|

| Gold V.1.3.1 signal Telegram Channel (English) |

Dow Plunges 600 Points on Weak Jobs Report and Tariff Fears: What Investors Need to Know

Dow Plunges 600 Points on Weak Jobs Report and Tariff Fears: What Investors Need to Know

2025-08-03 @ 17:00

Stock Market Turmoil: Dow Plunges 600 Points Amid Weak Jobs Report and Tariff Concerns

The US stock market took a sharp nosedive today, with the Dow Jones Industrial Average tumbling over 600 points. Both the S&P 500 and Nasdaq followed suit, closing significantly lower as investors grappled with a disappointing jobs report alongside renewed worries about tariffs.

The decline started early in the trading session after new employment figures showed fewer jobs added to the economy than analysts anticipated. This weaker-than-expected job growth has reignited concerns about the strength of the US recovery, raising questions about consumer spending and overall economic resilience moving forward.

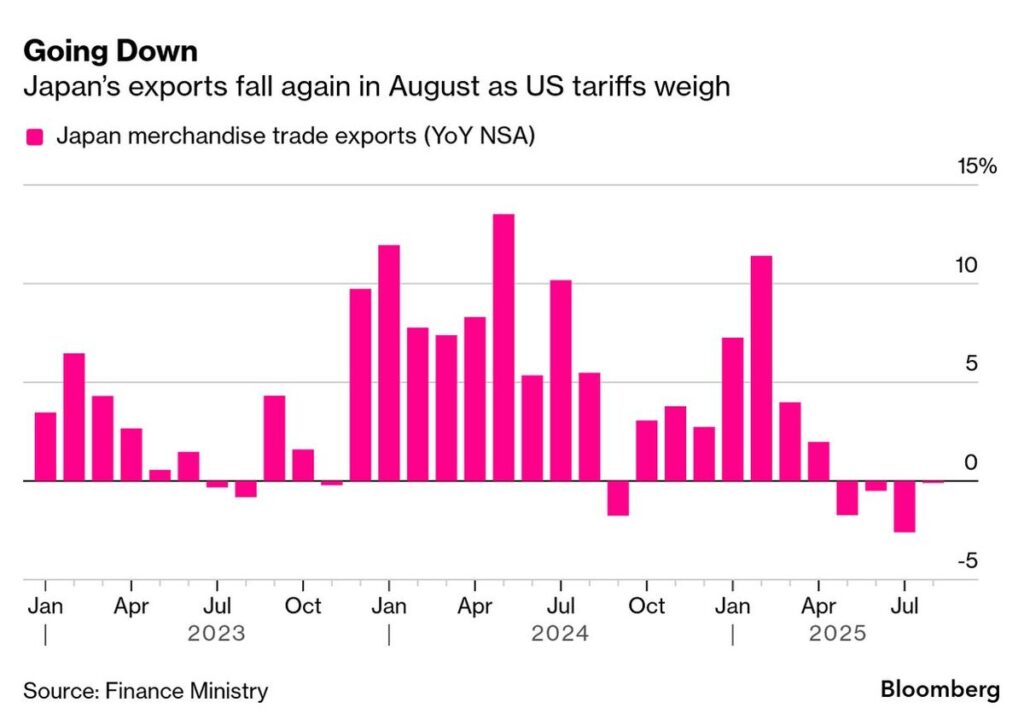

Compounding the market’s anxiety were fresh remarks from former President Donald Trump, who suggested a possible return to higher tariffs on imported goods. The mention of reviving tariffs has rekindled fears of trade tensions that could slow down global economic progress and further strain US businesses and consumers.

Tech stocks, which have led gains for much of this year, felt the brunt of the selloff. Major companies in technology and consumer sectors saw their shares slide, reflecting investor unease about both regulatory threats and the prospect of slower economic growth.

Bond yields also dropped as some investors sought safety in government debt, signaling a cautious attitude toward riskier assets like stocks. This flight to safety underscores the market’s uncertainty about Fed interest rate policy in light of the softer jobs data.

These combined factors—disappointing jobs numbers and the specter of renewed tariffs—have cast a shadow over the recent market rally. While some analysts remain optimistic that this could be a temporary pullback, today’s steep losses highlight just how sensitive investors are to shifts in economic data and policy proposals.

As the week progresses, market watchers will closely monitor upcoming economic reports and any signals from policymakers to gauge whether this downturn will be short-lived or the start of a rough patch for US equities.