|

| Gold V.1.3.1 signal Telegram Channel (English) |

China Weakens Yuan to Counter U.S. Tariffs and Pressure

2025-04-08 @ 13:02

Yuan Weakening Signals Beijing’s Strategic Trade Response Amid Intensified Tariffs

The economic chessboard between the United States and China has shifted yet again. In response to aggressive U.S. tariffs, China made a striking move by allowing the yuan to weaken past the psychologically important 7.30 threshold against the dollar. While this might sound like a technical monetary action, its ripple effects have sent clear signals across global markets. Let’s break down why this matters and what it tells us about China’s evolving trade war playbook.

China’s Currency Tactic: A Lever in the Trade Tug-of-War

The People’s Bank of China has subtly permitted the yuan’s depreciation, a move with deliberate strategic underpinnings. The timing of the currency adjustment is no coincidence—it’s a calculated effort to offset the economic strain from recent U.S. tariff escalations.

This tactic is driven by several motivations:

- Export Price Advantage: A cheaper yuan makes Chinese goods less expensive abroad, giving exporters a lifeline in an increasingly protectionist environment.

- Negotiation Leverage: The move subtly reminds Washington that China can buffer against U.S. trade pressure by adjusting its financial tools.

- Macroeconomic Adjustment: It’s also a reflection of slowing growth at home, prompting policymakers to seek external demand as a source of stabilization.

However, this short-term relief doesn’t come without risks.

Risks Under the Surface: Inflation and Capital Pressure

While a weaker yuan may help exports, it also raises internal economic vulnerabilities in China:

- Imported Inflation: Commodities and raw materials priced in dollars become costlier, potentially squeezing manufacturing margins and consumer purchasing power.

- Capital Flight Concerns: Historically, sustained currency depreciation has triggered fears of capital outflows. If investors believe the yuan will continue to fall, they may move funds offshore, destabilizing financial markets.

- Debt Servicing Strain: With significant dollar-denominated debt, Chinese firms could face rising repayment burdens, further complicating corporate balance sheets.

These side effects make Beijing’s currency strategy a delicate balancing act—one that may support trade but threaten domestic financial stability if left unchecked.

Escalating Tariff War: U.S. Turn Up the Heat

Tensions between Washington and Beijing have reached a new pitch. The U.S. has announced a sweeping 50% tariff hike on all Chinese imports—an aggressive countermeasure to China’s retaliatory tariffs. Now, certain Chinese goods face a combined tariff burden of up to 84%.

Implications of the tit-for-tat escalation include:

- Supply Chain Complications: Multinational companies sourcing from China may face disruptions and rising costs, prompting some to reevaluate supplier relationships.

- Consumer Price Inflation: Higher import costs could ultimately be passed on to U.S. consumers, fueling broader inflationary trends.

- Investor Uncertainty: Fear of prolonged trade tensions has injected volatility into equity and currency markets across Asia, Europe, and the Americas.

These dynamics have nudged global markets into a risk-off mode, prompting investors to seek safety in defensive assets.

Market Sentiment Sways as Currency and Trade Tools Clash

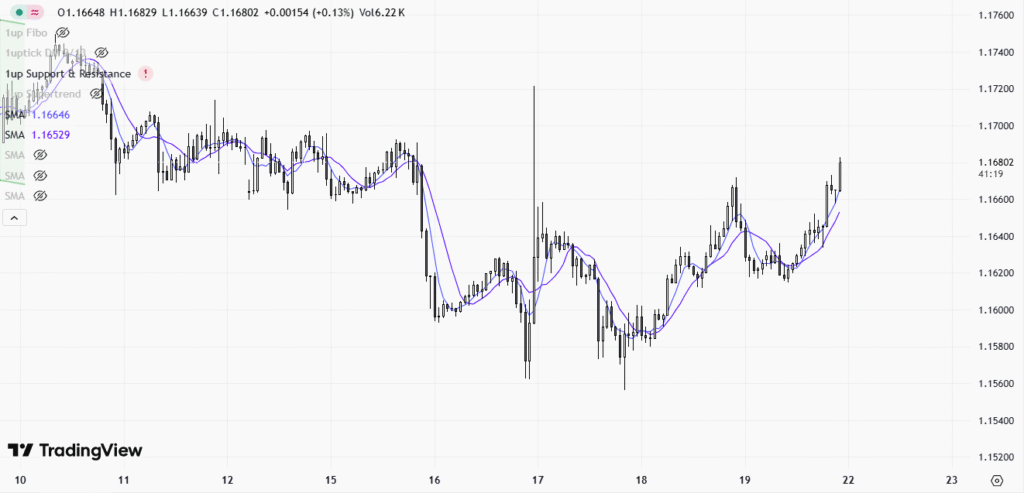

Markets are responding with unease to the dual pressures of a weakening yuan and the escalation of tariffs. Chinese stocks have tumbled in response, while broader Asian indices reflect caution.

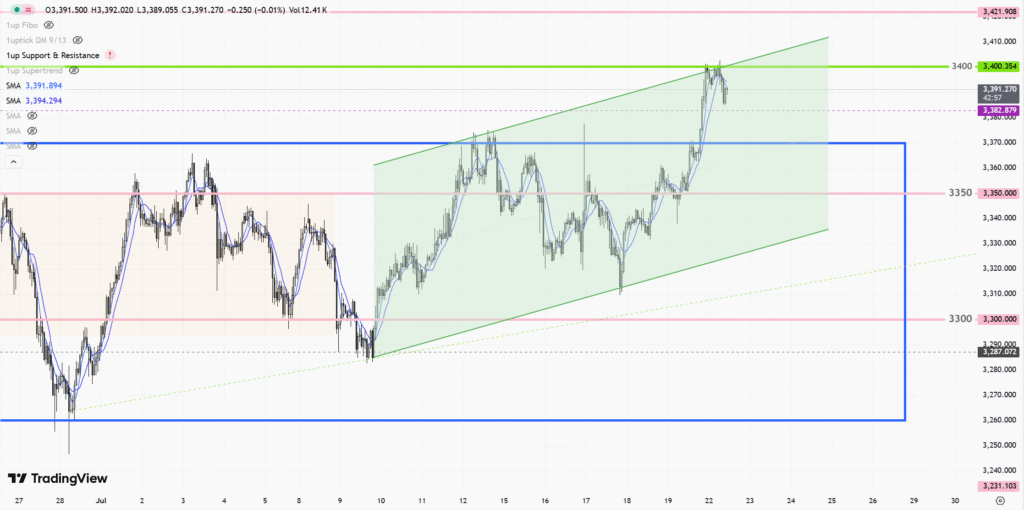

- Volatility on the Rise: With uncertainty surrounding trade negotiations, volatility indices have spiked, and safe-haven assets such as U.S. Treasuries and gold have gained traction.

- Currency Watch: Central banks and global investors are closely monitoring the yuan’s trajectory as a marker of Beijing’s economic policy intentions.

Beijing’s message is clear: China is willing to deploy its currency as an economic buffer. But that strategy also sends a signal to global markets—a signal that policy uncertainty is far from over.

Global Spillover Effects: More Than a Bilateral Issue

The U.S.-China trade war and China’s yuan recalibration are not contained issues—they send shockwaves through global economics. Emerging market currencies are particularly vulnerable