 2024.

- Dow Jones Industrial Average lost 2.37% but remains positive year-to-date.

The stock market rout has now erased over $1.1 trillion from the Nasdaq-100’s market value, signaling deeper concerns for tech investors.

Macroeconomic Troubles: Jobs Data Fuels Investor Fears

Weaker-than-expected economic data has further rattled investor sentiment. February’s job growth failed to meet expectations, and January’s numbers were revised sharply downward.

Key concerns from the recent economic data release:

- Unemployment rate rose to 4.1%, surprising analysts.

- Wage growth slowed more than expected, adding to economic uncertainties.

- Increased recession fears are influencing market sentiment.

This cooling job market has strengthened concerns about a possible economic downturn, contributing to the ongoing market volatility.

Policy Uncertainty: Tariff Concerns Weigh on Markets

Policy uncertainty has compounded investor anxiety. President Trump’s decision to postpone tariffs on Mexican and Canadian imports under the USMCA did little to alleviate worries. Instead, the lack of clear direction has further impacted consumer and investor confidence.

How policy changes are impacting the market:

- Investors remain uncertain about the future of global trade policies.

- Tariff postponements have not been enough to calm market jitters.

- Sector-specific impacts, particularly in tech and manufacturing, remain significant.

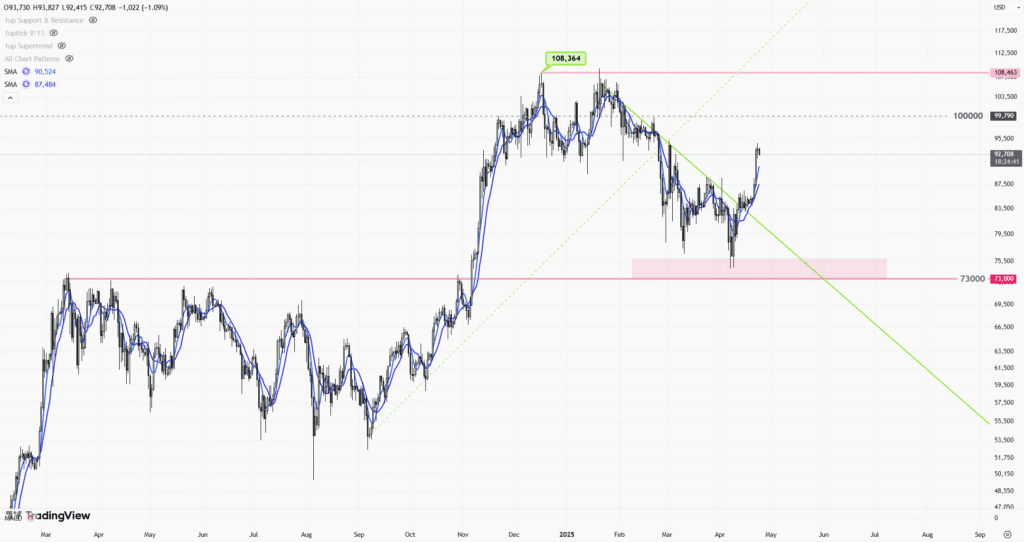

Tech Sector Hit Hard: Stock-Specific Declines

Several major tech stocks experienced significant declines over the past week.

- Marvell Technology (MRVL) saw a sharp drop due to disappointing guidance.

- Hewlett Packard Enterprise (HPE) suffered its worst single-day loss since 2020 after weak margins and a concerning earnings outlook.

- Intel (INTC) faced selling pressure as hopes for a Broadcom takeover faded.

- Taiwan Semiconductor (TSM) raised competitive concerns for Intel by expanding its U.S.-based production.

Despite the widespread tech sell-off, Broadcom (AVGO) and Nvidia (NVDA) saw some relief:

- Broadcom’s AI guidance brought optimism to the sector.

- Nvidia’s stock regained ground on reports of a $100 billion AI chip deployment in Texas.

Upcoming Earnings: Oracle and Adobe in Focus

As the Q4 2024 earnings season nears its end, a few major tech companies still have reports on the horizon:

- Oracle (ORCL) will release earnings on March 10.

- Adobe (ADBE) will report on March 12.

These earnings reports will give investors a clearer picture of how the tech sector is holding up amid ongoing market fears.

“`