|

| Gold V.1.3.1 signal Telegram Channel (English) |

Fed Officials Signal Possible Multiple Rate Cuts in 2025 as Inflation Trends Take Center Stage

Fed Officials Signal Possible Multiple Rate Cuts in 2025 as Inflation Trends Take Center Stage

2025-06-02 @ 13:45

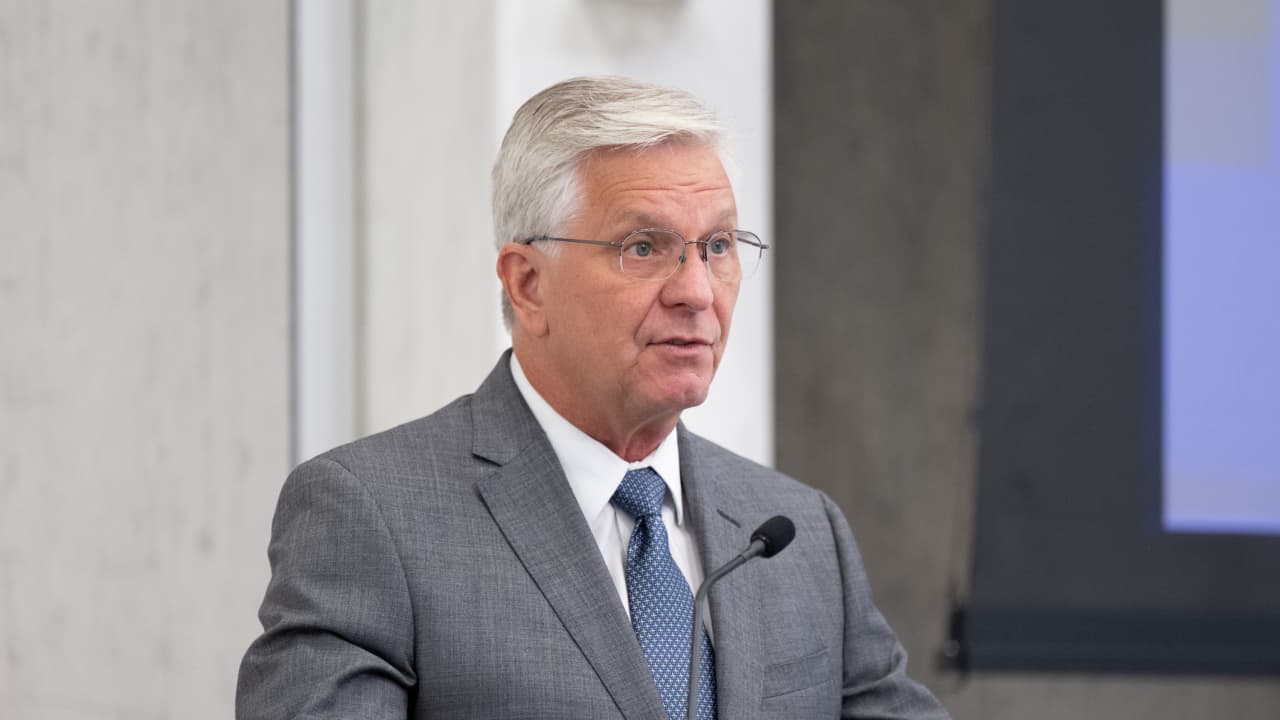

🚨 Fed Governor Waller Signals Multiple Rate Cuts Could Happen This Year

Speaking at an international conference in Seoul, Federal Reserve Governor Christopher Waller suggested that if inflation continues to cool in the coming months, the Fed could implement multiple interest rate cuts before the year ends.

Waller emphasized that temporary inflation pressure—such as that potentially caused by new tariffs—won’t necessarily alter the Fed’s broader path. “Unlike the early pandemic period, today’s economy is more balanced, and the labor market is relatively stable,” he said. In his view, short-term price increases wouldn’t derail plans to ease monetary policy.

Waller was clear: “As long as inflation remains under control and the job market stays strong, I’d support rate cuts later this year.” That means upcoming rate cuts wouldn’t be a response to economic weakness, but rather a sign of monetary policy normalization.

The Fed has held the federal funds rate between 4.25% and 4.5% since the start of 2025, following a full percentage point of cuts in late 2024 amid rising unemployment and slowing growth. For now, markets widely expect no change at the mid-June Fed meeting—but Waller’s remarks provide fresh insight into what could follow.

Recent economic data also support his views. Inflation slowed in April, and hiring remains robust. Consumer demand, however, appears to be softening. While auto sales showed a modest uptick, overall spending is growing at a slower pace compared to late 2024.

Bottom line: Waller’s comments mark a shift toward more adaptive policymaking. The Fed is no longer reacting solely to risks—it’s watching the data and leaving room to adjust. For investors, inflation trends and consumer data in the next few months will likely determine when those rate cuts begin.