|

| Gold V.1.3.1 signal Telegram Channel (English) |

U.S. Stocks Climb as Treasury Secretary Signals Positive Outlook; Washington Seeks New Trade Deals with 17 Nations

2025-05-08 @ 12:53

**U.S. Trade Talks Signal Breakthrough—Markets React Positively**

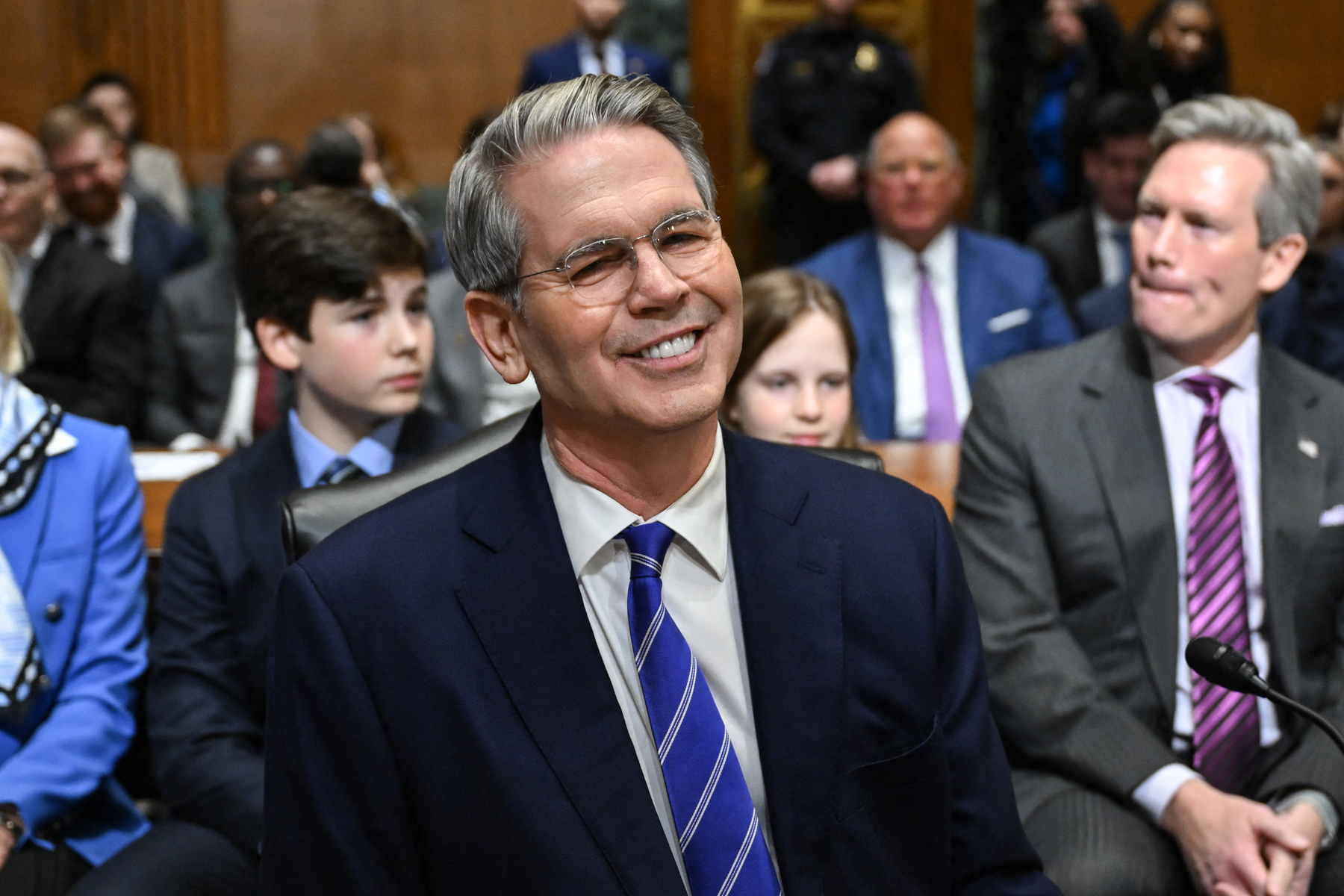

Positive developments in U.S. trade policy helped lift markets mid-session, as Treasury Secretary Scott Bessent hinted at potential progress in a sweeping strategic trade agreement involving up to 17 partner nations. Speaking at a recent congressional hearing, Bessent revealed that the Trump administration is fast-tracking negotiations and could unveil concrete results as soon as this week.

This potential deal, seen as a counterbalance to recent tariff pressures, reassures markets and brings renewed clarity to the outlook for the U.S. economy.

**Beyond Tariffs: A Broader Trade Agenda**

Unlike past negotiations narrowly focused on tariff reductions, Bessent noted that the current discussions span a wide range of issues—from non-tariff barriers and currency manipulation to subsidy practices and labor standards. Key areas such as agricultural imports and technology regulations have reportedly seen “greater-than-expected” willingness to compromise from partner countries.

Though he stopped short of naming specific nations, recent trade data suggests Canada, Mexico, Germany, Japan, and South Korea are likely among the central parties involved. Overall, 17 major trade partnerships—excluding China—are now in meaningful talks.

**Phased Agreements Aimed at Year-End Milestones**

To maintain momentum, the U.S. is pursuing phased agreements. The first step focuses on easing tariffs, with follow-on discussions addressing more complex details. A 90-day tariff suspension introduced earlier has already brought key players back to the negotiating table. If talks progress as planned, up to 90% of the new trade framework could be in place by the end of 2025—months ahead of schedule.

**China Still Outside the Tent**

While negotiations with several countries advance, China remains a wildcard. Bessent acknowledged that formal talks with Beijing have not resumed. President Trump recently reinforced this stance by confirming that existing tariffs on Chinese goods will stay in place for now, maintaining pressure as a source of leverage.

**Domestic Debate: Tariff Strategy Under Scrutiny**

During the hearing, political divisions sharpened. Democratic lawmakers questioned whether tariffs disproportionately burden American consumers, while Bessent defended them as a “strategic tool” to reduce the annual trade deficit—potentially by as much as $120–150 billion.

**Markets Respond with Renewed Optimism**

News of the pending agreements energized financial markets. The VIX dropped noticeably as risk sentiment improved. The U.S. dollar gained strength, helping push capital toward dollar-based assets. In equities, automotive and agriculture stocks led the charge—GM and Ford both rose more than 3%, and farm equipment maker Deere jumped over 5% intraday.

However, tech stocks were mixed. Globally dependent semiconductor firms like Intel and Micron saw modest gains. In contrast, Texas Instruments, with a more regionally focused model, outperformed, suggesting investors are reassessing business models under a more localized trade regime.

**Trade Policy Tied to Growth Ambitions**

Bessent also indicated that trade reforms will align closely with tax cuts and regulatory rollbacks, all part of aiming for 3% economic growth. According to government models, a 10% reduction in trade uncertainty could lift manufacturing investment by over 1%. A new fast-track system for tariff rebates and enhanced current account surplus monitoring are also in development.

**New Legislation to Bolster Negotiating Power**

Meanwhile, the House Ways and Means Committee has begun reviewing the “2025 Trade Priorities Act,” aimed at strengthening the U.S. position in trade disputes and increasing transparency around foreign subsidies. Analysts see this as a tactical move to reinforce the administration’s leverage by uniting congressional support with executive actions.

As campaign season heats up, both parties are framing trade policy in political terms—Republicans focusing on industrial-state voters, and Democrats stressing the need for more structural reform, not just short-term wins.

If the U.S. can finalize an initial agreement with key partners this week, it would signal a significant policy pivot and offer a much-needed boost to global economic sentiment—particularly in a period of tighter liquidity and rising geopolitical risk. Still, details will matter, and investors should remain alert, agile, and prepared to reassess their portfolios as policy continues to evolve.