|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold and Silver in 2025: Record Highs, Key Resistance Levels, and Market Outlook for Investors

2025-08-13 @ 17:00

Precious metals have once again captured the attention of investors in 2025, with both gold and silver posting remarkable gains and sparking lively debate over their near-term direction. As we approach key US economic data releases, the atmosphere is one of caution and anticipation, with prices hovering near notable resistance levels. Here’s an in-depth look at current trends, factors influencing the market, and what investors should keep in mind in the months ahead.

Gold’s Record-Breaking Run and the Path Forward

Gold has dazzled markets by recently soaring to new all-time highs. This ascent has been mirrored by gold mining stocks, with proxies like the GDX ETF also testing historic resistance. The uptrend has been fueled by widespread macro uncertainties, ranging from persistent inflationary pressures to geopolitical tensions and sustained central bank buying.

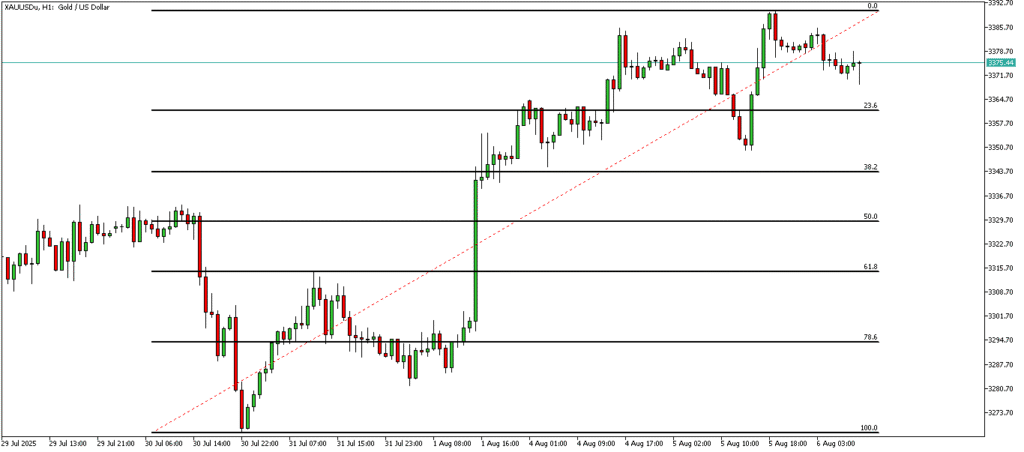

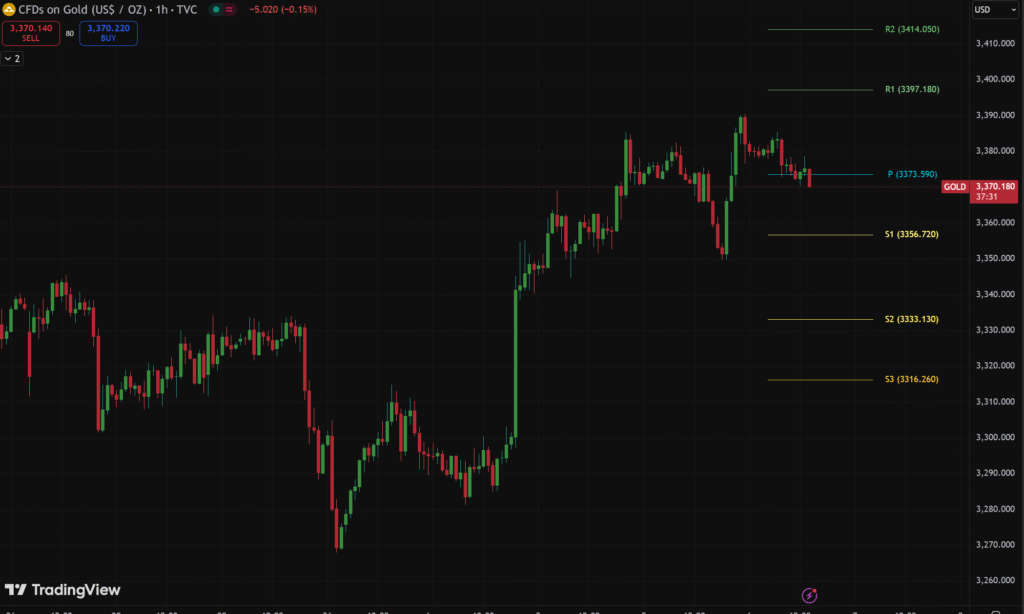

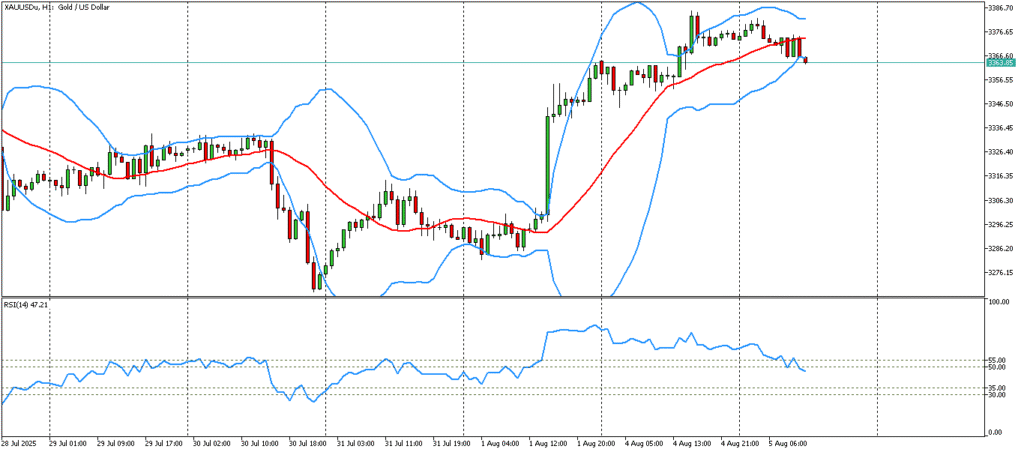

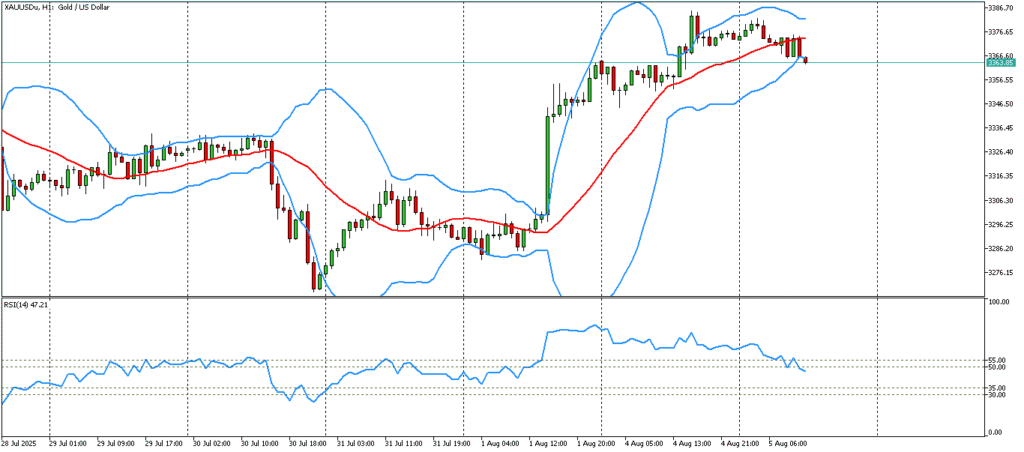

Yet, despite bullish sentiment and record levels, several technical indicators hint at potential headwinds. Gold and related assets are now acting much like they did during their previous cyclical peaks, such as the 2011 high. With gold futures already showing early signs of softening, some market watchers warn that the rally could be due for a pause or even a reversal. Key price targets for gold in 2025 vary dramatically depending on the forecaster. Some institutional analysts expect prices to average between $2,700 and $3,900 per ounce, while popular surveys and user sentiment see potential spikes even above $3,000.

It’s important to note that resistance areas—those price levels where sellers have historically dominated—are now being retested. Should gold fail to break through and sustain above these points, a more pronounced corrective phase could emerge, especially if US economic data surprises to the upside or the dollar strengthens further.

Silver’s Strong Momentum and Industrial Demand

While gold often grabs headlines, silver has had a quietly outstanding year. Prices began 2025 near $29 per ounce and have rallied close to $37.50—a year-to-date gain approaching 30%. Much of silver’s allure stems from its dual status as a precious and industrial metal. The electrification boom, growing renewable energy sector, and ongoing industrial recovery have kept demand robust, supporting higher prices and fueling investor interest.

Supply-side dynamics have also played a critical role. For the fifth consecutive year, silver faces a market deficit, with demand outstripping supply by wide margins. Even as the deficit is expected to shrink slightly this year, it remains a major structural support for silver prices going forward.

Forecasts for silver’s trajectory in the months ahead range widely. Some expect consolidation near $37–40 as the market digests recent gains, while others anticipate increased volatility if economic data or US dollar movements shift sentiment. Nevertheless, longer-term trends remain favorable, especially for investors seeking exposure to both defensive and growth-driven components of the precious metals universe.

Market Psychology: Why Caution is Necessary

With both gold and silver trading near multi-year highs, investors must remain aware of the psychological undercurrents. Returns have been stellar, but history shows that run-ups to resistance levels can prompt abrupt reversals—particularly in periods of uncertainty before major data releases. Sharp price moves in either direction could occur if the latest US inflation, labor, or growth numbers exceed expectations or disappoint.

Technical traders will be closely watching price action and volume near current thresholds. A decisive breakout could signal another leg higher, but repeated failures to sustain above resistance might reinforce the bearish camp and accelerate unwinding of speculative positions.

The Dollar Factor and Geopolitics

In parallel, the strength of the US dollar continues to shape the metals landscape. The greenback has recently stabilized following a long-term bottom and a confirmed breakout, buoyed by improving trade clarity and reduced chaos surrounding tariffs and monetary policy. A firmer dollar generally works against gold and silver, as it makes them more expensive for foreign investors. Should this dollar uptrend persist, gold and silver may face additional pressure, regardless of their underlying bullish fundamentals.

Geopolitics remains another wild card. Any escalation in global tensions, supply disruptions, or central bank responses could swiftly reignite risk aversion and flight-to-safety buying, pushing metals back toward—and possibly beyond—their previous highs.

Investor Takeaways

- Gold and silver have enjoyed exceptional rallies in 2025, but both are now testing key resistance zones that have historically triggered volatility and corrections.

- Technical and fundamental factors—including US economic data, dollar moves, supply deficits, and real rates—will be crucial in determining the next major trend.

- Caution is paramount as markets digest incoming data. Watch for confirmation or rejection of price breakouts around current highs.

- Longer-term, both metals retain strong appeal for diversification, defense against systemic risks, and potential growth—especially if central bank accumulation and industrial demand persist.

Stay tuned for continued analysis as US data sets the tone for the next phase in precious metals trading. Whether you’re a short-term trader or long-term investor, understanding these dynamics is the key to navigating the current market landscape with confidence.