|

| Gold V.1.3.1 signal Telegram Channel (English) |

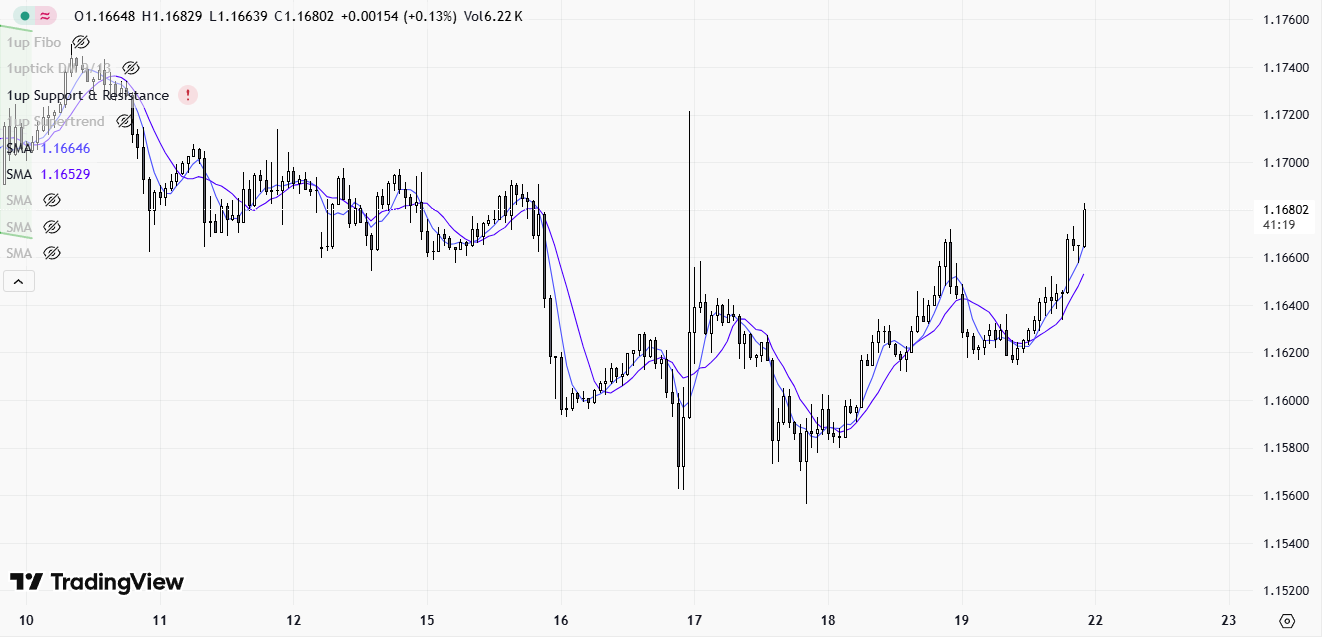

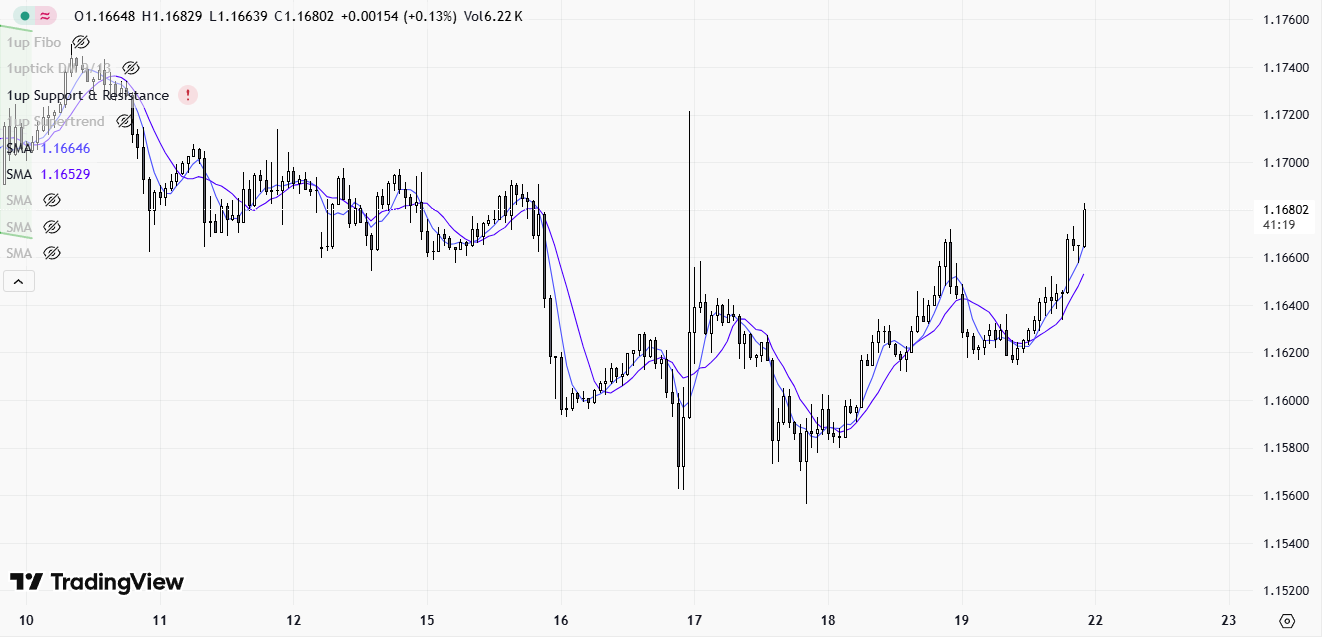

EURUSD-1 hour

2025-07-21 @ 22:29

Market Overview

EURUSD traded lower over the past week, moving from around 1.1727 on July 8 to 1.1689 on July 11. The pair experienced a moderate average volatility of about 73 pips, reflecting a cautious market environment. This decline was driven by renewed strength in the US dollar, which held above key support levels as the US Dollar Index reclaimed ground. Eurozone uncertainties, alongside the break and retest of May channel support for EURUSD, added downward pressure. The market remains in a consolidation phase, with EURUSD range-bound between key resistance at 1.1750 and support near 1.1580. Ongoing global economic concerns and dollar strength continue to influence euro weakness, and the pair is likely to trade tightly until a clear breakout from this recent range occurs.

EUR/USD 1-Hour Chart Technical Analysis

Technical Indicators

– Moving Averages: The EUR/USD is trading below its key short-term moving averages, indicating sustained bearish momentum. This typically signals that sellers remain in control and rallies are likely to meet resistance until these averages are reclaimed.

– RSI (Relative Strength Index): While not explicitly displayed, current price action near support levels and successive lower closes suggest that the RSI is likely approaching or even breaching oversold territory—a common precursor to short-term consolidations or corrective bounces.

– MACD (Moving Average Convergence Divergence): Implied bearish crossovers are consistent with the recent downside push. This momentum indicator likely remains in bearish alignment.

– Bollinger Bands: The chart action suggests price is hugging or testing the lower Bollinger Band. This often precedes mean reversion or a minor corrective retracement; however, persistent closes at or below the lower band reinforce weak sentiment.

Chart & Candlestick Patterns

– Bearish Channel: A well-defined counter-bearish channel dominates, with price action remaining decisively below the channel midline, validating sellers’ ongoing control.

– Support and Resistance:

– Major Support: 1.1580, 1.1556, 1.1520

– Major Resistance: 1.1670, 1.1730, 1.1800

Recent lows at 1.1556 and buyer defense near 1.1580 reinforce these as key support zones. Upside rallies are likely to face sellers at 1.1670 and above.

– Candlestick Formations: Recent hourly candles show a mix of small-bodied candles (potential doji or spinning tops) and some lower wicks near supports, hinting at fading downside pressure. However, there are no strong single-bar reversals (like hammer or bullish engulfing) that would suggest an imminent bullish move.

Trend Direction

– The prevailing trend remains downside-dominant. Continued failure to break above previous swing highs and adherence to the descending channel confirms ongoing bearish sentiment.

– Brief pauses and minor pullbacks have not fundamentally altered the downtrend’s structure; the market remains in “sell the rally” mode unless a major resistance is reclaimed.

Momentum & Volume

– Price momentum is negative but showing early signs of deceleration, reflected in recent stalling candles and modest buy attempt wicks. This could portend a short-term pause or minor bounce, predominantly if the RSI hits oversold extremes.

– Volume trends on the 1-hour chart often surge around key support tests or breakout attempts, so watch for increased participation signaling potential reversals or continuations.

Actionable Summary

– Bearish bias prevails unless EUR/USD reclaims the 1.1670 resistance zone.

– The pair risks further losses toward 1.1520 if support at 1.1580 fails to hold, but vigilance is warranted for potential short-covering or corrective rallies if oversold conditions intensify.

– For traders, short positions remain favorable on rallies toward resistance, while aggressive short-term longs may consider tentative entries near major support—with prudent stop-loss management, as bear momentum is not yet definitively exhausted.

– Major market-moving news related to tariffs and central bank policy could introduce volatility; stay alert for any breakout from the current range as confirmation of a new short-term direction.