|

| Gold V.1.3.1 signal Telegram Channel (English) |

Trump’s Tariffs Shake Global Markets, Trigger Trade War Fears

2025-04-08 @ 11:44

Global Trade Rattled as Trump Unleashes Sweeping Tariffs

As of April 9, 2025, President Donald Trump has launched a fresh wave of aggressive tariffs under a national emergency declaration—fueling a new stage in global economic uncertainty. The updated framework, justified under the International Emergency Economic Powers Act, takes aim at what the administration defines as “unfair and non-reciprocal international trade practices.” The strategy? Significant tariffs ranging from 10% to 46% on imported goods from key trading partners.

This bold move impacts a global economy valued at $115 trillion, introducing ripple effects in capital markets, manufacturing, and geopolitical relationships.

Breaking Down the New Tariff Structure

The tariff rollout isn’t uniform—it targets trade deals and manufacturing hubs with surgical precision:

- China: A 34% tariff now applies to all Chinese imports, hitting over $540 billion in bilateral trade. This is the sharpest escalation, clearly aimed at decoupling supply chains.

- European Union: A 20% blanket duty has been imposed, putting added stress on already fragile transatlantic relations.

- Vietnam: Tariffs have been cranked up to an eye-watering 46% for selected goods, part of a broader strategy to limit reliance on Southeast Asian outsourcing.

- Mexico and Canada: Tariffs range from 12%–25%, excluding USMCA-compliant shipments, creating compliance pressure on North American manufacturers.

The tariffs signal an administration ready to prioritize domestic industry expansion at the expense of international trade flows.

Immediate Shockwaves Across Markets

Markets responded swiftly—and not in a good way:

- Stock Sell-offs: Global indices turned red. The Shanghai Composite dove 3.5%, while the Euro Stoxx 50 fell nearly 3%. U.S.-listed multinationals also experienced significant intraday volatility.

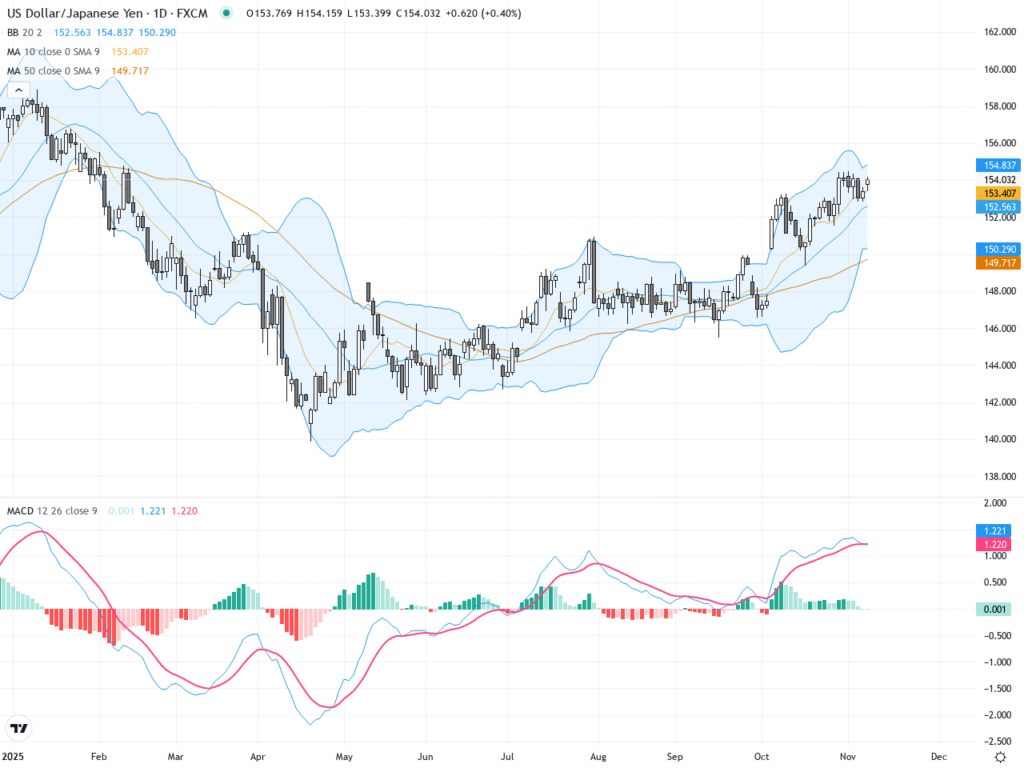

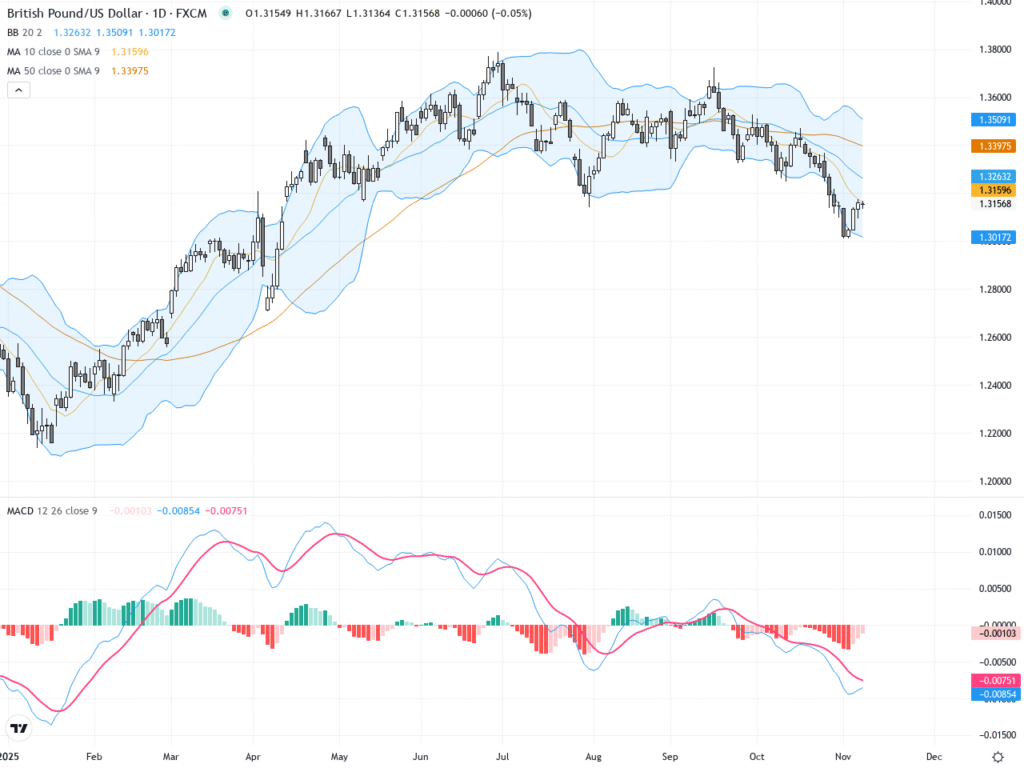

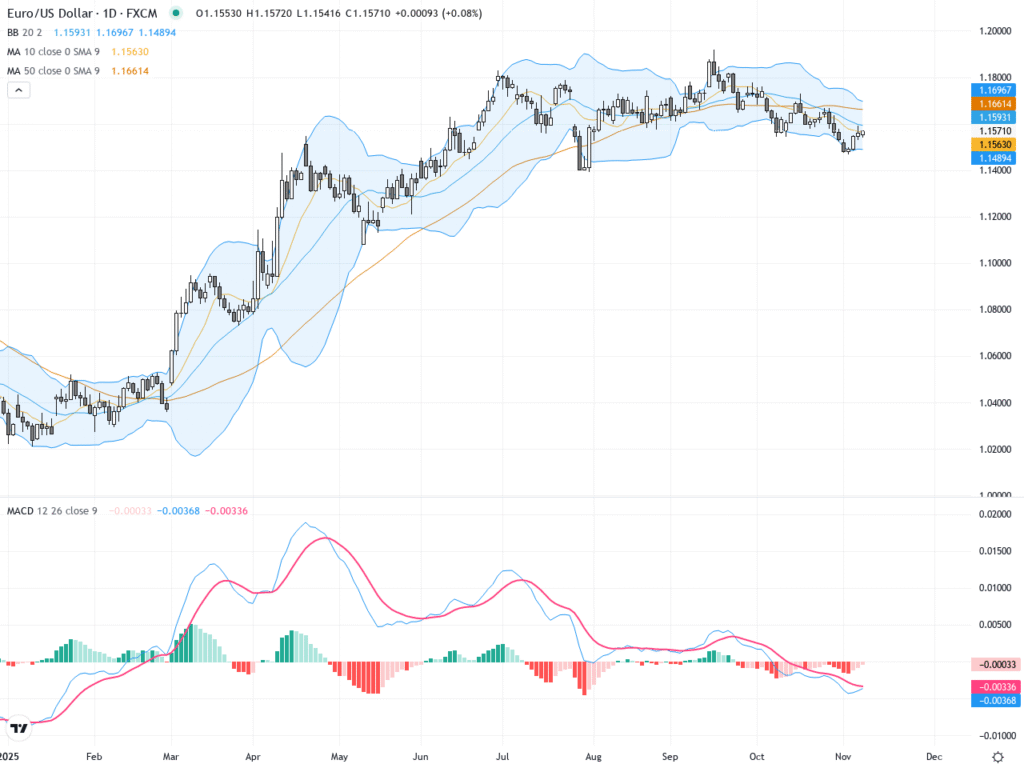

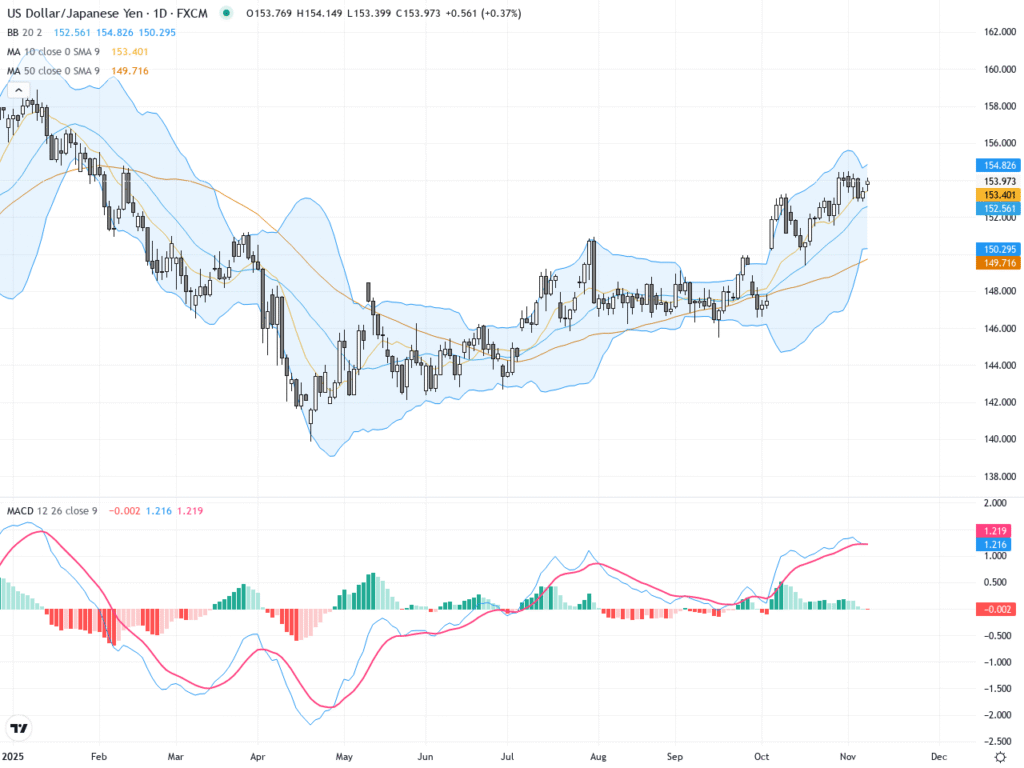

- Currency Moves: The Chinese yuan tumbled in overseas trading, pushing towards levels last seen during the 2019 tariff standoff. Currency watchers warn of defensive devaluations ahead.

- Threat of Retaliation: The European Union and China have both announced plans for reciprocal tariffs targeting major U.S. export sectors like agriculture and semiconductors.

The potential for a full-fledged trade war has raised alarm bells for central banks and institutional investors.

Corporate Strategy Recalibrates in Real Time

Top U.S.-based firms aren’t waiting to adapt. In the last 48 hours alone, we’ve seen fast-moving announcements from global giants:

- Apple: The tech titan is accelerating plans to shift production away from China, exploring partnerships in India, Vietnam, and Mexico.

- Tesla: Elon Musk’s European expansion—particularly the German Gigafactory—now faces cost headwinds from U.S. tariff retaliation and EU import duties on American electric vehicles.

This signals a new phase of supply chain diversification—less about efficiency, more about geopolitical risk management.

Sector-Specific Impacts: Who’s Getting Hit Hardest?

Some industries are facing direct consequences:

- Energy: The inclusion of a 10% tariff on energy imports sent Brent crude surging to $92 per barrel. Analysts anticipate rising domestic gas prices as foreign supply tightens.

- Autos: U.S. carmakers are bracing for cost spikes. Tariffs on imported auto parts—especially from Asia and Europe—are expected to push up prices from assembly to sales lot.

- Agriculture: China’s retaliatory tariffs on U.S. agriculture could devastate export demand. Corn, soy, and pork producers are particularly exposed as trade disputes escalate.

The knock-on effects could contribute to inflating consumer prices and slowing GDP growth through 2025.

IMF Issues Stark Global Warning

The International Monetary Fund issued an urgent advisory following the White House’s policy shift:

- Global Slowdown: The IMF now anticipates a 0.6% decline in projected global GDP growth for 2025.