|

| Gold V.1.3.1 signal Telegram Channel (English) |

Japan’s GDP Shrinks Unexpectedly, Yen Slides Near 145 as BOJ Stays Dovish and Safe-Haven Demand Grows

2025-05-16 @ 22:29

Japan’s First-Quarter Contraction Weighs on Yen, as Market Reassesses Policy Risks

Japan’s economy unexpectedly shrank in the first quarter of 2025, prompting renewed uncertainty around the yen and monetary policy outlook. With the Bank of Japan holding steady on rates and maintaining a dovish stance, USD/JPY has been oscillating around the critical 145.00 threshold—trading sentiment is cautious, and the market is clearly reassessing the fundamentals behind the yen.

According to fresh data, Japan’s GDP contracted by 0.7% quarter-over-quarter—the first decline in a year and significantly weaker than the expected 0.2% drop. The yen initially strengthened on the news, pushing USD/JPY briefly as low as 144.80 during the Asian session, before recovering to around 145.30. Investors are now taking a closer look at what’s fueling the yen’s trajectory.

Two key drags stand out: sluggish exports and weak consumer spending. Exports—particularly in automobiles and electronic components—fell amid soft global demand and policy uncertainty. At the same time, consumer spending stalled, suggesting rising prices are still outpacing wages. Although corporate investment grew 1.4%, analysts see this as front-loaded activity ahead of potential tariff risks, rather than a sign of sustained momentum.

Against this backdrop, the Bank of Japan has opted to keep policy unchanged. Following its mid-May meeting, the central bank held interest rates at 0.5% and revised down its GDP growth forecast for the year. Despite hiking rates slightly earlier this year, the deteriorating macro environment is casting doubt over the possibility of another rate increase in September, which previously seemed more likely.

This policy limbo has added to the divergence in yen market sentiment. Some analysts warn that if the U.S. raises tariffs on Japanese auto imports, it could further hit Japan’s export outlook and force the BOJ into a policy shift—possibly even reigniting quantitative easing.

Meanwhile, the Federal Reserve’s tone is also shaping the yen’s path. Chair Jerome Powell recently emphasized that rates are likely to stay elevated for an extended period, yet did not rule out the risk of policy shifts amid rising inflation. The surprise uptick in U.S. import prices in April, compounded by new tariff measures, has led markets to reassess both inflationary pressures and the Fed’s timeline for action.

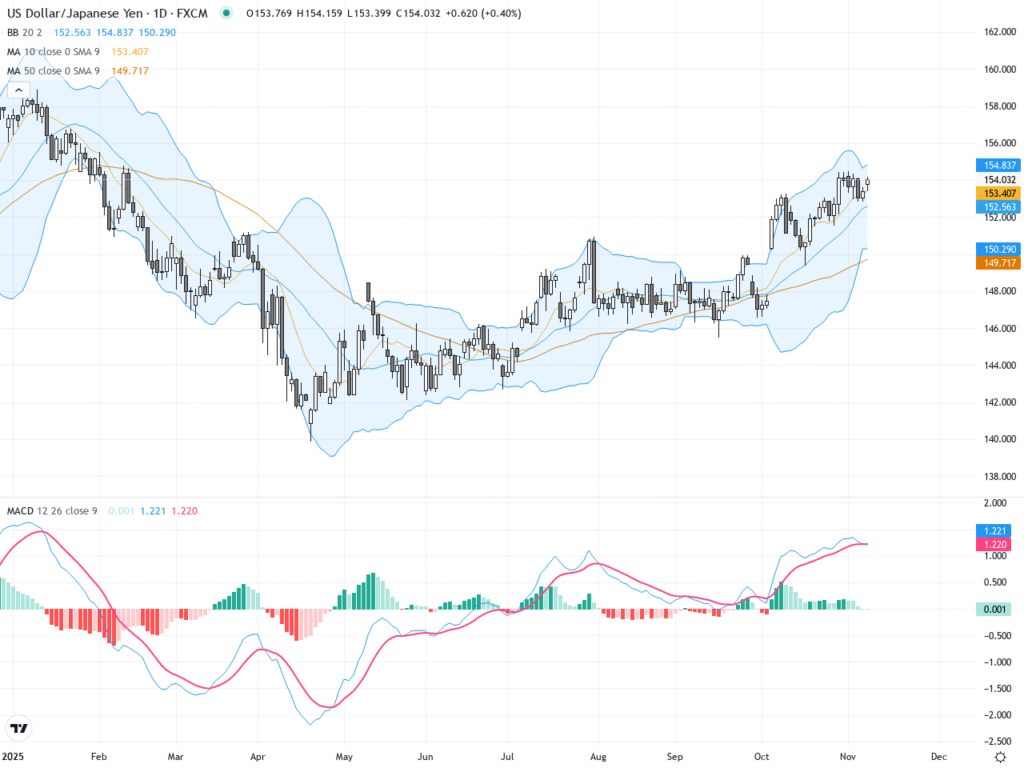

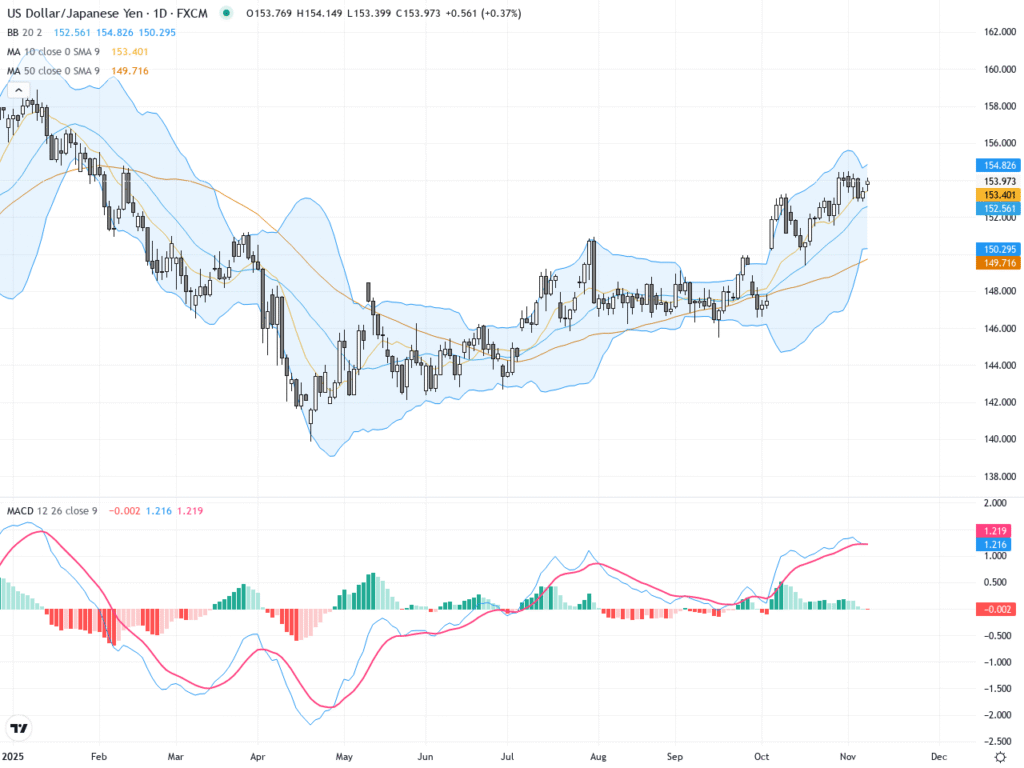

The dollar index remains range-bound, reflecting indecision among investors. This ambiguity makes technical levels in USD/JPY all the more important. The 144.50–145.00 zone is acting as a key support—bolstered by the 200-day moving average and key Fibonacci retracement levels. A decisive break below could open the door to deeper downside, while a bounce and move above 146.60 would raise the odds of retesting the 148.00 resistance zone.

On the sentiment front, options markets show that demand for yen as a haven hasn’t gone away. With incoming data and policy risks still unpredictable, the yen remains a preferred short-term shelter under stress.

Looking ahead, several catalysts could sway market direction. Chief among them are ongoing trade negotiations between Japan and the U.S.—any increase in tariff rhetoric could directly hit exports and drive FX volatility. The Fed’s policy decision in early June, along with the release of the core PCE price index, will also provide critical clues on inflation and rate outlook. Domestically, Japan’s upcoming industrial production data will be another key barometer of confidence.

Bottom line: USD/JPY is likely to remain range-bound in the near term as markets search for direction between policy signals and macro fundamentals. As long as 145.00 holds, a wait-and-see approach dominates. But should data deteriorate further, the yen could regain strength as a safe haven, while the dollar would need fresh catalysts to break higher.