|

| Gold V.1.3.1 signal Telegram Channel (English) |

Australian Dollar Pulls Back Near Yearly High as Markets Eye CPI and RBA Rate Cut Outlook

Australian Dollar Pulls Back Near Yearly High as Markets Eye CPI and RBA Rate Cut Outlook

2025-04-29 @ 21:49

🇦🇺💱 **Aussie Dollar Pulls Back Slightly Ahead of Key CPI Data, But Still Near Yearly Highs**

On April 29, the Australian dollar eased modestly against the U.S. dollar, slipping 0.49% to 0.6398 during European hours. Despite the minor retracement, AUD/USD remains close to its annual high set earlier this month at 0.6439. The Aussie has been buoyed recently by improving global risk appetite and growing speculation that the Federal Reserve may pivot toward looser monetary policy.

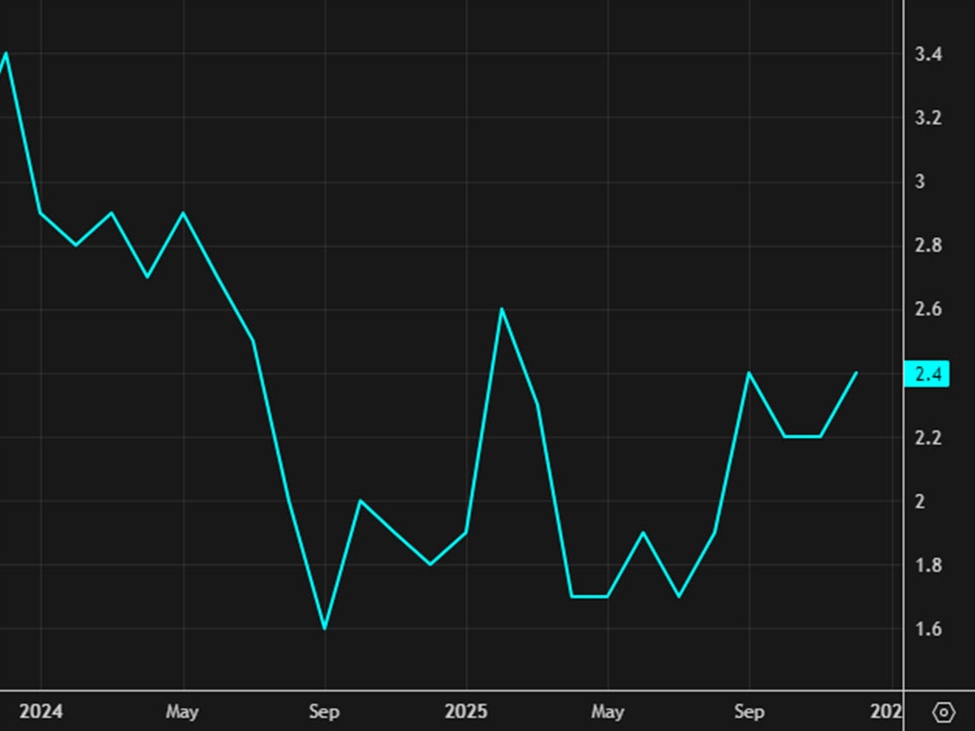

Markets are now turning their attention to Australia’s Q1 CPI data, due on April 30. Annual inflation is expected to ease slightly from 2.4% to 2.3%, while core inflation (trimmed mean CPI) is forecast to drop from 3.2% to 2.9%. If the data lands as expected, it would mark the first time since 2021 that core inflation returns to the RBA’s 2–3% target range — a development that may clear the way for a potential rate cut as early as May.

However, external risks continue to cloud the outlook. Rising U.S.-China trade tensions are back in focus, especially after the U.S. announced a 20% tariff on a range of Chinese imports. That could spell trouble for Australia’s export-reliant economy, particularly in key sectors like iron ore and agriculture. At its April meeting, the RBA held the cash rate steady at 4.10%, but flagged heightened caution over global headwinds and their possible impact on domestic inflation trends.

From a technical angle, AUD/USD continues to trade above its 9-day moving average (0.6387), with the daily RSI holding above 50 — a sign that buying interest remains intact. Immediate resistance sits at 0.6439; a breakout could open the door for a run toward 0.6515. On the flip side, a drop below the 50-day moving average at 0.6312 could put pressure on the pair to retest support at 0.6175 — the year-to-date low.

💼 Meanwhile in the U.S., upcoming labor market data could influence broader market sentiment. The JOLTS job openings report (due April 29) is expected to show a decline to 7.48 million, with nonfarm payrolls (May 2) projected to slow to 135,000 new jobs. Recent dovish signals from Fed Governor Christopher Waller — suggesting rate cuts could come sooner if the economy loses steam — have further weighed on the U.S. dollar, reducing its safe-haven appeal.

🔍 Looking ahead, AUD performance will hinge on the direction of Australia’s inflation data and developments in U.S.-China trade dynamics. While Beijing denies ongoing tariff negotiations, recent comments from former President Trump indicate a willingness to revisit trade policy — something investors are watching closely. A downside surprise in Australian CPI next week could strengthen the case for a rate cut at the RBA’s May 7 meeting, potentially triggering short-term downside pressure on the Aussie.

*(This post is for informational purposes only and does not constitute investment advice.)*