|

| Gold V.1.3.1 signal Telegram Channel (English) |

[Gold price weekly] – Volatile Consolidation Driven by Multiple Factors

[Gold price weekly] – Volatile Consolidation Driven by Multiple Factors

2025-04-28 @ 13:55

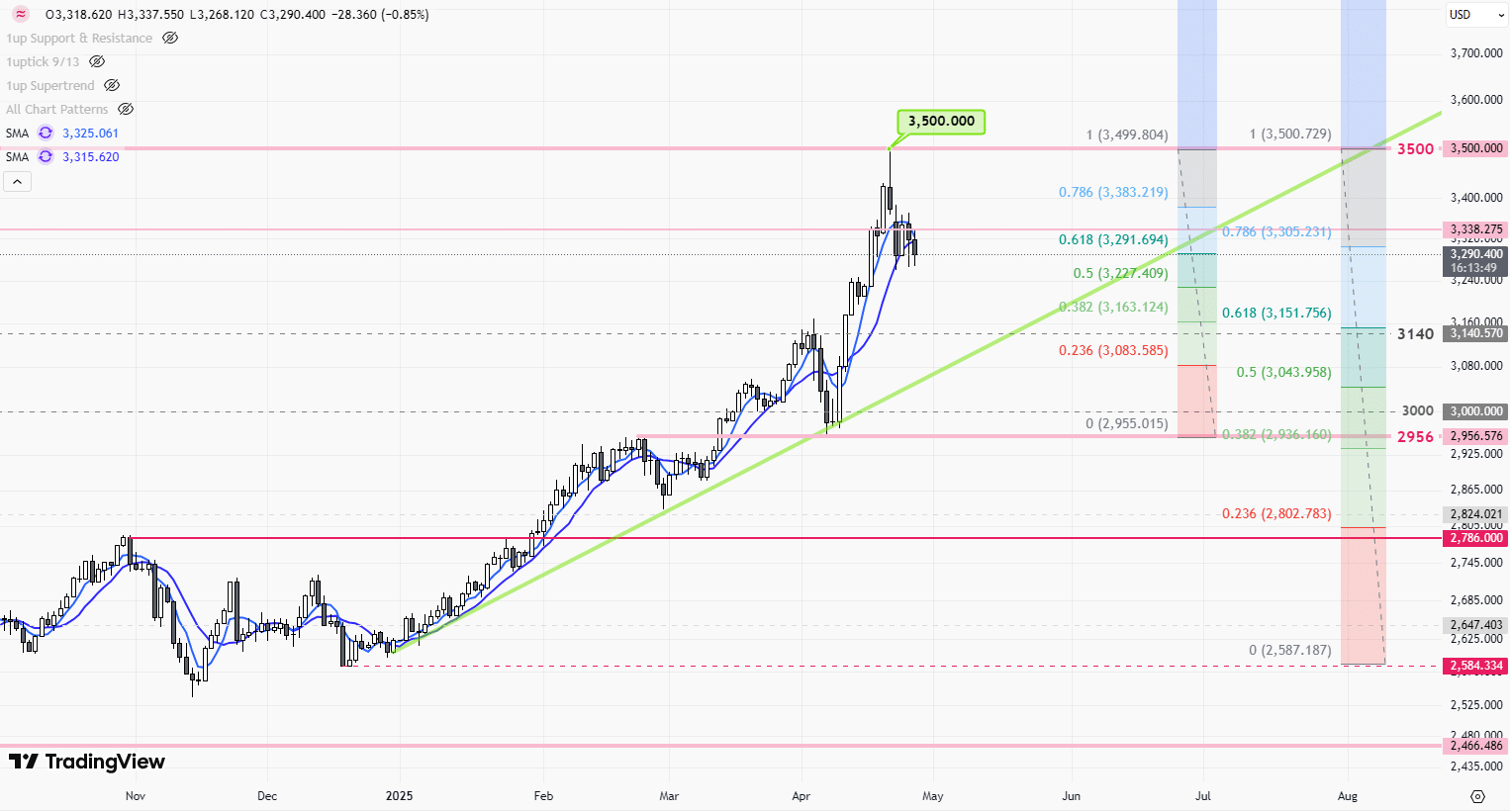

Spot Gold (XAU/USD) spent last week consolidating, with prices bouncing within a range under the pressure of geopolitical tensions, changing Fed policy expectations, and a volatile U.S. dollar. Since hitting a record high on April 22, gold pulled back, ending the week down 4.18%.

According to closing data, on April 22, gold prices reached a historic high of $3,500 per ounce. Subsequently, profit-taking pressure emerged, causing a decline of 0.85% to $3,394 on April 22. The downward trend continued on April 23, with gold prices plummeting to $3,260. On April 24, the minutes from the Federal Reserve meeting indicated a shift toward dovish monetary policy, leading to a 1.54% rebound in gold prices, closing at $3,354. As the weekend approached, market sentiment turned bearish, and gold closed at a weekly low of $3,318 on April 25.

Several key factors drove these moves:

First, geopolitical tensions initially boosted safe-haven demand. The escalation between Israel and Iran, together with the U.S. announcing a fresh wave of tariffs on Chinese imports, encouraged investors to pile into gold early in the week. However, reports of possible progress in Russia-Ukraine peace talks later tempered these worries and capped gold’s rally.

Second, the Fed’s policy outlook remained a major driver. The April meeting minutes revealed officials’ growing concern over economic growth risks, which fueled market hopes for a rate cut this year. That narrative knocked the dollar to a weekly low. But stronger-than-expected U.S. GDP data — 3.1% annualized growth in Q1 — reversed those losses by week’s end, putting renewed pressure on gold.

Lastly, technical factors added to the volatility. Gold struggled to sustain its breakout above $3,400, triggering a bearish rising wedge pattern that was compounded by algorithmic selling. Many institutional investors also chose to lock in profits at high levels, intensifying downward pressure.

Looking ahead, gold is likely to trade in a wide range between $3,250 and $3,400 this week. Two events stand out: the Federal Reserve’s rate decision on May 1 and the non-farm payrolls report on May 2. Should the data hint at slowing economic momentum, safe-haven demand for gold could make a comeback. Meanwhile, any updates on China’s central bank gold reserves are worth watching — continuous buying by Beijing could offer another layer of support for the market.

(This report is for information purposes only and should not be construed as investment advice. Markets involve risk; please assess your risk tolerance before investing.)