|

| Gold V.1.3.1 signal Telegram Channel (English) |

Canadian Dollar Poised to Rise Ahead of April CPI Report, as U.S. Credit Downgrade and Oil Price Swings Take Center Stage

2025-05-20 @ 13:21

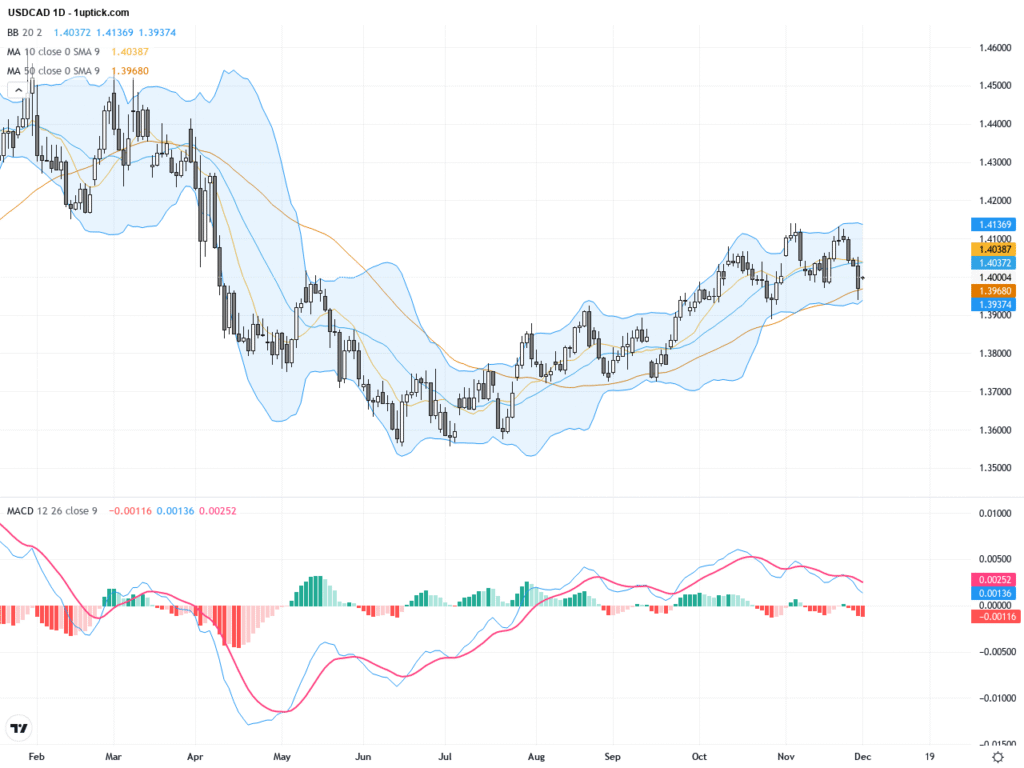

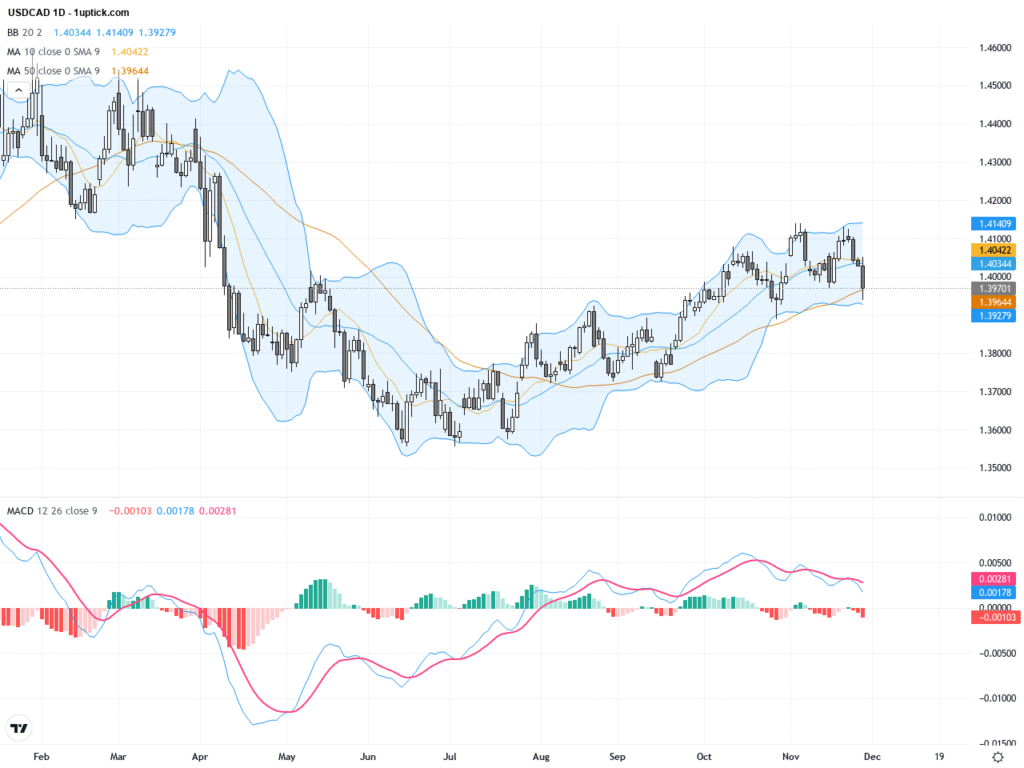

**Loonie in the Spotlight as Inflation Data Looms, USD/CAD Dips Near 1.3950**

During the Asian session on Tuesday, the US dollar continued to slide against the Canadian dollar, with USD/CAD briefly touching 1.3950. Market attention is now firmly on Canada’s April inflation report, due later today, while broader themes—like the recent downgrade of US credit and simmering US-Canada trade tensions—are weighing on the greenback.

**US Credit Downgrade Pressures the Dollar**

Last Friday, Moody’s lowered the long-term foreign currency credit rating of the United States from AAA to AA1, citing concerns about ballooning debt—now at $36 trillion—and the lack of political consensus on fiscal reforms. As a result, the US dollar weakened across the board, touching fresh one-week lows and dragging USD/CAD lower.

**All Eyes on Canadian CPI**

Investors are keenly awaiting Canada’s CPI report for April, which is expected to directly impact the short-term direction of the loonie. Consensus forecasts point to a headline inflation slowdown to 1.6% year-over-year, down from 2.3%, largely due to the temporary removal of the federal carbon tax. However, core inflation—excluding food and energy—may tick higher to 2.6%.

If core inflation beats expectations, it could reduce the likelihood of a near-term rate cut by the Bank of Canada, providing support for further loonie gains.

**Trade Tensions and Oil Prices Add Volatility**

US-Canada trade relations are back in the headlines. Former President Donald Trump recently floated the idea of reimposing a 10% tariff on Canadian aluminum, accusing Canada of failing to live up to past border agreements. Ottawa responded quickly, threatening retaliatory tariffs on $15.5 billion worth of US goods. These developments have increased overall market caution and fed into risk-off sentiment.

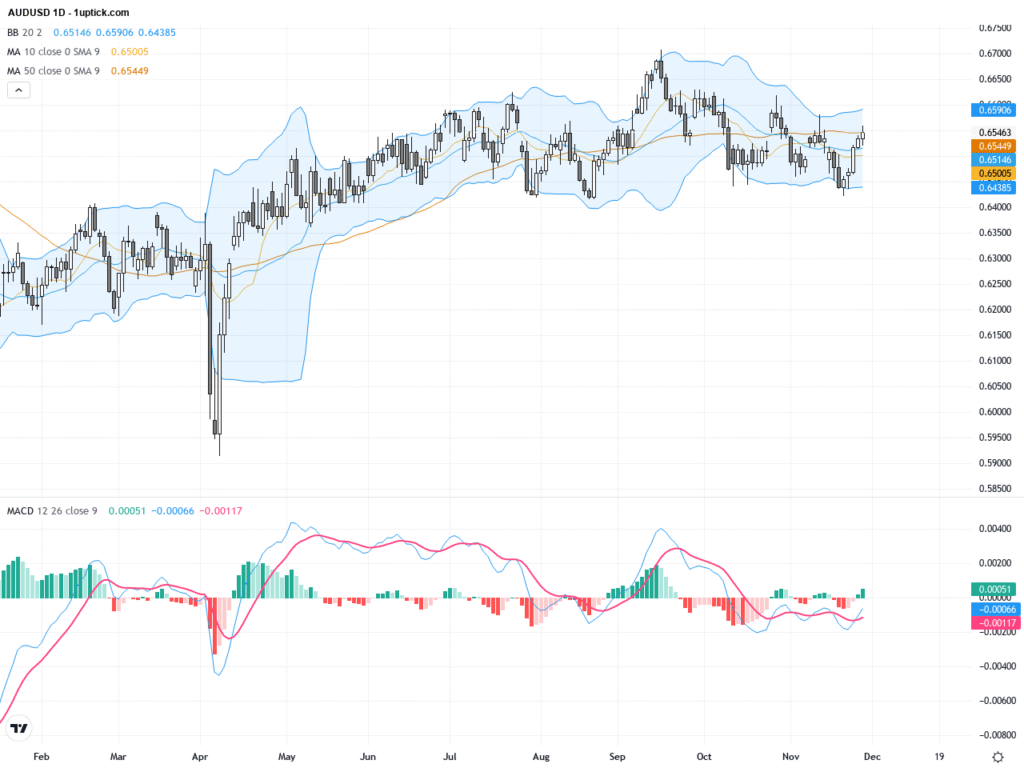

Meanwhile, fluctuating oil prices have added another layer of complexity. West Texas Intermediate (WTI) crude—a major Canadian export—has pulled back to around $78 per barrel amid easing geopolitical tensions in the Middle East, putting some short-term pressure on the Canadian dollar.

**Technical Levels and Market Outlook**

From a technical perspective, USD/CAD is testing support near 1.3936, the 9-day moving average. A break below this could open the door to 1.3900. If the upcoming CPI data shows persistent core inflation, there could be more room for CAD strength, especially with rate futures now pricing in a 65% chance the Bank of Canada holds rates steady in June.

In contrast, the market sees an 88% probability of a Fed rate cut in September, which may further weaken the US dollar.

If tonight’s inflation report confirms sticky core inflation, USD/CAD could challenge 1.3850 in the coming days. But if the data surprises to the downside, there’s room for a bounce back toward the 1.4050 level.

Investors should closely monitor both the CPI release and any updates on US-Canada trade talks, alongside developments in global oil markets.