|

| Gold V.1.3.1 signal Telegram Channel (English) |

2025 Gold Investment Guide: Top 5 Trading Methods and Essential Risk Management Tips for Beginners

2025-04-20 @ 15:50

In recent years, gold has once again captured the spotlight in investment circles. From steady buying by central banks to everyday people purchasing gold with a tap on their phones, this age-old safe haven is experiencing a remarkable revival in 2024. According to recent data, global demand for gold has reached record levels, and its price surge has caught the attention of seasoned investors and newcomers alike. For those looking to enter the gold market, understanding current trends and choosing the right way to invest is a crucial first step.

In 2024, gold prices saw a strong upward trend, gaining more than 27% over the year. In the fourth quarter, prices climbed above $2,790 per ounce—a new high. This rise is largely driven by significant purchases from central banks, particularly from emerging markets like China and India that are looking to reduce their reliance on the U.S. dollar by increasing their physical gold holdings. Heightened geopolitical tensions, especially in Ukraine and the Middle East, have further boosted demand for safe-haven assets. Meanwhile, the U.S. Federal Reserve began cutting interest rates in the second half of 2024, lowering the opportunity cost of holding gold and pushing prices up.

What’s interesting is that gold buying is no longer just the domain of large institutions—retail investors are getting involved through more accessible channels. Gold ETFs, which experienced outflows in the first half of the year, saw a strong rebound in the second half, ending the year with a 25% increase in investment demand. Many financial platforms also now offer micro-contracts starting from just one gram, coupled with apps that provide real-time pricing, making gold investment easier and more flexible, especially for those with smaller budgets.

If you’re thinking about investing in gold, it helps to get familiar with five common ways to do so:

1. Spot Gold Trading (Electronic)

This is the most flexible and popular method. With just an online account, you can buy and sell gold 24/7. Most platforms offer leverage ranging from 5x to 20x, which appeals to those looking to profit from short-term market movements.

2. Gold Futures

More suitable for investors with larger budgets and a focus on precision. Standard futures contracts on exchanges like the Chicago Mercantile Exchange involve 100 ounces of gold per contract. However, smaller 10-ounce contracts, which better suit retail investors, have seen a 40% jump in trading volume this year.

3. Gold ETFs

Ideal for mid- to long-term holders who don’t want to deal with physical storage. Buying into a gold ETF is as easy as buying a stock, and the potential for compound growth adds appeal. In Asia, gold ETFs have performed particularly well this year, with a notable increase in assets under management.

4. Physical Gold

Despite its lack of liquidity, some investors still prefer the tangible security of coins and bars. In 2024, national mints around the world reported a surge in coin sales, showing strong faith in gold as a physical asset. However, storing and selling physical gold requires planning and the right channels, making it better suited for long-term holders.

5. Digital Gold Saving Accounts

These newer tools allow investors to convert small sums (even a few dollars) into gold through automated, periodic purchases. Combining the predictability of savings with the potential of investing, they’re particularly friendly for beginners. Over time, even tiny monthly investments can build meaningful gold holdings.

But just like any other investment, gold carries risks. Experts recommend not allocating more than 15% of your total assets to gold and suggest using a balanced strategy. For example, use a small portion for leveraged trades, while holding the rest in ETFs or physical gold to hedge against volatility. If monthly volatility exceeds 8%, reducing short-term positions may be wise to prioritize stability.

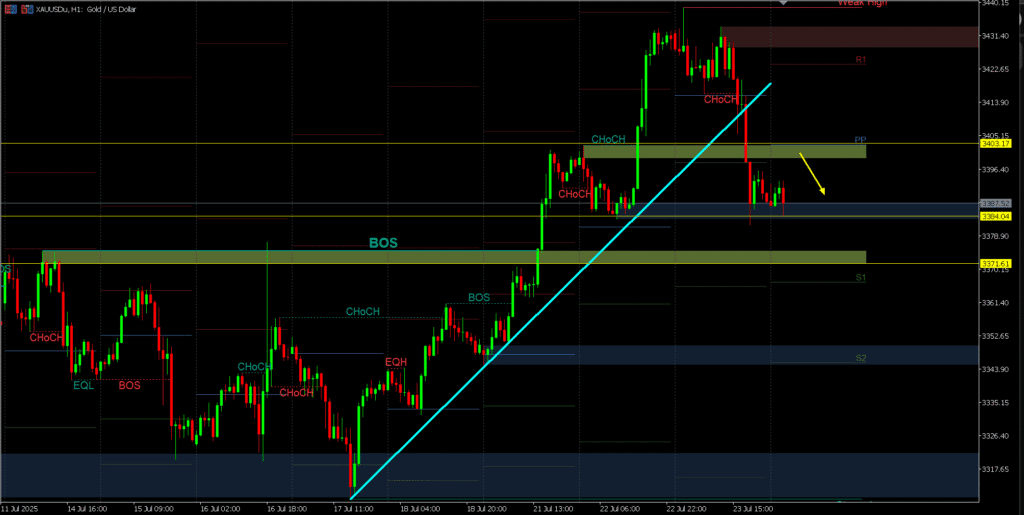

When it comes to timing gold trades, technical charts such as moving averages and Bollinger Bands are helpful tools—but they should be paired with fundamental data. Reports like the Federal Reserve’s meeting minutes, U.S. job numbers, and inflation (CPI) data can all impact the dollar and, by extension, gold prices.

Stop-loss strategies are essential for new investors. Rather than setting arbitrary limits, it’s better to adjust based on market conditions. For instance, using the average range of the past 20 days as a guide can help avoid being triggered by short-term swings. If your trade turns profitable, consider using a trailing stop to secure your gains, rather than holding out for rare windfalls.

Looking ahead to 2025, gold still has room to grow. If geopolitical risks remain and central banks continue buying, gold may challenge new record highs—especially if the U.S. dollar continues to weaken. However, investors should also watch for potential headwinds, such as unexpected shifts in U.S. monetary policy or a seasonal drop in demand from the Indian wedding season. It’s wise to lock in profits when prices are high, then re-enter the market during pullbacks.

For beginners especially, building a solid foundation matters much more than chasing quick profits. Start by choosing a reputable, regulated platform to ensure both the safety of your funds and smooth trades. Next, spend time practicing with demo accounts—learn how to monitor prices, set stop-losses, and develop good habits. Lastly, tailor your strategy to your risk tolerance and financial goals. Whether you’re stacking gold slowly or trading more actively, regularly revisit and adjust your plan.

Gold has long been a store of value, but modern investing offers more tools than ever before. With the right knowledge and approach, you don’t need piles of cash or complex trades—just a phone and a plan. The key is to understand the market, manage risk, and stick to your own pace. As the saying goes: “Gold doesn’t lie—but the market will test you.” Now’s a great time to consider making gold a dependable part of your investment portfolio.