|

| Gold V.1.3.1 signal Telegram Channel (English) |

Bitcoin vs. Gold in 2025: Which Asset Offers the Best Investment Strategy?

Bitcoin vs. Gold in 2025: Which Asset Offers the Best Investment Strategy?

2025-07-30 @ 23:00

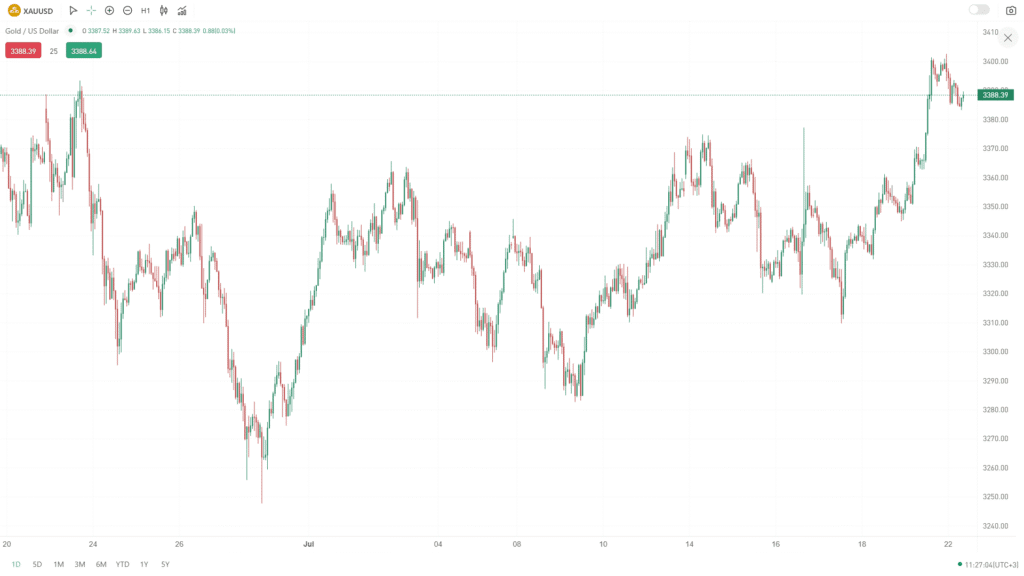

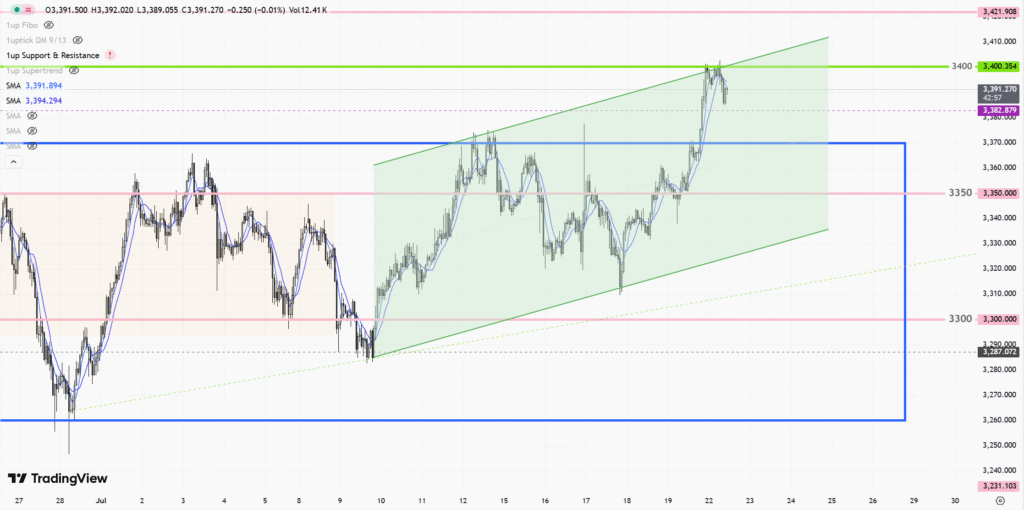

Gold and Bitcoin have continued their dramatic tug of war in 2025, with each asset displaying its unique strengths amid shifting market tides. This year, Bitcoin has shattered records, surging past $123,000 and attracting headlines as digital gold builds momentum. At the same time, gold itself soared to an all-time high above $3,500 per ounce earlier in the year before entering a correction phase, now consolidating in the $3,200–$3,500 range.

Although both assets have rallied impressively, their risk profiles and strategic roles could not be more different. Bitcoin’s rapid ascent is fueled by innovation, speculative fervor, and growing institutional interest, positioning it as a high-growth but high-risk alternative in portfolios. Long-term forecasts even hint at the potential for Bitcoin to reach $200,000—and possibly much higher within the decade—making it particularly attractive to those seeking outsized returns.

Gold, by contrast, remains the quintessential safe-haven. Its centuries-long reputation as a store of value continues to attract governments, central banks, and conservative investors, especially when global uncertainty spikes. Gold’s price movements are underpinned by real-world demand, supply constraints, and its critical role in global reserves—features that lend it reliability but limit its explosive upside.

Recent performance data underscores this dichotomy. Bitcoin may be generating bigger short-term gains, but it also comes with greater volatility. Meanwhile, gold’s stability has again made it the preferred hedge during geopolitical and economic shocks.

For most investors, the decision between Bitcoin and gold need not be either-or. A diversified approach harnesses Bitcoin’s upside potential while leveraging gold’s ability to preserve wealth in turbulent times. The landscape in 2025 remains dynamic, and close attention to evolving regulation, macroeconomic shifts, and technological innovation will be crucial for those seeking to benefit from both digital and physical gold.