|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Prices Break Above $3,350 an Ounce as Weaker Dollar and Geopolitical Tensions Fuel Bullish Outlook

2025-05-22 @ 12:22

Gold prices have been on a strong run this week, with spot prices briefly climbing to $3,350 an ounce on Thursday, May 22—marking a two-week high. This continues the steady uptrend that began in early May. Markets are now eyeing the upcoming U.S. preliminary PMI (Purchasing Managers’ Index) data for May, which could shape the next leg of momentum for gold.

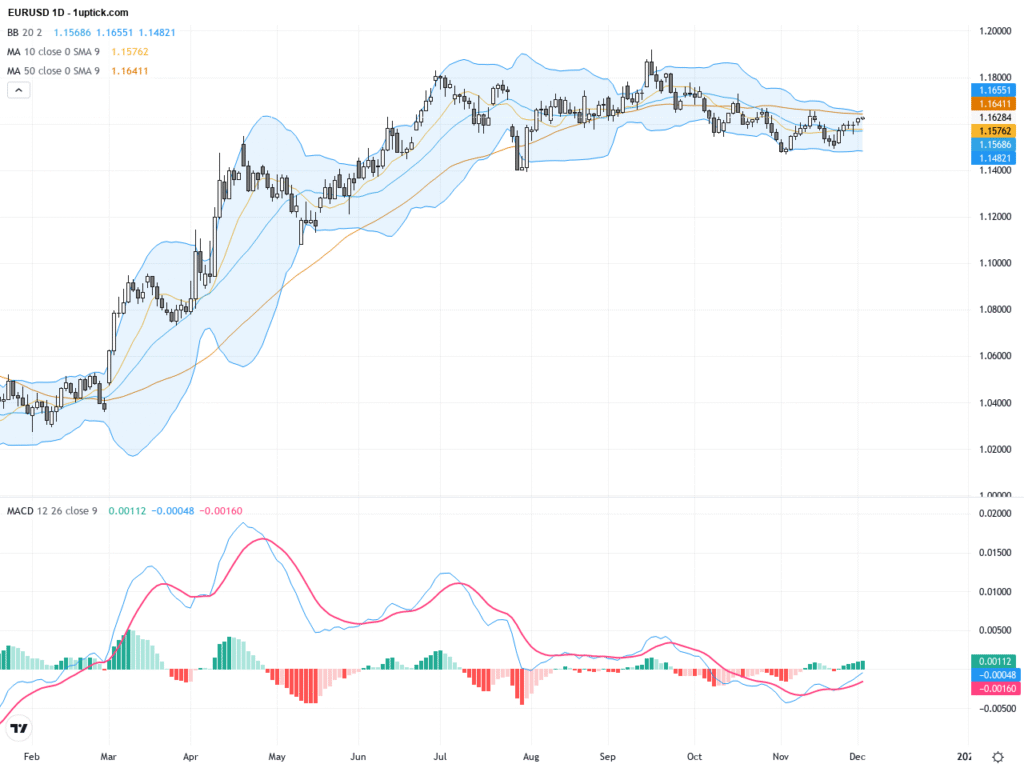

Current expectations suggest that the U.S. manufacturing PMI will inch up to 50.1, while the services PMI is forecast to hold at 50.8—just above the expansion threshold. If the figures come in stronger than anticipated, it could reinforce confidence in the U.S. economic recovery, weigh on the U.S. dollar, and help support gold prices. The dollar index has already slipped to around 99.60, a two-week low, making dollar-denominated gold more attractive to global investors.

On the technical side, gold has broken out of a consolidation range bounded by the 21-day and 50-day moving averages, with momentum turning positive. RSI has climbed to 57.5, indicating growing bullish control. Analysts say that a clean breakout above the $3,380 downtrend line could open a path toward retesting gold’s all-time high near $3,500.

From a macro perspective, Fed policy remains a key market focus. While the Fed kept rates steady at its May meeting, some dovish voices have emerged within the central bank. St. Louis Fed President Alberto Musalem recently suggested that if the labor market softens and inflation remains in check, rate cuts could be on the table later this summer. This softer stance has weakened the dollar and bolstered demand for safe-haven assets like gold.

Geopolitical headlines are also adding fuel. Former U.S. President Donald Trump announced new tariffs on imported pharmaceuticals, reigniting concerns over global trade tensions. This heightened uncertainty has driven demand for gold, with risk-averse investors increasing their positions. During Asian trading hours, spot gold jumped 1.4% in a single session, reflecting this flight to safety.

Technically, gold found support around $3,295 earlier this month—near the 38.2% Fibonacci retracement level—which also aligns with the 21-day moving average. This zone is now seen as a key support area. A break below this level could see gold testing the next supports at $3,232 and $3,165.

Looking at market sentiment, Metals Focus managing director Philip Newman believes geopolitical risks and continued central bank gold buying provide solid support for prices. As long as gold holds above $3,200, the broader trend remains bullish. Some analysts expect gold to test the $3,448 region in the near term—about 3% higher from current levels.

One near-term risk to watch is the upcoming U.S. 10-year Treasury auction. If yields come in higher than expected, it could temporarily dampen gold buying interest. That said, futures market data show that hedge funds and asset managers have continued to increase their long positions in gold over the past three weeks, with open interest reaching its highest level since 2023. This indicates a broadly optimistic outlook among institutional players.

Bottom line: Whether it’s technicals, macro policy, or global risk sentiment, the current setup continues to favor a firm bottom for gold. Investors should keep a close eye on incoming data and policy guidance, and stay alert for opportunities to initiate or adjust positions accordingly.