|

| Gold V.1.3.1 signal Telegram Channel (English) |

EUR/USD Technical Analysis and Outlook for April 21–25, 2025

EUR/USD Technical Analysis and Outlook for April 21–25, 2025

2025-04-26 @ 13:11

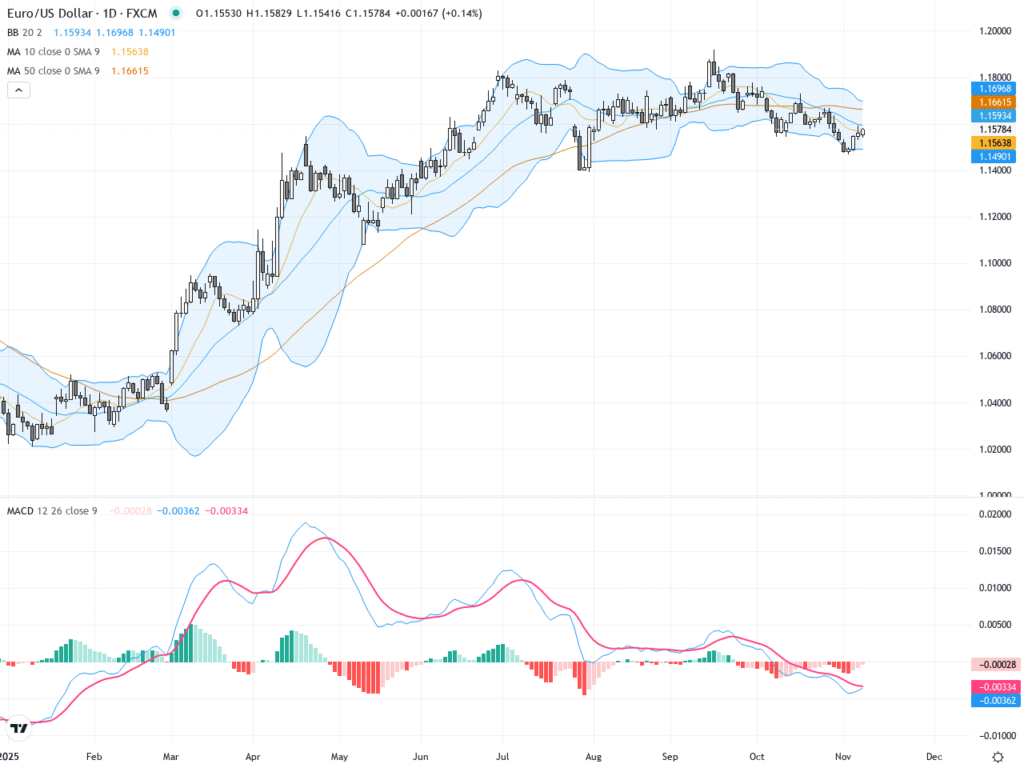

From April 21 to 25, 2025, the euro-dollar (EUR/USD) exchange rate experienced significant volatility, with the pair pulling back from highs and then entering a consolidation phase. Early in the week, the euro briefly touched 1.1573 before retreating to around 1.1310 due to a rebound in the US dollar. By Friday, it closed near 1.1360, down about 0.2% from the previous week.

Three main factors drove the market this week.

First, political and trade developments in the U.S. stirred major fluctuations in dollar sentiment. At the start of the week, uncertainty surrounding White House policies weighed on the dollar, giving the euro a boost. However, as the U.S. sent out more conciliatory signals later in the week, risk aversion faded, supporting the dollar and capping the euro’s upward momentum.

Second, economic data played a role in shifting demand between the two currencies. Preliminary April PMI readings from the eurozone surpassed expectations, with both manufacturing and services sectors showing expansion, giving the euro some short-term support. Still, the U.S. core PCE for March remained elevated, reinforcing market expectations that the Federal Reserve would keep interest rates higher for longer—limiting the euro’s gains. Meanwhile, dovish remarks from European Central Bank officials, suggesting a possible rate cut as soon as June, added to the cautious outlook on the euro.

Third, technical buying and short covering helped the euro find support and rebound near key levels. The 1.1300–1.1245 zone provided a strong floor, triggering a recovery that lifted EUR/USD back above 1.1370, signaling on the daily chart that the correction phase might be ending.

On the technical front, immediate support lies at 1.1300 and between 1.1245–1.1290, with stronger support further down at 1.1140–1.1170. Initial resistance is at 1.1380—if the pair breaks above this level convincingly, it could open the door to retesting 1.1475 or even the 1.1573 high. Momentum indicators on the daily chart suggest some slowing, but the broader weekly trend remains skewed in favor of the bulls.

Looking ahead to next week, all eyes will be on the Federal Reserve’s May meeting, the eurozone’s preliminary April CPI figures, and April U.S. employment data. If EUR/USD can hold above 1.1380, the rebound could gain further traction. However, if it falls back below 1.1245, there’s a risk of a deeper correction down to the 1.1140–1.1170 zone. For short-term trading, a range-trading strategy is recommended until a clear breakout of key technical levels occurs.