|

| Gold V.1.3.1 signal Telegram Channel (English) |

Oil Prices Plunge in April 2025 — Biggest Drop in Four Years Amid Escalating US-China Trade Tensions and OPEC+ Supply Surge

2025-05-01 @ 02:05

**Oil Prices Plunge in April 2025, Posting Steepest Monthly Decline Since 2021**

In a sharp reversal, global oil prices tumbled in April 2025, on track for their biggest monthly drop since 2021. The renewed escalation of trade tensions between the US and China has reignited fears of a global economic slowdown—sending shockwaves through the oil market and triggering a wave of aggressive sell-offs.

At the start of the month, the U.S. imposed a new round of steep tariffs on Chinese goods. China immediately retaliated, and the tit-for-tat exchange between the world’s two largest economies cast a long shadow over global trade prospects. As investor confidence eroded, crude oil, a cyclical asset tightly linked to economic conditions, became one of the hardest-hit sectors.

Expectations for stable growth in oil demand this year have been sharply revised downward. Recent data paints a more cautious picture, with agencies slashing their demand forecasts. Many analysts now warn that if signs of contraction continue to spread, the oil market could face a “demand vacuum” as early as Q3—putting additional pressure on prices.

Adding to the tension, OPEC+ chose to accelerate its production plans. Member countries are ramping up output despite growing signs of weaker demand. This move has deepened concerns of an oversupplied market and further weighed on near-term prices.

One unusual development is the pricing structure in the futures market. While front-month contracts remain relatively elevated due to current supply tightness, longer-dated contracts are slipping. This rare “smile-shaped” curve suggests traders are growing more pessimistic about the market balance heading into late 2025 and beyond.

Looking at macro data, U.S. manufacturing has slowed again, consumer sentiment is fading, China’s crude imports have declined noticeably, and Europe’s energy storage levels are near full capacity. Together, these indicators signal that actual end-user demand is beginning to weaken. With households and businesses turning more cautious, demand could face further headwinds.

By the end of April, Brent and WTI prices had both slumped over 15%—a one-month plunge that significantly slashed the value of the broader energy sector. In response, several U.S.-based energy companies have announced delays to planned exploration and expansion projects, citing pressure from falling prices.

There’s growing consensus that this is more than a short-term correction—it may mark a structural pivot in the global energy landscape. While oil-producing nations and investors tread carefully, some analysts warn that the accelerating adoption of renewables and electric vehicles is eroding the foundation of long-term oil demand. As clean technologies mature, oil’s dominance as a price-setting asset may no longer be a given.

With geopolitical tensions and policy shifts still in play, volatility in oil markets is likely far from over. For investors navigating an increasingly uncertain global landscape, it’s time to reassess both the risks and roles of energy assets in their portfolios.

The oil price shock of April 2025, born from trade disputes but deepened by broader shifts, could mark a turning point in the global energy narrative.

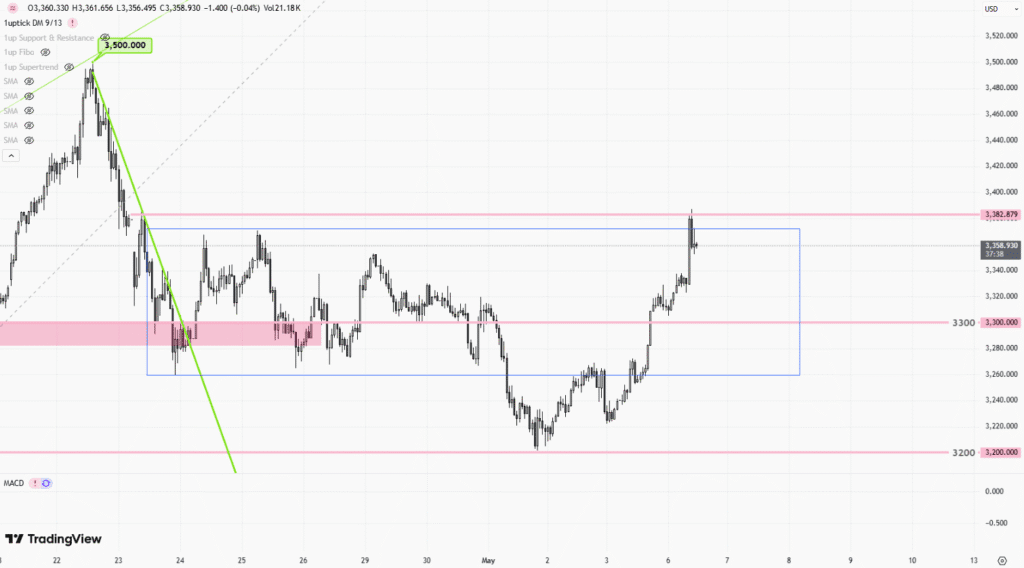

![[Daily Closing 🔔] Gold – Gold Prices Surge on May 6, 2025 Amid Rising Market Uncertainty and Central Bank Buying](https://int.1uptick.com/wp-content/uploads/2025/05/2025-05-07T025824.761Z-file-1024x576.png)