|

| Gold V.1.3.1 signal Telegram Channel (English) |

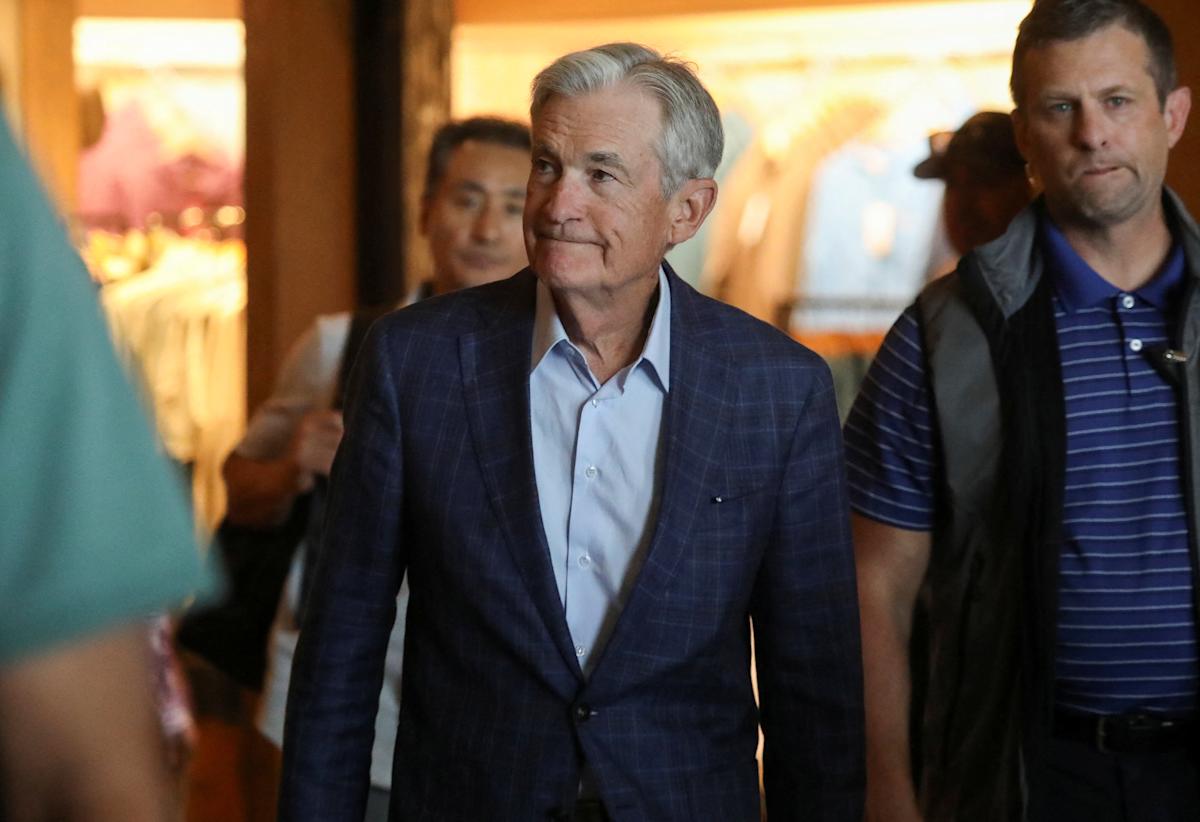

Federal Reserve Chair Jerome Powell Signals Potential September Rate Cut Amid Labor Market Uncertainty

2025-08-23 @ 01:01

Federal Reserve Chair Jerome Powell Signals Possible September Rate Cut Amid Shifting Economic Risks

In a closely watched speech at the annual Jackson Hole symposium, Federal Reserve Chair Jerome Powell signaled that the central bank is open to cutting interest rates, with a decision likely hinging on the evolving economic landscape as the September policy meeting approaches.

Powell addressed an audience of global central bankers and leading economists against the backdrop of mounting political pressure and conflicting economic signals. His speech marked a pivotal moment, especially as it may be his last appearance at Jackson Hole in his current tenure.

Powell highlighted the intricate challenges currently facing the economy, pointing to a “curious kind of balance” in the labor market. Traditionally robust, the jobs market now faces both slowing demand from employers and a dwindling supply of available workers. This intersection, according to Powell, creates an unusual and potentially precarious situation: while hiring has slowed, the risks to employment are beginning to tilt downward. He noted that should these risks materialize, they could manifest abruptly through higher layoffs and a rapid rise in unemployment.

The most recent labor data has fueled this concern. July’s job figures came in weaker than economists anticipated, with revised downward estimates of previous months’ job gains, an uptick in the unemployment rate, and indications of growing slack in the labor market. Investors responded swiftly, recalibrating their expectations for monetary policy: markets now price in a roughly three-in-four chance that the Fed will lower rates at its September meeting.

Powell remained cautious but flexible in his remarks. While acknowledging that inflation pressures persist—partly fueled by new rounds of tariffs from the Trump administration—he stated that the Fed stands ready to adjust its policy stance if risks to the job market increase. He emphasized that the Federal Reserve’s decisions will not be swayed by political considerations, implicitly pushing back against the Trump administration’s public calls for a steep reduction in interest rates.

“We will never deviate from that approach,” Powell said, reaffirming that the Fed’s guiding principle remains a commitment to data-driven decision-making. Any move to alter rates will be made based solely on the institution’s ongoing assessment of incoming economic data and its implications for both inflation and employment.

The current federal funds rate stands at 4.25%–4.50%, a level maintained since earlier this year as the Fed strives for a delicate balance: containing persistent inflation without choking off economic growth. Powell acknowledged that, while this stance remains restrictive, the evidence of labor market softening warrants ongoing vigilance.

The minutes from the most recent Federal Open Market Committee (FOMC) meeting reflected a growing divide within the Fed’s policymakers. While nearly all officials favored leaving rates unchanged, a minority, citing labor market weakness, argued for an immediate cut. Their argument has become more salient in light of the latest jobs data.

Political pressure adds another layer of complexity. In recent weeks, President Trump has called for an outsized reduction in rates, arguing that lower borrowing costs would support government spending and help the economy weather ongoing uncertainties. Powell, however, was unequivocal that such calls will not dictate policy. Instead, the Fed’s dual mandate—maximum employment and price stability—remains its sole compass.

Market reaction to Powell’s speech was swift. Treasury yields fell, equity prices jumped, and the dollar slid as investors interpreted his comments as a clear signal of increased flexibility. Nevertheless, Powell stopped short of fully committing to a rate cut, instead underscoring the importance of future economic indicators.

Looking ahead, all eyes are on the Fed’s upcoming policy meeting scheduled for September 16-17. The recent mix of softer employment readings and stubborn inflation will force policymakers to weigh the risk of tipping the economy into recession against the dangers of letting inflation remain above target. Powell’s Jackson Hole speech leaves the central bank with room to maneuver, asserting that policy could change quickly if downside risks to jobs become more pronounced.

As the summer ends, the financial world watches for further signals. Powell’s remarks encapsulate the uncertainty of the present moment: a central bank aiming to remain agile, data-driven, and insulated from political winds—while faced with a uniquely complex set of choices. Should labor market deterioration accelerate, the September FOMC meeting could mark a significant turn in U.S. monetary policy. For now, Powell’s message is clear: flexibility and vigilance will guide the Fed’s response to evolving risks.