|

| Gold V.1.3.1 signal Telegram Channel (English) |

US Dollar Rises Against Yen Amid Market Volatility, with Focus on Bank of Japan Policy and Economic Data

2025-04-30 @ 21:02

**USD/JPY Climbs as Weak Japanese Data and Policy Uncertainty Weigh on Yen**

The US dollar has been edging higher against the yen in recent days, largely driven by disappointing Japanese economic data that has further eroded confidence in the country’s recovery prospects. On Wednesday (April 30), the dollar strengthened for a second straight session, trading at 142.48, as traders awaited the upcoming Bank of Japan (BOJ) rate decision and monitored potential developments in US-Japan trade talks.

Japan’s March industrial output fell by 1.2% month-over-month, marking the third consecutive decline and the steepest drop since August of last year. Ongoing inventory adjustments in the automotive sector, along with weakening overseas demand for electronic components, dragged down manufacturing overall. Meanwhile, retail sales rose just 1.7% year-over-year—well below expectations of 2.4%—highlighting cautious consumer spending. Slower tourism demand and subdued domestic discretionary spending were key factors behind the softness in retail activity. Japanese equities and derivatives markets reacted promptly to the data, with sentiment turning notably risk-averse.

On the policy front, the BOJ is widely expected to hold its benchmark rate steady at 0.5%. However, attention will focus on the central bank’s post-meeting statement, particularly its take on the link between inflation and wage growth. March’s labor negotiations saw the biggest wage increase in nearly three decades, but BOJ officials remain cautious, seeking further signs that wage hikes could support a sustainable inflation cycle. Market participants are also considering whether a perceived lack of inflation momentum could prompt the central bank to delay its next rate hike.

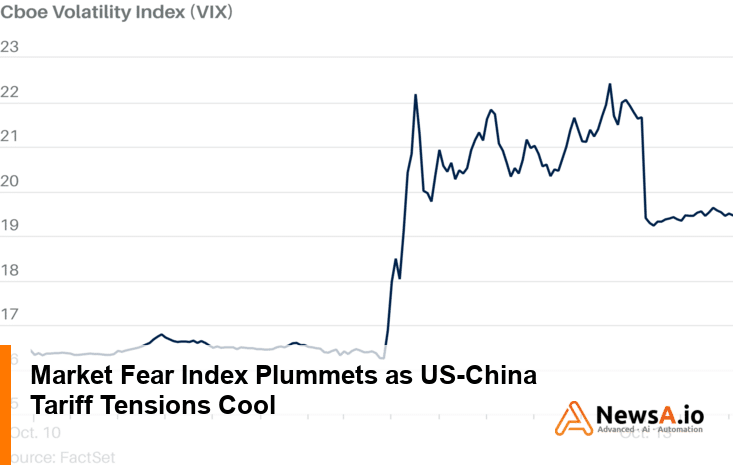

At the same time, developments from Washington are having an impact. The US Treasury Secretary recently confirmed ongoing high-level trade talks with Japan. With US-China tension simmering in the background, whether Tokyo and Washington can reach an agreement is being closely watched. Early reports suggest Washington is pressing Japan to open up more on agricultural and digital trade, while Japan is emphasizing auto parts tariffs and rare earth supply security. If progress stalls, concerns may rise over currency intervention, potentially increasing yen volatility.

From a technical perspective, USD/JPY remains in a broader uptrend but is currently undergoing a pullback. After breaking 142.75, the pair has dipped to around 141.56—still within a retracement phase. Indicators like MACD and stochastic oscillators suggest that selling pressure may be easing. If the pair can consolidate above 141.50, there could be scope to revisit 144.00 and possibly test the yearly high at 146.40. On the downside, 141.00–141.50 is shaping up as a critical support zone.

Recent intraday trading has been range-bound near 142.30, reflecting a cautious tone ahead of Thursday’s BOJ rate decision. Option markets are also signaling anticipation of volatility, with one-week implied vol jumping to 12.8%—suggesting investors are bracing for surprises.

Looking ahead, in addition to the BOJ decision, several key US data releases, including non-farm payrolls and the ISM Manufacturing Index, may sway dollar sentiment and influence the Federal Reserve’s rate outlook. Futures markets are currently pricing in more than 80 basis points of rate cuts by year-end. Any significant deviation in upcoming data—either strength or weakness—could serve as a catalyst in currency markets.

In sum, the direction of USD/JPY will likely hinge on a mix of central bank signals and trade developments. In the near term, 141.50 and 144.00 are the technical levels to watch. A clear break of either could set the stage for a more decisive trend. Traders should keep a close eye on both macro data and policy cues to adjust their positioning accordingly.