|

| Gold V.1.3.1 signal Telegram Channel (English) |

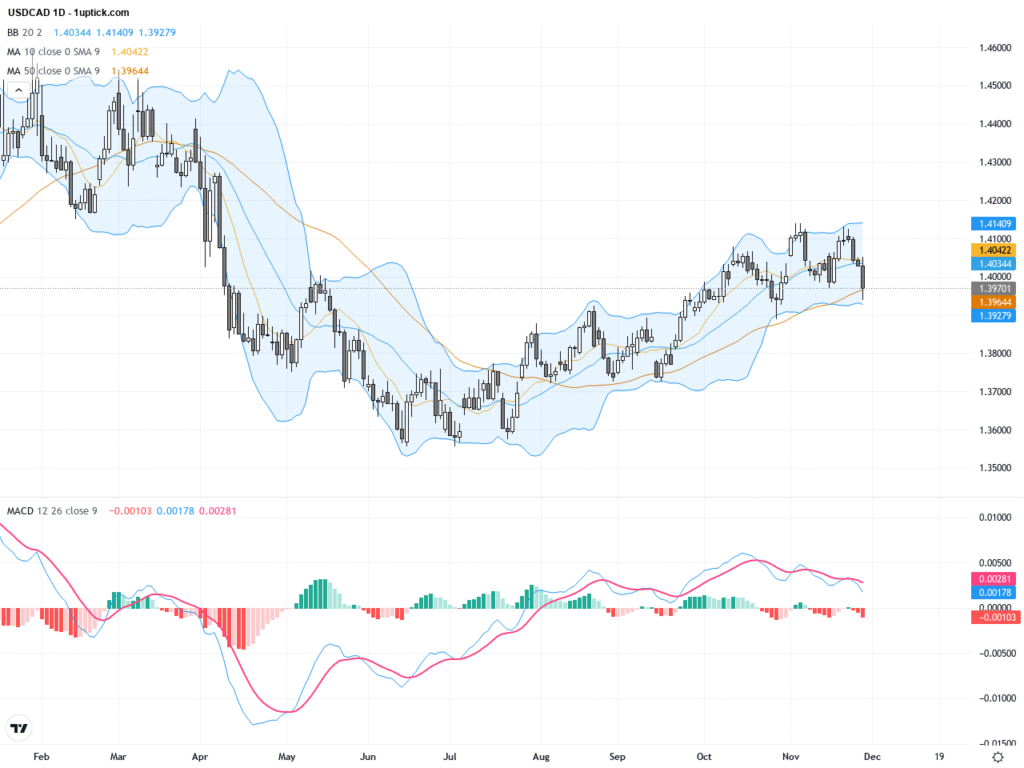

USD/CAD Stuck in Tight Range as Inflation Data and Oil Prices Take Center Stage

2025-05-19 @ 14:39

USD/CAD: Range-Bound as Markets Weigh Economic Signals and Policy Divergence

The USD/CAD exchange rate has been trading within a tight range between 1.3965 and 1.3970 recently, reflecting market indecision amid mixed economic data. Investors appear hesitant to take strong directional bets, and this tug-of-war is likely to continue in the near term unless a clear catalyst emerges.

On the U.S. side, the latest inflation data showed the consumer price index slowing to 2.3% in April, reinforcing expectations that the Federal Reserve could start easing rates later this year, despite continued labor market strength. This softening inflation gives policymakers more flexibility, and has somewhat dampened bullish sentiment on the dollar.

Canada’s situation is more nuanced. April’s CPI dipped to 1.6%, partly due to a carbon tax rollback, though core inflation remains stubborn around 2.6%. The Bank of Canada is holding its policy rate steady at 2.75% for now, signaling a cautious approach as it balances price pressures and the pace of recovery. Markets are not yet pricing in aggressive rate cuts from the BoC, but expectations could shift quickly if consumer data shows softness.

Global oil prices—which heavily influence the Canadian dollar given Canada’s status as a major exporter—are injecting further volatility. While WTI has bounced back above $60 per barrel, Brent crude recently slid below $65, raising concerns about global demand and geopolitical tensions. Softening oil prices are limiting the Canadian dollar’s upside, especially in times when the U.S. dollar weakens.

Trade dynamics between the U.S. and Canada are also in focus. Recent talks between U.S. and Canadian leaders touched on trade fairness, and while no concrete results were disclosed, the dialogue is a step toward reinforcing market confidence in North American economic stability. That said, rising U.S. trade pressure on other partners is fueling concerns about a potential uptick in protectionism.

Investors should also be aware of medium to long-term risks. Moody’s recent downgrade of U.S. sovereign credit has raised questions about the dollar’s reliability as a safe-haven currency. Meanwhile, if Canadian retail data continues to disappoint, it could push the Bank of Canada to act sooner, putting additional downward pressure on the loonie.

Looking ahead, USD/CAD will likely remain sensitive to economic and policy signals from both countries. Key events to watch include upcoming statements from Fed officials and Canada’s retail sales data, both of which could shape market sentiment. For now, the 1.3970 level remains a key resistance point. A meaningful breakout will require a decisive shift in fundamentals. For investors and businesses alike, staying attuned to central bank policy signals and commodity price trends will be crucial to navigating short- and medium-term moves in this pair.