|

| Gold V.1.3.1 signal Telegram Channel (English) |

Australian Dollar hovers around 0.6450 as Weak Chinese Demand and U.S. Rate Pressure Weigh on Outlook

2025-05-20 @ 13:16

📉 Aussie Dollar Under Pressure: What’s Weighing Down the AUD?

Australian Dollar hovers around 0.6450 against the US dollar during Tuesday’s Asian trading session. The move reflects investor reaction to a wave of dovish policy signals out of Australia and China, prompting a more cautious stance in currency markets.

🇦🇺 RBA Begins Easing Cycle

The Reserve Bank of Australia (RBA) cut the official cash rate by 25 basis points to 3.85%, marking its first rate cut in three years. The decision mirrors a sluggish domestic outlook: slowing job growth, dampened consumer spending, and a cooling housing market. While the move was largely expected, some analysts had speculated the RBA might opt for a more aggressive cut.

Despite meeting forecasts, the rate cut added downward pressure to the AUD. The RBA emphasized a data-dependent approach going forward, keeping the door open for further easing later this year. Market consensus now sees room for one or two additional rate cuts in 2024.

🇨🇳 China Joins the Easing Trend

Adding to the mix, China’s central bank also lowered its key lending rates—the one-year and five-year Loan Prime Rates—in a rare adjustment intended to support its fragile recovery. However, April’s economic indicators fell short of expectations, with weaker industrial output and a slowdown in investment growth. For a commodity-exporting economy like Australia, which is heavily reliant on Chinese demand, this raises fresh concerns.

🪨 Iron Ore Shows the Strain

Iron ore, Australia’s largest export, has taken a hit. Futures in Singapore fell below $100 a ton for the first time in three months. The trend reflects concern over China’s tepid infrastructure momentum. If stimulus efforts don’t translate into tangible demand, we may see continued pressure on prices—another headwind for the AUD.

🇺🇸 What About the US Dollar?

Last week’s surprise sovereign credit rating downgrade by Moody’s shook confidence in the US dollar, briefly pushing the dollar index towards 100. A weaker USD typically supports other major currencies, including the AUD. Still, given Australia’s own economic soft spots and weakened commodity demand, the AUD’s ability to rebound remains restrained.

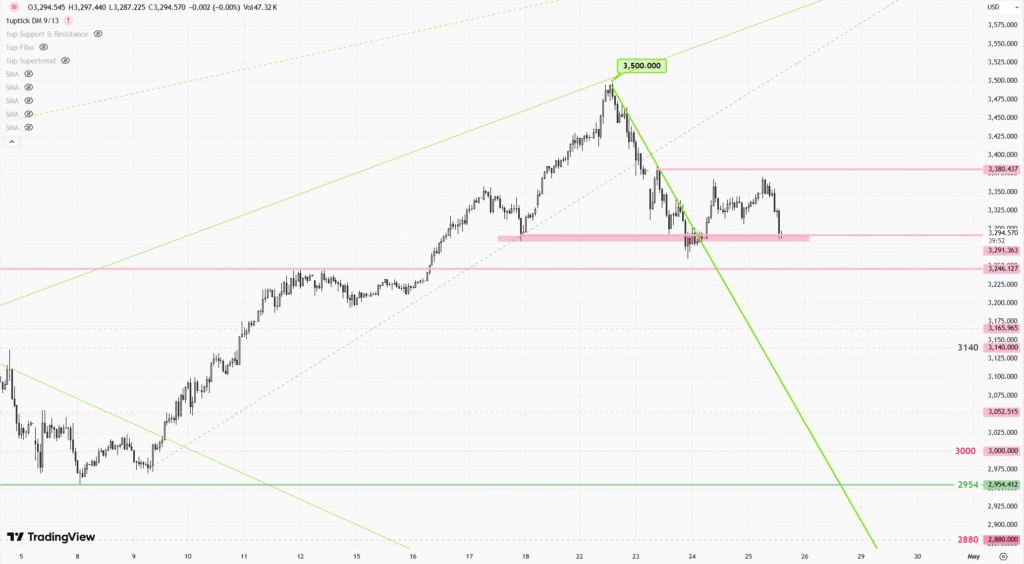

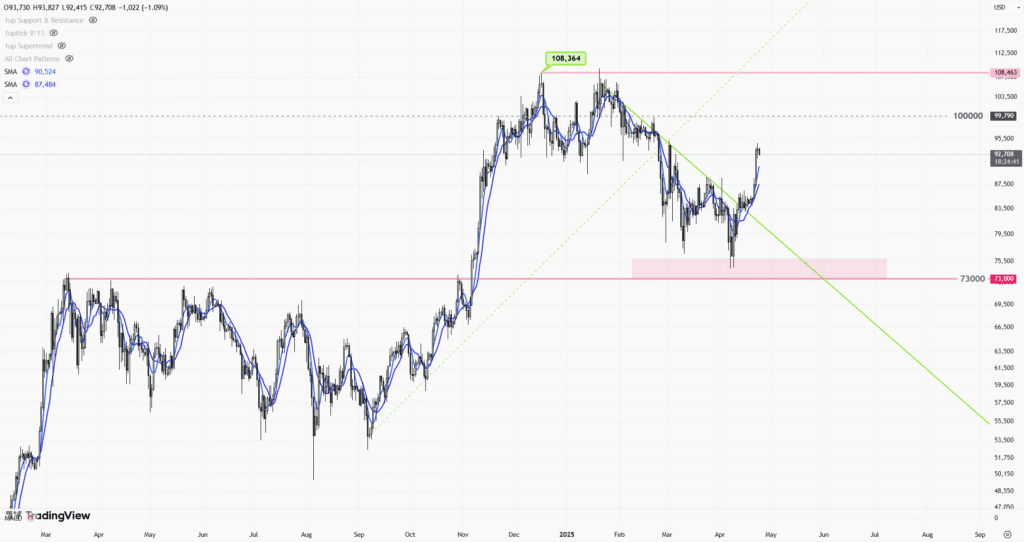

📊 Technical Outlook

Technically, AUD/USD is hovering within a consolidation range between 0.6350 and 0.6500. The 0.6450 level has become a resistance zone; failure to break above could increase the chance of retesting 0.6300. All eyes are now on the Fed’s upcoming meeting minutes and key US economic reports, which could shape market expectations around global interest rate trends.

🔮 Looking Ahead

A divergence in monetary policy is likely to persist. Australia is clearly moving toward an easing cycle, while firm US data suggests the Fed may keep rates high for longer. This widening rate gap could further limit upside for the AUD.

In the short term, the Aussie remains under pressure from multiple fronts: weakening Chinese demand, falling commodity prices, and global monetary uncertainty. Investors considering AUD exposure should keep a close watch on central bank signals and any potential turnaround in Chinese economic momentum.