|

| Gold V.1.3.1 signal Telegram Channel (English) |

Euro Falls to Five-Week Low Against Dollar as US-China Tariff Easing Lifts Greenback; All Eyes on US CPI for Rate Cut Clues

2025-05-13 @ 23:28

On May 13, 2025, the euro continued to weaken against the U.S. dollar, dropping to a five-week low of 1.1065. Market sentiment has clearly grown more bearish on the euro, driven by a shift in trade policies between the U.S. and China that boosted the dollar’s momentum.

Over the weekend, the U.S. and China reached an agreement to significantly lower tariffs on certain goods. The average U.S. tariff on Chinese imports fell from 145% to 30%, while China cut tariffs on U.S. goods from 125% to 10%. The news sent the U.S. Dollar Index (DXY) surging past 101, marking its largest daily gain in two months. U.S. equity markets responded strongly as well, with Nasdaq futures jumping more than 3%, reflecting renewed risk appetite and a flow of capital into dollar-denominated assets.

Comments from Fed Chair Jerome Powell amplified the market’s expectation that interest rates may remain elevated for longer. While he acknowledged that the tariff cuts could ease some supply-side pressures, Powell also warned that the adjustments might add upward pressure to inflation over a longer period. As a result, traders have scaled back expectations for a rate cut in September — CME’s FedWatch tool now shows just a 50% probability, down from nearly 70% a week ago.

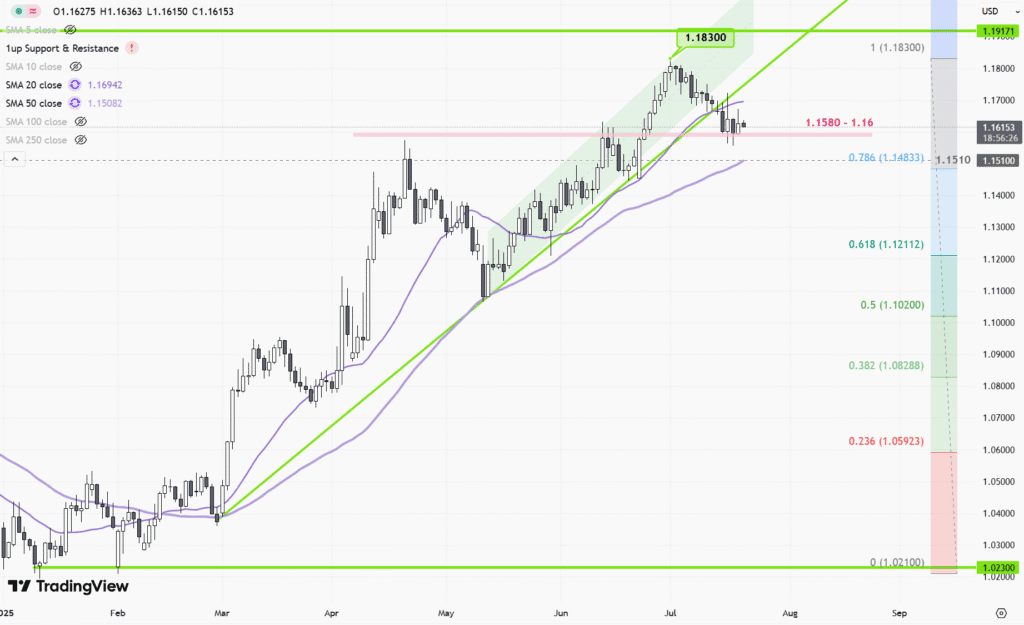

From a technical perspective, the euro is showing clear signs of weakness. On the four-hour chart, EUR/USD has fallen below the 200-period moving average and formed a bearish “death cross” — a technical pattern where the 50-period MA crosses below the 200-period MA — signaling mounting downward pressure. The Relative Strength Index (RSI) remains below 40, suggesting more room to fall. The key support at 1.1050 — also the 50% Fibonacci retracement level — is under threat. A breach could open the door to the next major support at the psychological level of 1.1000. If that fails as well, the euro may be heading toward this year’s low of 1.0875.

ING’s forex strategy team has emphasized that 1.1000 is more than just technical support — it’s a psychological barrier. If breached ahead of high-impact data events, it could trigger significant stop-loss flows from algorithmic trading systems, potentially accelerating downside moves.

All eyes are now on tonight’s U.S. CPI report for April. Markets expect core CPI to rise by 0.3% month-over-month. A stronger-than-expected reading could reinforce the Fed’s hawkish stance and delay any potential rate cuts, strengthening the dollar further. Meanwhile, unstable conditions in the Middle East and surging crude prices — Brent is trading above $86 per barrel — may also fuel imported inflation pressure in the second half of the year.

Technical analysts note that if tonight’s data lifts the dollar and pushes DXY above the 101.50 resistance, EUR/USD could quickly slide toward the 1.0850–1.0800 range. Bulls will need to defend support at around 1.1030 to preserve any short-term rebound potential.

Looking ahead, the outlook for the euro has turned increasingly cautious. Morgan Stanley recently lowered its year-end EUR/USD target to 1.04, citing expectations that the ECB may cut rates before the Fed, as well as ongoing political uncertainty in Germany and a sluggish eurozone economy. Technically, some are even eyeing a potential return to parity (1.0000) if the Fed maintains its current policy stance into 2026.

For now, the 1.1000 region remains a key line in the sand. Later this week, the eurozone’s May ZEW economic sentiment index could offer fresh direction. While risk appetite has shown early signs of recovery, market volatility remains high. Traders should prepare for sharp swings around major data releases and consider hedging strategies — such as options — to manage exposure and contain potential downside.