|

| Gold V.1.3.1 signal Telegram Channel (English) |

Dollar Declines for Third Straight Session, Boosting Safe-Haven Demand for Gold and Yen as G7 Summit Looms

2025-05-21 @ 20:45

**U.S. Dollar Falls for Third Straight Day Amid Growing Fiscal Concerns**

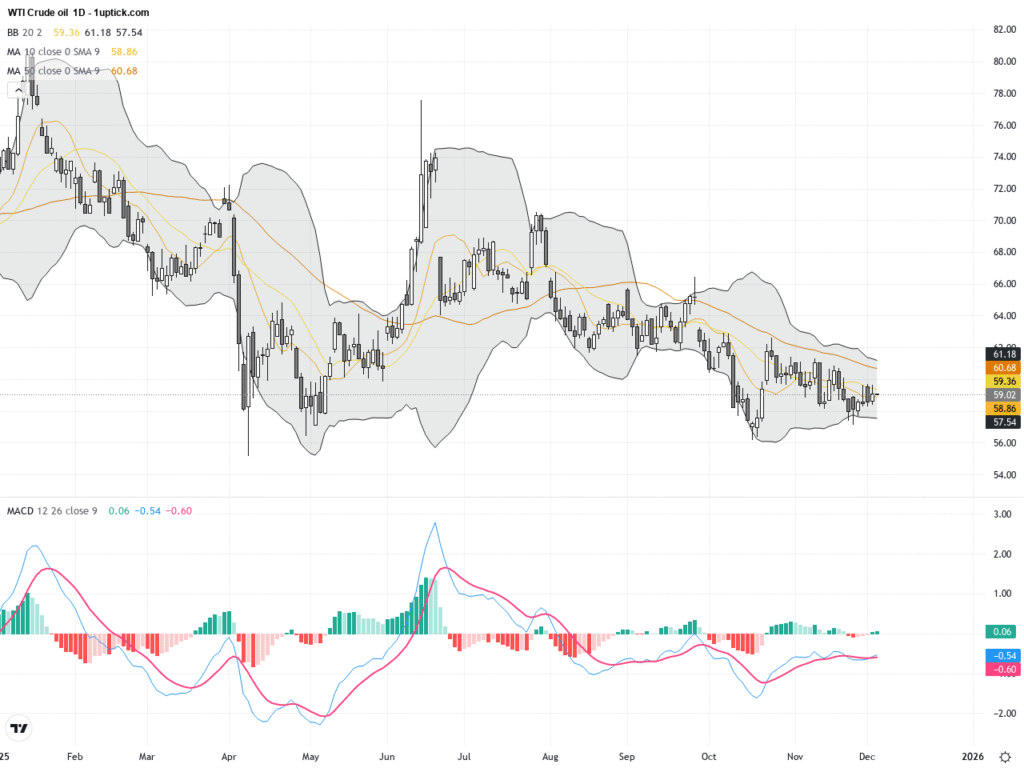

The U.S. dollar has slipped for the third consecutive day, with the dollar index dropping to a two-week low of 99.5 during Asian trading on May 21. The decline reflects mounting market anxiety over the U.S. fiscal outlook and uncertainty around the Federal Reserve’s next policy moves. While the underlying economy remains resilient, investor confidence in the dollar appears to be weakening.

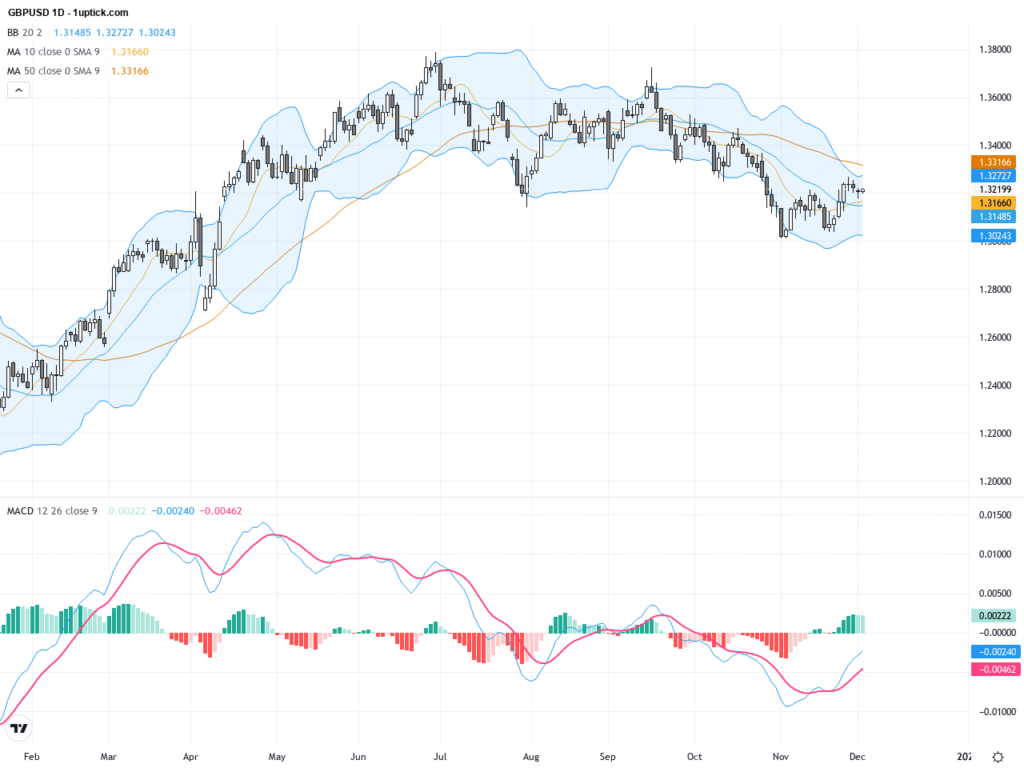

Recent comments from several Federal Reserve officials have leaned cautious, further fueling concerns about the broader economic trajectory. San Francisco Fed President Mary Daly and Cleveland Fed President Loretta Mester noted that business investment and consumer spending are slowing due to policy uncertainty. Atlanta Fed President Raphael Bostic also warned that continued instability in trade policy could threaten supply chain resilience.

Adding to the unease, ratings agency Moody’s last week downgraded the U.S. sovereign credit rating from Aaa to Aa1, spotlighting fears over Washington’s fiscal discipline. Some analysts warn that if U.S. debt rises to an estimated 134% of GDP, it could create sustained pressure on financial markets.

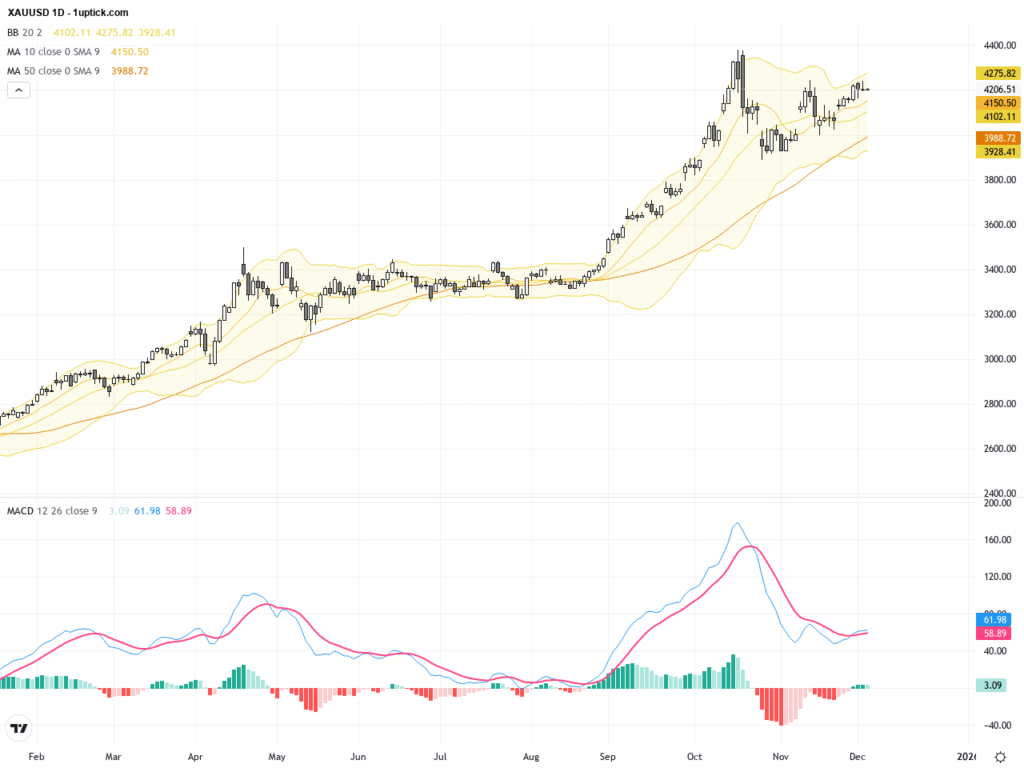

Geopolitical tensions are also injecting volatility. According to CNN, Israel is reportedly weighing military action against Iran’s nuclear facilities, prompting a surge in safe-haven demand. Investors are flocking to assets such as gold, the Japanese yen, and the Swiss franc. Gold prices briefly broke above $3,300 an ounce, and the yen strengthened past 144 against the dollar. With heightened risk aversion, the dollar has struggled to attract flows.

Markets are also closely watching this week’s G7 finance ministers meeting, where investors are looking for any signs that the U.S. might be willing to tolerate a weaker dollar to ease trade tensions with key partners. Should such a stance emerge, the greenback could face further pressure.

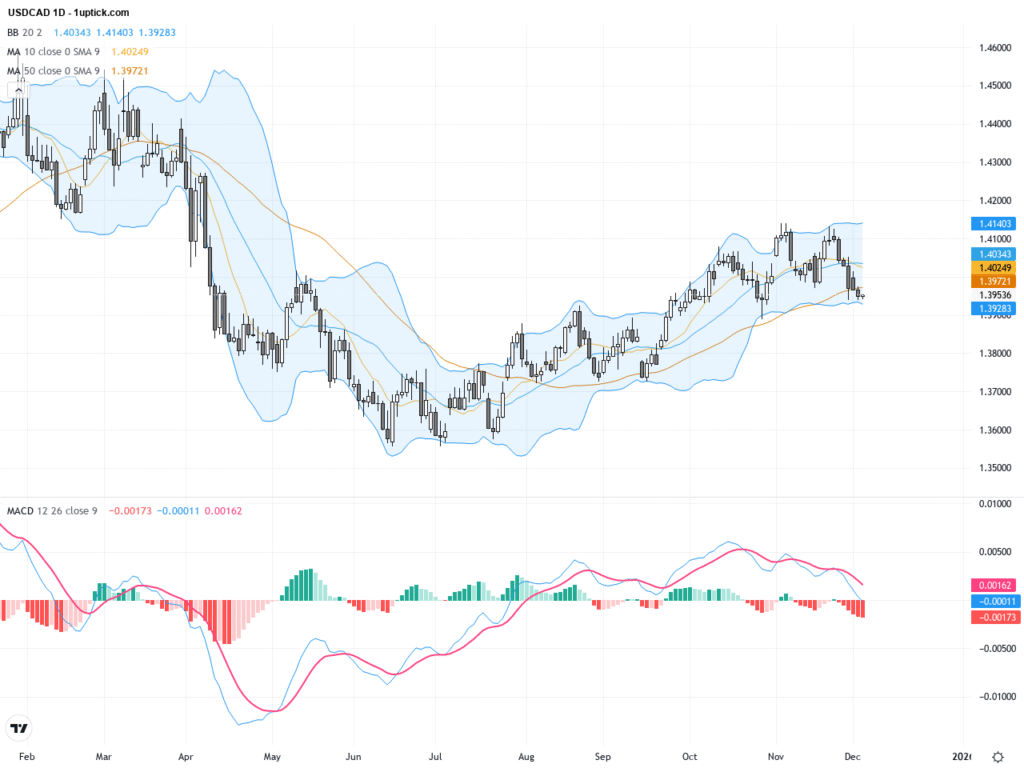

Currency performance has diverged. The euro climbed past 1.13 against the dollar, its highest in two weeks, while the British pound rallied to 1.3450 after an unexpected rise in April inflation to 3.5% year-over-year. The yen found support from safe-haven flows, though investors are watching closely to see if the Bank of Japan intervenes to manage exchange rates. Meanwhile, the U.S. 10-year Treasury yield edged up to 4.528%, helping support carry trades but potentially undermining longer-term dollar appeal.

Looking ahead, markets are focused on the upcoming auction of 20-year U.S. Treasury bonds and ongoing Republican negotiations over the Trump-era tax cut extension. Investors have started adjusting their expectations for Federal Reserve policy in 2025, pricing in up to 125 basis points of rate cuts—well above what Fed officials currently signal.

All told, downward pressure on the dollar may persist in the near term—unless Washington takes clearer steps toward fiscal stability and policy transparency. For now, markets remain on edge, with volatility likely to intensify at the first sign of unexpected news.