|

| Gold V.1.3.1 signal Telegram Channel (English) |

[Daily Closing 🔔] Gold – Gold Prices Surge Nearly 2% to $3,287.60 as Weaker US Dollar Fuels Rally

[Daily Closing 🔔] Gold – Gold Prices Surge Nearly 2% to $3,287.60 as Weaker US Dollar Fuels Rally

2025-05-21 @ 06:40

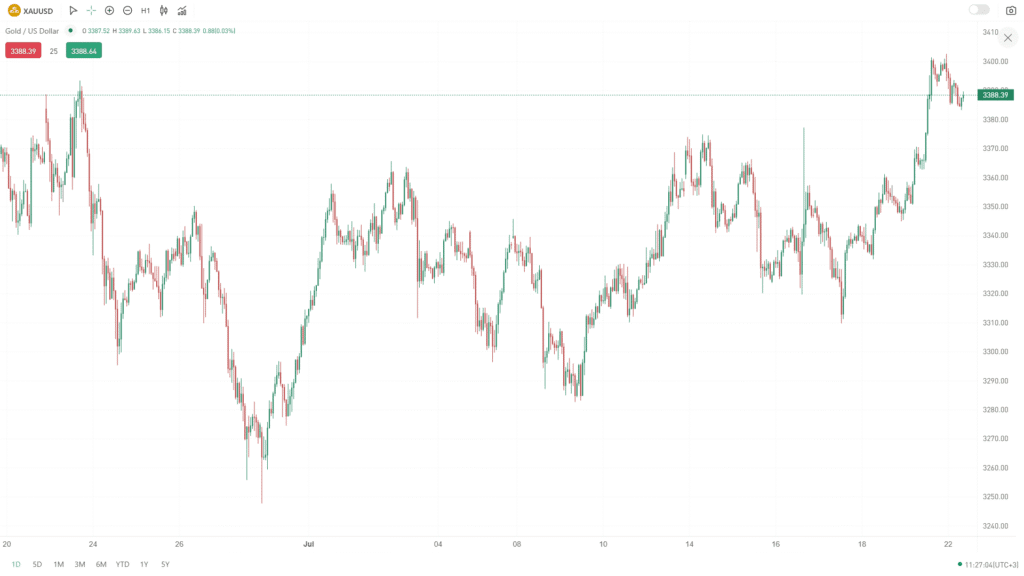

Spot gold surged on Tuesday, hitting a new weekly high as a weaker U.S. dollar and rising demand for safe-haven assets boosted buying interest. XAU/USD saw wide intraday swings, dipping early in the session before rebounding sharply in the afternoon. Gold ended the day at $3,287.60 per ounce, up nearly 2%.

Prices opened at $3,230.15 and dropped to an intraday low of $3,204.40 before climbing to a session high of $3,290.20. The rally picked up momentum during European trading hours and accelerated further in New York, breaking through several technical resistance levels.

One of the key drivers behind gold’s rise was the decline in the U.S. dollar, which drew significant attention in the market. The dollar index fell to its lowest level in a week, pressured by recent signs of economic slowdown in the U.S.—including weaker manufacturing data and waning consumer confidence. These reports have led traders to reassess the chances of future interest rate hikes from the Federal Reserve. A softer dollar makes gold more affordable for investors using other currencies and increases the metal’s appeal as a hedge against inflation.

Rising geopolitical tensions also added to gold’s strength. Renewed concerns over instability in the Middle East have prompted investors to seek safety in tangible assets, further supporting demand for precious metals.

From a technical standpoint, gold broke above its 200-hour moving average during the session, holding steady above the $3,265 level—a short-term bullish signal. If prices manage to stay above $3,280, traders will likely eye the $3,300 mark as the next resistance area. On the downside, the first line of support now sits near $3,235.

Looking ahead, markets will be closely watching Friday’s release of U.S. core PCE inflation data for April—a key indicator for the Fed’s policy outlook. Comments from European Central Bank officials and fresh labor market data out of the U.S. could also influence gold’s near-term trajectory.

(All prices and data in this report are based on publicly available market information and real-time quoting platforms.)