|

| Gold V.1.3.1 signal Telegram Channel (English) |

Elon Musk vs OpenAI: Inside the Legal Battle Over Early Investment, Ownership, and AI Governance

2025-08-22 @ 15:00

In recent months, the merger and acquisition (M&A) landscape has been shaken by a highly publicized legal battle involving Elon Musk’s X Corp., formerly known as Twitter, and OpenAI, the creator of ChatGPT. This dispute has brought significant attention not just to the business dealings of some of the world’s most influential tech entrepreneurs but also to the critical role played by investor capital in fueling AI innovation.

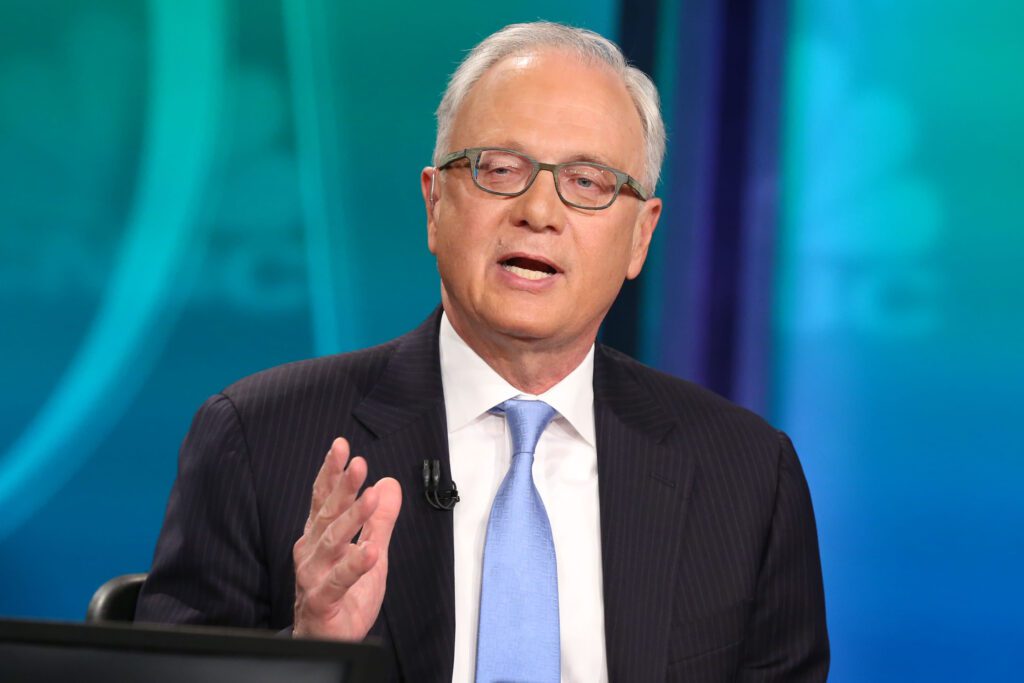

At the heart of this dispute is the attempted acquisition of a stake in OpenAI, in which Elon Musk sought to obtain partial ownership around 2022, facilitated by funds managed by prominent investor Chuck Baggett. Legal documents from the proceedings reveal Musk’s efforts to secure a position in OpenAI while emphasizing his long-standing relationship with the company and its founders.

Elon Musk has long presented himself as one of the earliest and most important backers of OpenAI, having reportedly supported the organization during its formative stages with both ideas and financial resources. However, as OpenAI’s valuation soared on the back of ChatGPT’s breakout success, Musk increasingly sought to secure a larger stake, reflecting the perception that early-stage investors deserved a significant share of the company’s future value.

This view led to a conflict with other early backers and OpenAI’s board, who argued that original investors had already received adequate benefits from their initial participation and that new investments would require real value-add, not just historical association. The dispute eventually escalated into a legal struggle between X Corp. and key OpenAI stakeholders.

A closer look at the court files reveals the intricacies of these transactions, the terms of the proposed stake purchases, and the disagreements about the appropriate allocation of shares and influence within the company.

The case carries important lessons for the financial and tech communities:

- Valuing Early-Stage Capital: The dispute spotlights the evolving expectations of early investors in major tech startups. While early capital is often essential to launch high-risk ventures, ongoing rewards depend on continual engagement and value creation, not merely on being present at the beginning.

- Corporate Governance Challenges: For AI companies like OpenAI, governance structures must balance the interests of founders, investors, and the broader mission of the organization. The Musk-OpenAI dispute illustrates potential pitfalls when early roles are not clearly defined or when company missions pivot as commercial opportunities expand.

- Innovator Dilemmas as Companies Scale: The situation illustrates the classic “innovator’s dilemma.” As a technology matures and the company shifts from nonprofit or research-oriented roots toward commercial expansion, early contributors may feel left behind or motivated to demand a larger share of the pie.

- Transparency and Stakeholder Communication: The legal battle underscores the need for transparency in communications with stakeholders and clear documentation of strategic decisions, especially as organizations navigate the high-stakes world of AI commercialization.

Beyond the courtroom, OpenAI’s rapid commercial ascension has drawn intense scrutiny from financial and technological observers. Institutions and venture capitalists are keen to tap into AI-driven growth, but this very eagerness has exposed gaps in how capital, intellectual property, and operational control are negotiated in transformative tech companies.

For investors, one key takeaway is the importance of understanding the lifecycle of high-growth technology firms. Early risk-taking may be rewarded, but staying influential requires more than just an initial check; it demands sustained value and influence as the company evolves.

For founders and management, the OpenAI saga serves as a warning about the complexity of ownership, power, and purpose in the fiercely competitive AI landscape. Clear alignment on mission and stakeholder expectations — from seed stage through global expansion — is essential to avoid costly and reputation-damaging conflicts down the road.

As artificial intelligence continues to reshape financial markets and the broader economy, the story of Musk, OpenAI, and investor intrigue highlights both the extraordinary opportunities and the governance hurdles that will define Silicon Valley for years to come. Investors, founders, and employees in AI should study these events not just as a business drama, but as a guide for navigating the disruptive impact of innovation at scale.