|

| Gold V.1.3.1 signal Telegram Channel (English) |

Auto Tariffs Spike Prices: Impact on Consumers and Tesla Explained

2025-04-02 @ 17:37

25% Auto Tariffs Set to Shake U.S. Car Market: What It Means for Consumers and Tesla

New Tariffs Threaten to Push Car Prices Up by Thousands

The Trump administration’s newly announced 25% tariffs on imported vehicles and auto parts are slated to roll out on April 3 for passenger cars and light trucks, and May 3 for auto parts. While initially seen as a move favoring American automakers like Tesla, the reality paints a far more complex picture.

Consumers are likely to face steep increases in vehicle prices, with analysts warning that the cost of a typical car could jump by as much as $5,000 to $10,000. Even budget models won’t be spared. Take the Hyundai Venue — a modest subcompact crossover with an average list price of $24,000. Post-tariff, it could retail close to $28,500, pricing out many cost-conscious buyers.

Key Price Impact Highlights:

- Sub-$30,000 vehicles may become increasingly rare

- Increase in MSRP expected across almost all categories

- Middle class and first-time buyers may feel the biggest pinch

Tesla: Not as Immune as You Might Think

Despite being seen as a U.S. manufacturing powerhouse, Tesla won’t escape the ripple effects of these new auto tariffs. While much of Tesla’s production is domestic, the electric vehicle giant still depends on imported parts such as batteries—many from China.

Elon Musk has publicly acknowledged that the tariff impact is “not trivial,” undermining the belief that Tesla stands to benefit disproportionately. Rising costs for imported components mean Tesla could face more expensive production and slimmer margins, and those costs may be passed on to consumers.

Why Tesla Will Still Feel the Pinch:

- High dependency on global supply chain for advanced components

- Battery packs and electronics sourced from international partners

- Pressure on Model 3 and Model Y pricing structure

What It Means for the Broader Auto Industry

The American auto supply chain is heavily integrated with international partners, especially in Mexico and Canada. The new tariffs could disrupt production pipelines, reduce manufacturing efficiency, and limit consumer choice due to the reduced inflow of imported models and parts.

Furthermore, the squeeze isn’t limited to new car buyers. The cost of replacement parts is expected to surge, prompting a jump in vehicle repair bills and insurance premiums. Insurify reports a likely average premium increase to around $2,759 — a rise of 19%.

Broader Consequences:

- Reduced competition in the sub-$40,000 market

- Higher costs for repairs and insurance

- Production slowdowns in North American factories

Luxury Car Market Feels the Heat

Not even high-end automakers are spared. Ferrari has already announced it will increase prices on select models such as the Ferrari 296, SF90, and Roma by 10% starting April 1. These vehicles, which already command six-figure price tags, will soon become even more exclusive.

Impact on Luxury Brands:

- Base prices for top models likely to exceed expectations

- Fewer incentives or dealer discounts to absorb increased costs

- Affluent consumers may shift toward domestically-built options

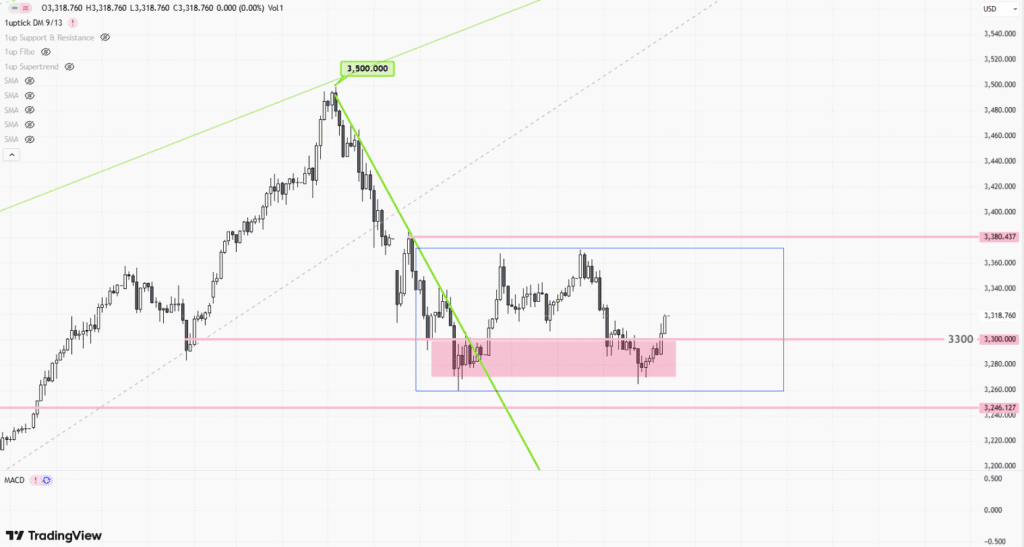

![[Gold price weekly] – Volatile Consolidation Driven by Multiple Factors](https://int.1uptick.com/wp-content/uploads/2025/04/2025-04-28T055444.196Z-file-1024x551.png)