|

| Gold V.1.3.1 signal Telegram Channel (English) |

U.S. Stocks Slide Across the Board on April 21, 2025 Amid Policy Uncertainty and Market Jitters

U.S. Stocks Slide Across the Board on April 21, 2025 Amid Policy Uncertainty and Market Jitters

2025-04-22 @ 11:48

On April 21, 2025, U.S. stocks slumped across the board amid rising global market tensions. All three major indexes closed lower, with the S&P 500 tumbling 2.36% to finish at 5,158.20 — its steepest single-day decline since April 10. The Dow Jones Industrial Average fell 2.48%, while the Nasdaq Composite dropped 2.55%. A risk-off mood took hold, driven by political noise, trade uncertainty, and a sharp pullback in tech stocks.

Former President Donald Trump weighed in on monetary policy, posting a sharp rebuke of Fed Chair Jerome Powell on social media. He accused Powell of being slow to respond to economic risks and called for swift rate cuts to avoid a slowdown. The comments raised concern among investors about the Fed’s independence and cast doubt on the predictability of future policy moves. Although Powell recently underscored the Fed’s commitment to monitoring inflation and economic conditions — while warning that trade policies could add pressure to prices — the apparent rift between the Fed and Trump’s political allies has spooked the markets.

Alongside growing domestic uncertainty, U.S.-China trade talks remain stalled. Since Washington imposed a new round of tariffs earlier this month, negotiations have hit a wall. Markets responded with caution, worried that rising supply chain costs and weak global demand could drag down corporate revenue and capital spending. Industrial stocks broadly moved lower, with Caterpillar sliding more than 3%, reflecting investor anxiety over multinational earnings.

The tech sector bore the brunt of Monday’s sell-off. Tesla plunged 7%, Nvidia dropped 6%, and both Amazon and Meta fell over 4%. Given that mega-cap tech names carry significant weight in the S&P 500, their declines magnified index volatility. The market’s recent rotation away from high-valuation stocks has also revealed how concentrated the sector has become — raising questions about hidden risks.

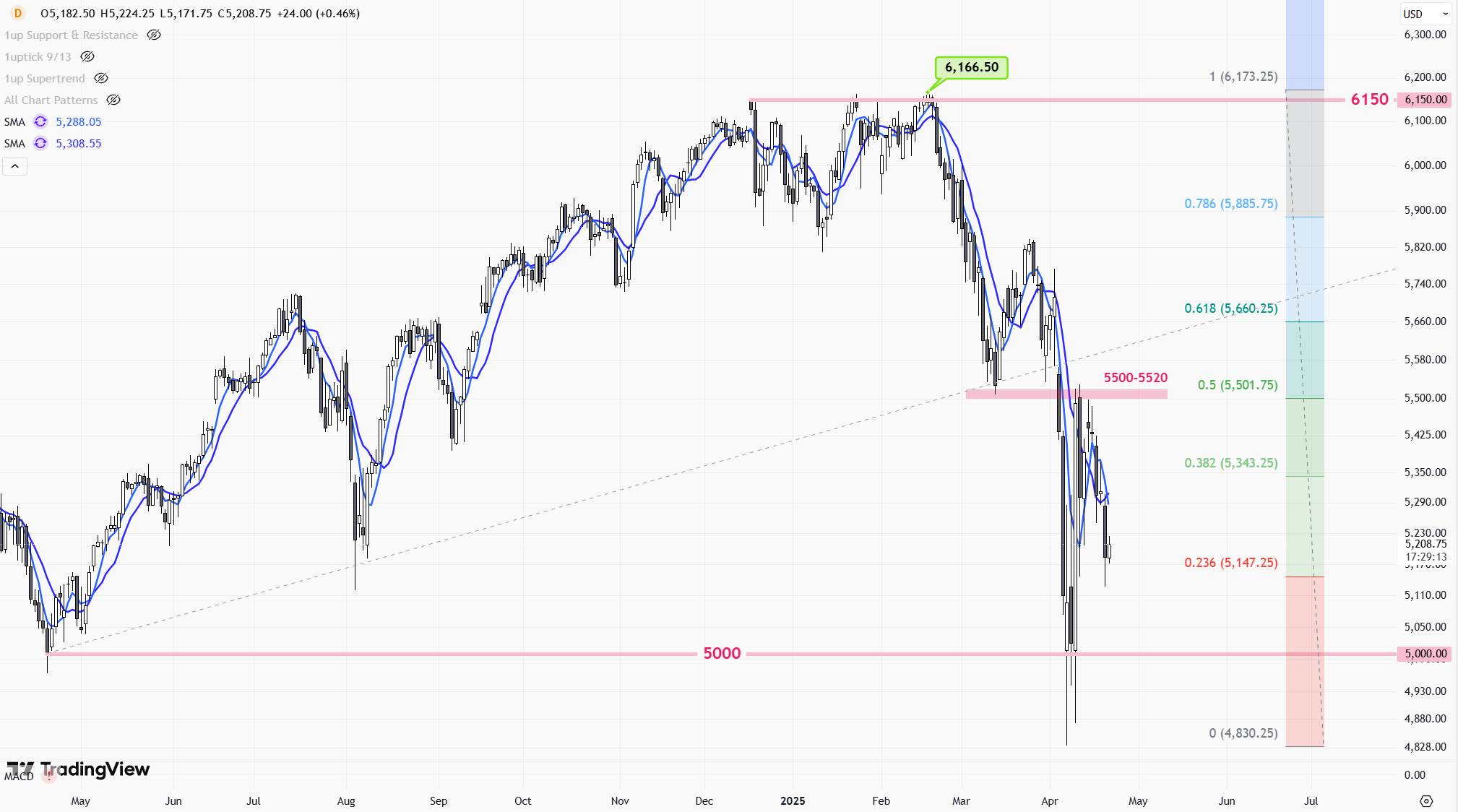

From a technical standpoint, the S&P 500 has broken below its 50-day moving average, and the Relative Strength Index (RSI) is approaching oversold territory, indicating persistent short-term pressure. Meanwhile, the VIX volatility index jumped to 31.98 — one of the highest readings this year — signaling stronger demand for hedging strategies. Investors are moving capital away from risk assets, as shown by a higher 10-year Treasury yield at 4.39% and gold prices climbing past $2,400 per ounce.

Overall, a mix of political and policy uncertainty is weighing heavily on sentiment, causing a clear pullback in risk appetite. For now, the market is focused on two key events: Thursday’s U.S. first-quarter GDP report and the Fed’s upcoming policy meeting next month, which may offer more clarity on the economic outlook.

For investors, a more defensive posture seems prudent in the short term. Increasing exposure to utilities and consumer staples may help buffer volatility, and option strategies can provide additional downside protection. While tech remains a long-term growth story, careful positioning is key amid ongoing volatility. Keeping an eye on the direction of the U.S. dollar and bond yields will also be important, as these factors could influence corporate earnings in the months ahead.