|

| Gold V.1.3.1 signal Telegram Channel (English) |

Why Gold Prices Aren’t Surging Despite Market Chaos

2025-03-11 @ 20:31

Gold Prices Hold Steady Amid Market Selloff and Economic Uncertainty

The financial markets have been on edge following a major downturn in U.S. stocks. However, gold—historically considered a safe-haven asset—has not yet experienced a substantial surge. Instead, gold prices have shown mixed performance, impacted by several economic and geopolitical factors.

U.S. Stock Market Selloff and Its Impact on Gold

In the last 48 hours, Wall Street has seen one of its worst trading sessions in months:

- S&P 500: Declined by 2.7% to 5,614.56

- Nasdaq Composite: Fell 4% to 17,468.32

- Dow Jones Industrial Average: Dropped 2.08% to 41,911.71

Despite such chaos, gold hasn’t reacted as a typical safe-haven asset. Instead of climbing sharply, gold prices slightly declined due to mild profit-taking and overall market weakness.

- Spot gold: Down 0.3% to $2,902.04 per ounce

- U.S. gold futures: Eased 0.2% to $2,908.00 per ounce

These movements suggest that investors are waiting for key economic data before making decisive moves in the gold market.

Economic and Geopolitical Uncertainty Weighs on Gold

Several important factors are shaping gold’s price action:

- Upcoming U.S. Inflation Data: Investors are closely watching the Consumer Price Index (CPI) report due Wednesday and the Producer Price Index (PPI) report on Thursday. If inflation comes in stronger than expected, the dollar could strengthen, placing additional pressure on gold.

- Trade Wars and Tariffs: President Donald Trump’s imposition of new tariffs and recent comments on potential economic turbulence have created further uncertainty. This could, however, lead to higher demand for gold as a hedge against financial instability.

- Federal Reserve Rate Cut Expectations: Traders are fully pricing in a U.S. interest rate cut in June. Since gold is a non-yielding asset, lower rates enhance its appeal, making it a key factor to watch in the coming months.

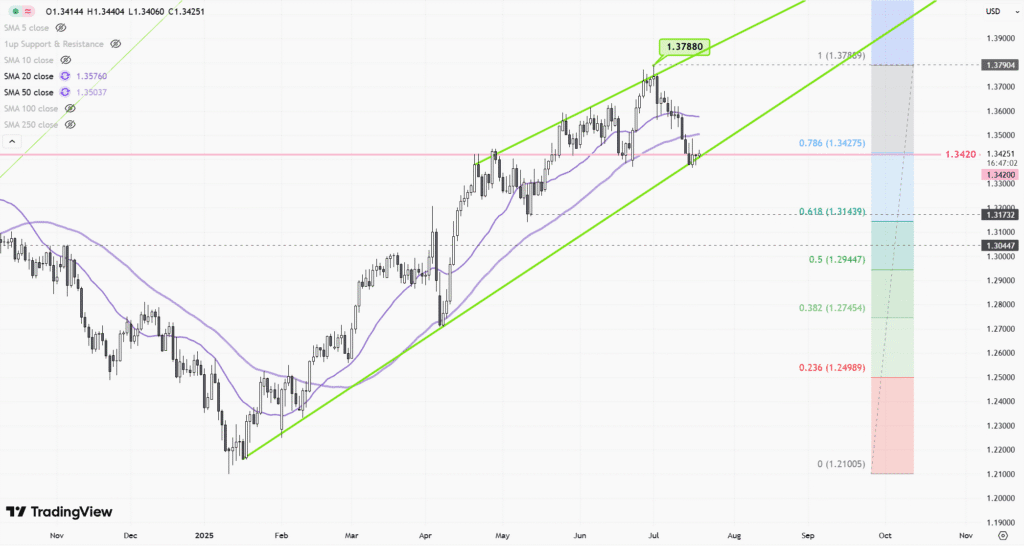

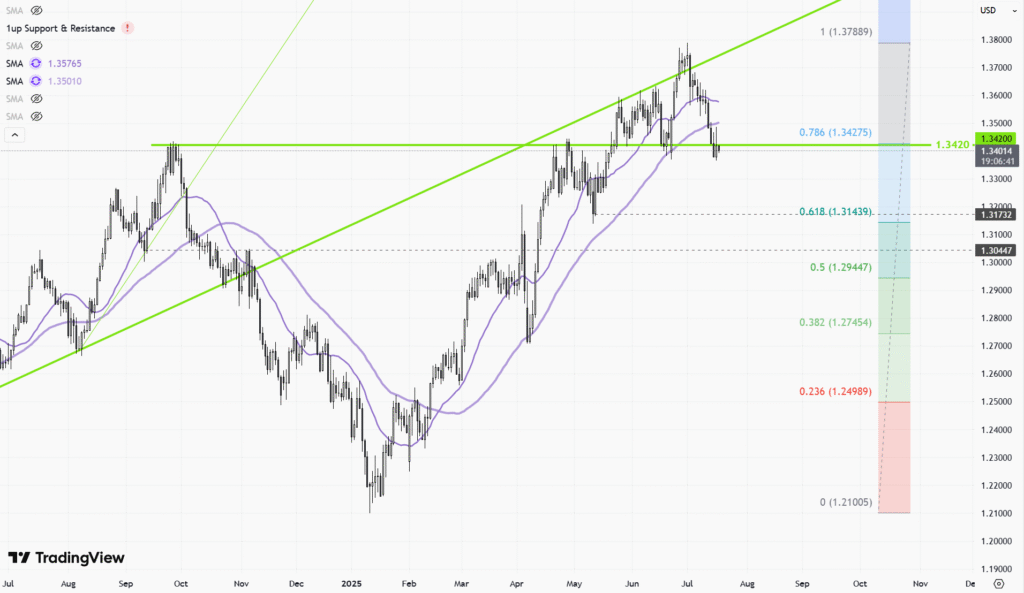

Gold Price Technical Analysis: Bullish or Bearish?

From a technical perspective, gold has slipped below a key upward trendline, indicating that bearish momentum is growing:

- Key Support Level: $2,790 – A zone where bullish traders may seek entry opportunities.

- Bearish Target: If gold breaks below $2,790, further downside towards $2,600 is likely.

While gold remains near all-time highs, traders must closely watch these levels to gauge future market direction.

Global Economic Concerns and Their Effect on Gold

In addition to U.S. market movements, global economic data is also influencing gold prices. In China, key indicators have raised concerns:

- Imports: Unexpectedly shrank over the January-February period.

- Consumer Prices: Fell at the sharpest pace in over a year.

These weak economic signals could boost gold’s demand as investors seek protection against broader financial instability.

As markets remain volatile, all eyes are on upcoming inflation data, geopolitical developments, and technical price movements. Investors should stay vigilant, as gold’s trajectory could shift rapidly in response to these external factors.