|

| Gold V.1.3.1 signal Telegram Channel (English) |

Federal Reserve’s September Policy Outlook: Will Monetary Easing Begin Amid Inflation and Employment Signals?

2025-08-25 @ 04:00

The Federal Reserve’s Monetary Policy: Looking Ahead to September

In recent months, global financial markets have been closely monitoring the evolving stance of the US Federal Reserve. A key question on the minds of investors and economists alike is whether the Federal Reserve will finally shift towards monetary easing—potentially as soon as September.

The Fed’s Recent Messaging

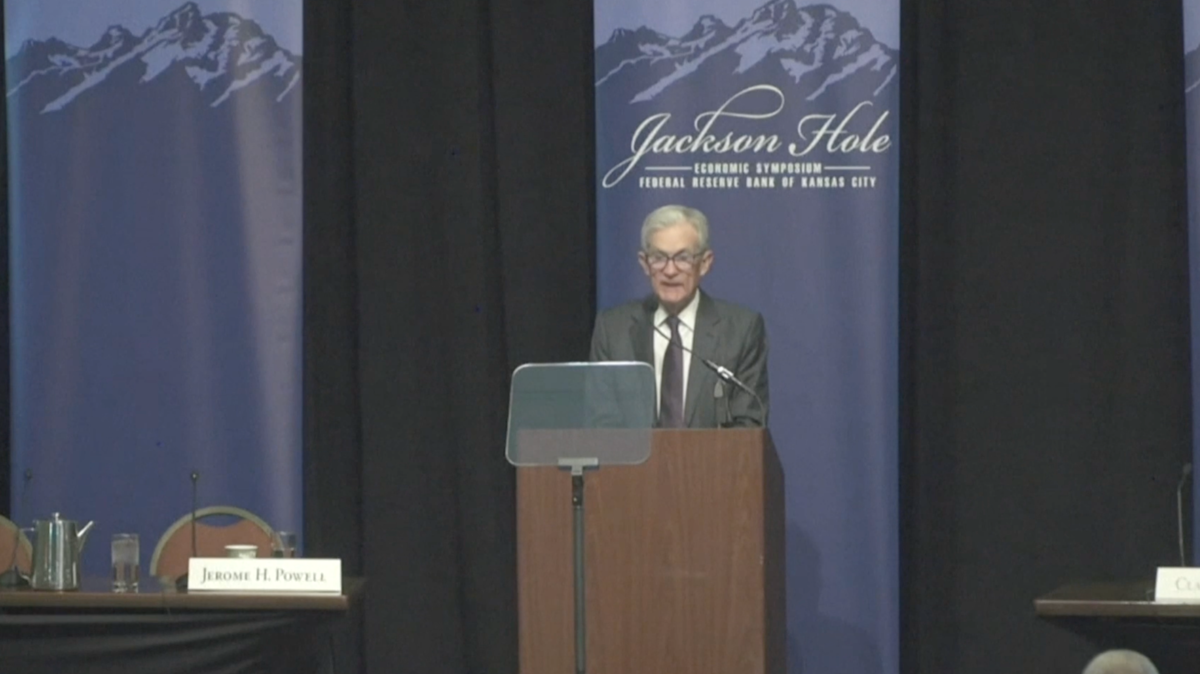

Federal Reserve Chair Jerome Powell has recently hinted at the possibility that the Fed may begin to consider interest rate cuts in the near term. However, Powell has also repeatedly underscored the central bank’s commitment to its dual mandate: price stability and full employment. While concerns about persistent inflation remain, there is a growing recognition that elevated rates are exerting increasing pressure on economic activity and could risk a future slowdown.

Since last year, the Fed has taken a cautious approach, raising rates aggressively to combat surging inflation. As the economy has shown signs of resilience, with employment remaining robust, policymakers have insisted they would maintain high rates until they are confident that inflation is firmly under control. However, recent inflation data suggest that price pressures are gradually abating—raising hopes that monetary policy could soon pivot.

September: A Potential Pivot Point

The upcoming September meeting is viewed by many market participants as a major inflection point. The rationale is straightforward: if incoming data continue to show that inflation is heading towards the Fed’s 2% target and the labor market displays signs of cooling, the Fed may gain enough confidence to begin loosening policy.

Financial markets have started to price in increased chances of a rate cut before year-end. Bond yields have reacted accordingly, while stock markets have enjoyed a boost from renewed risk appetite. Nevertheless, uncertainty persists: stronger-than-expected economic data, renewed inflationary pressures, or geopolitical shocks could still delay the long-awaited pivot. Investors should be prepared for possible volatility as new data emerges.

Challenges and Considerations for the Fed

Despite the improving inflation outlook, the path towards more accommodative policy is not straightforward. Several challenges may complicate the Fed’s decision-making process:

- Global Uncertainties: Risks such as geopolitical tensions and trade disruptions may impact global supply chains, maintaining upward pressure on prices.

- Domestic Dynamics: The US housing sector, consumer spending habits, and wage growth all remain in flux, making it difficult to assess the true state of inflationary forces.

- Financial Stability: Dwelling too long at high rates could strain certain sectors, particularly small businesses and highly indebted corporations. Conversely, cutting rates too quickly may reignite inflationary expectations and undo some of the progress made.

Powell and his colleagues are acutely aware of these risks. Their communications have emphasized the need for flexibility and data dependence, leaving all policy options on the table. This approach aims to maintain market stability while giving the Fed room to react as new information becomes available.

Investor Strategies Amid Uncertainty

Given the current backdrop, investors face both opportunities and risks. On one hand, the anticipation of a shift to easier monetary policy could bode well for equities, particularly growth-oriented sectors like technology and consumer discretionary. Bond markets may also benefit as yields come down. On the other hand, any unexpected acceleration in inflation could prompt the Fed to “hold higher for longer,” sparking renewed volatility.

Smart investors are adopting a balanced approach: diversifying portfolios, focusing on high-quality assets, and maintaining ample liquidity to take advantage of potential market dislocations. Keeping a close eye on macroeconomic data—especially inflation readings, employment statistics, and forward-looking indicators—remains critical.

What to Watch Going Forward

As we approach the September Fed meeting, several key indicators will drive expectations:

- Monthly inflation reports to confirm the disinflation trend.

- Labor market data to gauge whether employment conditions are cooling without jeopardizing economic growth.

- Global economic developments and potential shocks that could alter the Fed’s risk calculus.

For now, the message from the Fed is one of cautious optimism: monetary policy may soon become less restrictive, but only if conditions allow. Investors should brace for a potentially pivotal period as central banks worldwide navigate the complex trade-offs of the post-pandemic era.

Staying informed, agile, and disciplined will be essential as this monetary policy story continues to unfold.