|

| Gold V.1.3.1 signal Telegram Channel (English) |

Trump’s 2025 Economic Policies: Will a Recession Hit Soon?

2025-03-12 @ 14:31

Trump’s Economic Policies: Will They Lead to Recession in 2025?

The U.S. economy continues to be a hot topic as President Donald Trump remains confident in its strength, despite rising fears of a potential recession in 2025. His administration’s economic policies, particularly tariffs, have fueled ongoing market turbulence and trade uncertainty. Economists and financial experts warn that these moves could significantly impact business investments, consumer spending, and overall economic growth.

Economic Uncertainty and the Impact of Tariffs

One of the most pressing concerns surrounding Trump’s economic approach is his aggressive use of tariffs. Recent decisions to impose:

These measures have prompted retaliatory actions from these countries, intensifying trade tensions. Experts argue that these tariffs pose a serious risk to the U.S. economy.

Key Economic Warnings:

These escalating concerns suggest that unless substantial economic adjustments are made, the risk of a downturn will continue to rise.

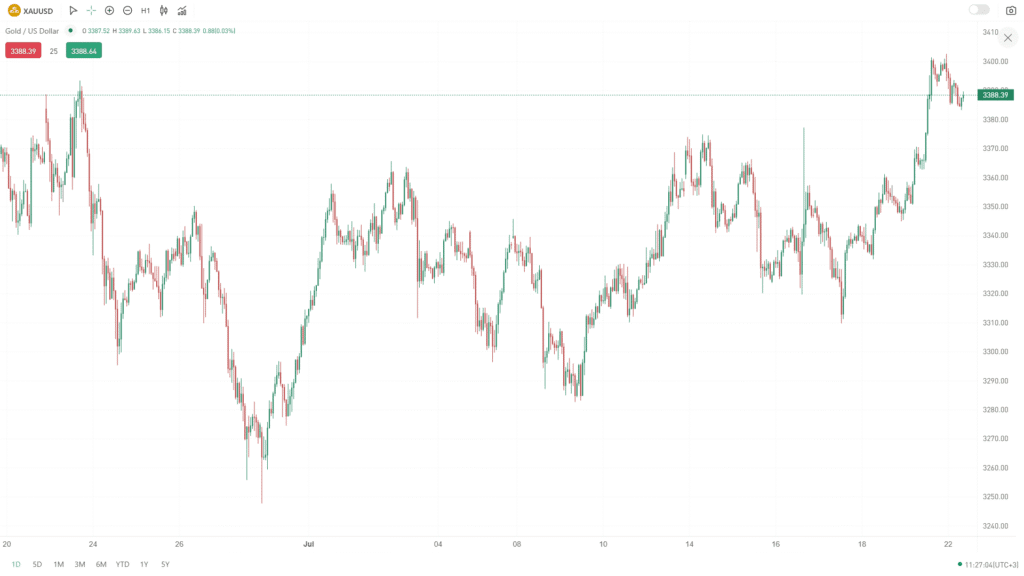

Market Reactions to Trump’s Tariff Policies

The financial markets have responded negatively to the uncertainty surrounding trade policies. In the aftermath of Trump’s tariff announcements, the S&P 500 fell by more than 3% in just one week, reflecting broader economic anxieties.

Despite assurances from the White House that this market turmoil is just a “temporary shift,” investors remain wary about the long-term consequences. Evidence suggests that continued trade disruptions and economic instability could further dampen market confidence.

How Consumers and Businesses Are Affected

America’s economy is largely driven by consumer spending, which accounts for approximately 70% of total economic activity. However, rising tariff-related costs are pushing up prices for everyday goods, potentially leading to:

Businesses also play a crucial role in economic health, contributing roughly 15% to the nation’s GDP through investments. If companies cut back on expansion plans due to a lack of confidence, overall economic activity could suffer.

Trump Administration’s Stance on Economic Risks

Despite mounting concerns, Trump remains steadfast in his position that his administration’s economic policies will ultimately strengthen America. He characterizes the current market fluctuations as a “necessary transition” to building a more stable and prosperous economy.

Commerce Secretary Howard Lutnick has doubled down on this optimism, insisting that Americans “absolutely should not” expect a recession. However, given rising market volatility, leading economic analysts continue to urge caution.

Economic Forecasts: What Lies Ahead?

Many financial institutions have released economic outlooks for the coming years. The American Bankers Association’s Economic Advisory Committee predicts:

Meanwhile, Comerica Bank warns that Trump’s tariffs could keep inflation above the Federal Reserve’s 2% target for 2025 and 2026. As a result, the Fed may opt for limited interest rate cuts, adding to economic strife.

With the outlook still uncertain, Wall Street, businesses, and consumers remain on high alert for further developments in trade policy and economic strategy.