|

| Gold V.1.3.1 signal Telegram Channel (English) |

Trump’s Policy Comeback Shakes Global Markets — 6 Key Trends Every Investor Must Watch for Smart Asset Allocation

2025-07-18 @ 10:24

As former President Trump’s policy agenda takes shape, financial markets are once again abuzz with a new wave of “Trump trades.” This time around, the proposals reflect a more comprehensive and targeted strategy compared to his previous term. From trade and taxation to geopolitics and industrial policy, the ripple effects are poised to reshape markets globally. To navigate these changes with clarity and confidence, investors should keep a close eye on these six key developments.

- Trade Policy Escalation Reorders Global Supply Chains

Starting this July, the U.S. has rolled out a new set of “reciprocal tariffs” on a range of imported goods—some tariffs topping out at 40%. While some countries have responded with concessions, the U.S. continues to press its advantage and has not ruled out further increases if retaliatory measures emerge. Industries that rely heavily on exports—such as autos, semiconductors, and agriculture—will feel the impact first. Meanwhile, the uncertainty has accelerated the redistribution and restructuring of global supply chains. -

Tax Reform Spurs Corporate Investment

Trump’s recently signed “One Big Beautiful Bill” introduces the 2025 tax changes, which include reinstating 100% accelerated depreciation for capital expenditures and raising Section 179 deduction limits. These provisions are designed to incentivize businesses—especially in manufacturing, infrastructure, and real estate—to ramp up capital investment. On the individual side, tax cuts on overtime pay and Social Security benefits are expected to boost consumer spending and job growth in the near term. -

Rising Geopolitical Risk Makes Asia a Manufacturing Magnet

With ongoing tensions between the U.S. and China, companies are increasingly looking elsewhere for production hubs to sidestep political and trade risks. Southeast and South Asia—particularly Vietnam, India, and Indonesia—have emerged as promising alternatives. Logistics, industrial real estate, and infrastructure in these regions are well positioned for growth, offering potential investment opportunities for those following the global realignment. -

Industrial Policy Shift Pressures Clean Energy, Favors Legacy Sectors

The new tax reform rolls back incentives for electric vehicles and home renewable energy installations, creating short-term headwinds for sectors like solar power, energy storage, and EV batteries. On the flip side, traditional energy and basic industries stand to benefit from favorable policy tailwinds and investor interest. Meanwhile, tech companies face mounting challenges from export controls and supply chain disruptions, which may lead to heightened volatility in the months ahead. -

Strong Dollar Meets Inflation Concerns: Watch for Capital Shifts

The combination of tariffs and tax cuts is bolstering the U.S. dollar, while at the same time raising flags around inflationary pressure. The Federal Reserve’s rate decisions will be a key variable driving global capital flows—impacting everything from emerging markets and commodities to bond yields. Investors should closely monitor the dollar index, inflation data (such as CPI), and messaging from the Fed. -

Domestic Demand and Employment: A Delicate Balance

While select tax breaks—like those on overtime and tips—may temporarily lift consumer strength, higher tariff-driven input costs may push companies to cut capacity or move operations abroad. These shifts could dampen hiring or reduce service-sector stability. The outlook for consumer, retail, and service industries will depend heavily on how effectively the policies are implemented and whether consumer confidence remains steady.

In summary, the return of Trump-era policymaking is not just a domestic pivot—it could catalyze a broad reshaping of the global economic landscape. From stock selection to portfolio strategy, adjusting for these six themes will be essential. While the road ahead carries its share of volatility, it also opens the door to opportunities for those ready to adapt.

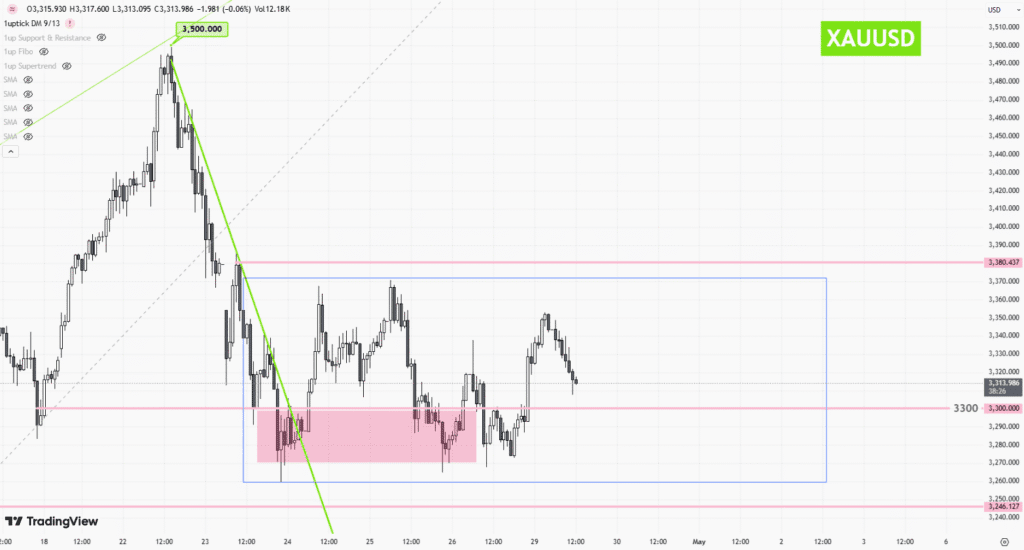

![[Daily Closing 🔔] Gold – Gold Prices Slip as Markets Await Key U.S. Economic Data Release](https://int.1uptick.com/wp-content/uploads/2025/04/2025-04-30T034839.563Z-file.jpeg)

![[Gold price weekly] – Volatile Consolidation Driven by Multiple Factors](https://int.1uptick.com/wp-content/uploads/2025/04/2025-04-28T055444.196Z-file-1024x551.png)