|

| Gold V.1.3.1 signal Telegram Channel (English) |

[Daily Closing 🔔] Gold – Gold Prices Slip Amid Volatility on Thursday as Stronger U.S. Dollar Weighs on Market

[Daily Closing 🔔] Gold – Gold Prices Slip Amid Volatility on Thursday as Stronger U.S. Dollar Weighs on Market

2025-05-02 @ 13:34

Spot gold prices edged lower on Thursday, as stronger U.S. dollar momentum and easing safe-haven demand prompted investors to lock in profits. Gold slipped 0.26% for the day. By the close of trading in New York on May 1, spot gold stood at $3,230.80 per ounce, after falling to an intraday low of $3,201 and reaching a high of $3,290.

A key factor weighing on gold is the recent strength of the U.S. dollar. The dollar index climbed to a two-week high, supported by robust U.S. economic data and increased expectations that the Federal Reserve will hold interest rates steady. Tougher rhetoric from the Treasury Secretary on trade with China also boosted dollar sentiment. When the dollar strengthens, dollar-priced assets like gold tend to become less attractive, often prompting outflows from the gold market.

Diminishing risk aversion has also taken a toll on gold. Signs of a thaw in U.S.-China trade negotiations—along with hints from the U.S. President about potentially easing certain tariffs—have shifted market sentiment toward a more optimistic outlook, prompting some investors to reallocate funds into riskier assets.

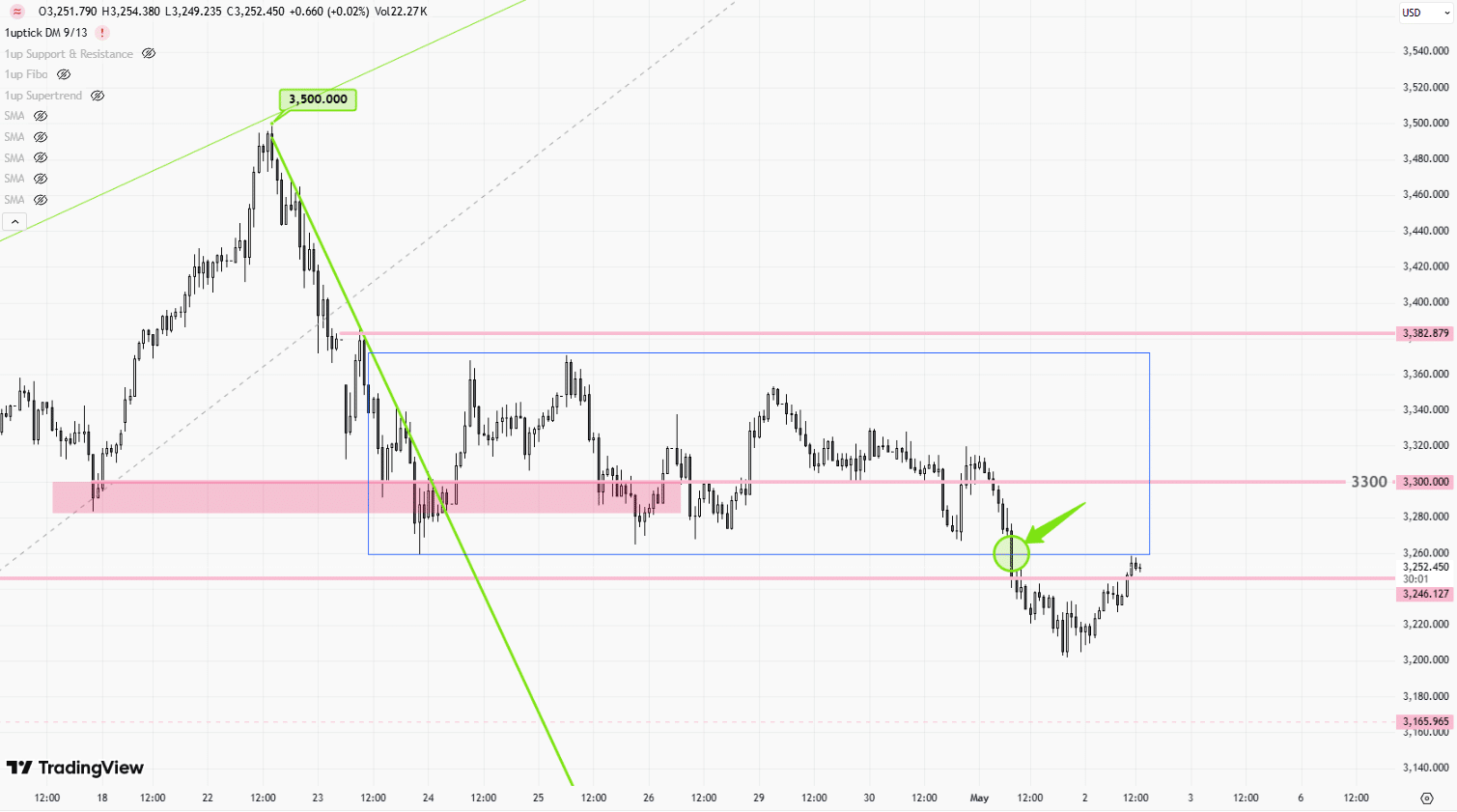

From a technical perspective, gold is undergoing a period of consolidation after surging more than 25% in April. The $3,300 level had been seen as a key support zone, but with prices now slipping below that threshold, near-term pressure has begun to build. Some analysts warn that a break below the psychological $3,200 mark could trigger a steeper correction. On the flip side, if gold can stabilize in the current range, another attempt at the upside remains possible.

Looking ahead, attention is turning to major upcoming U.S. economic releases—including the nonfarm payroll report—which could influence both the dollar and gold. Developments in U.S.-China tariff policy also remain in focus, as clearer signs of improvement in trade relations could further weaken gold’s appeal as a safe-haven.

In the short term, traders should keep an eye on the $3,200 support level. If prices hold above it, it may offer a buying opportunity on dips. However, a decisive break lower would raise the risk of a further technical slide. For long-term investors, central banks’ continued gold purchases and ongoing geopolitical tensions remain supportive factors for gold’s medium to long-term prospects.