|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold and Silver Set for Key Breakouts as Fed’s Dovish Shift and U.S. Inflation Data Influence Market Trends

Gold and Silver Set for Key Breakouts as Fed’s Dovish Shift and U.S. Inflation Data Influence Market Trends

2025-08-11 @ 17:00

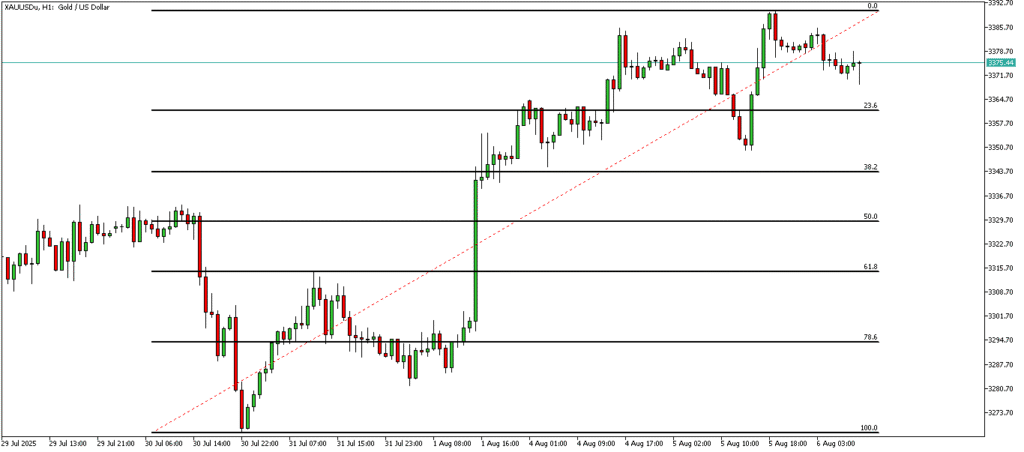

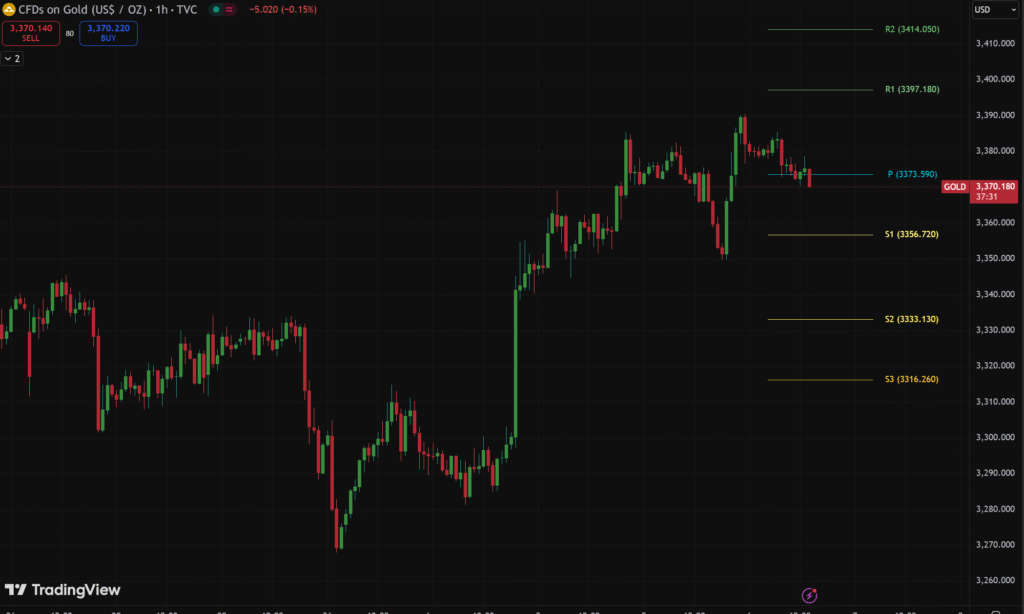

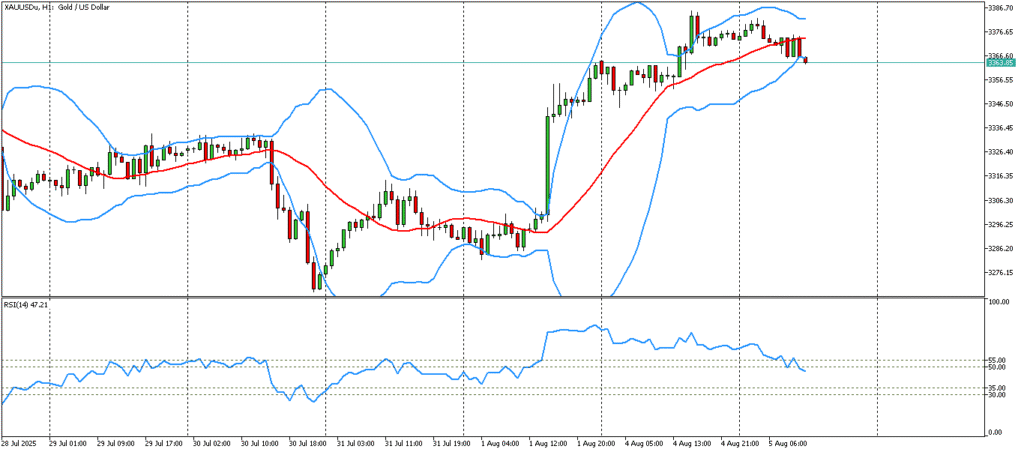

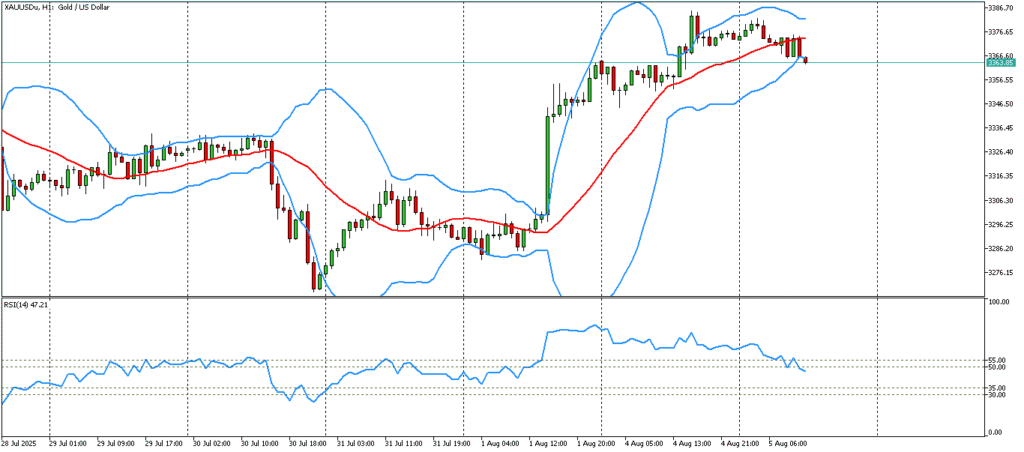

Gold (XAUUSD) and Silver (XAGUSD) enter a pivotal week with breakout potential as a dovish tilt from the Federal Reserve converges with fresh U.S. inflation data. With policymakers signaling growing comfort with disinflation and labor-market cooling, markets are increasingly pricing earlier and deeper rate cuts. A downside surprise in CPI would likely push real yields lower and the dollar softer—conditions that historically favor upside moves in precious metals.

For gold, immediate focus is on whether prices can sustain a move above recent congestion and reclaim momentum toward prior highs. A clean break higher on soft CPI could open a run toward new records as ETF outflows stabilize and central-bank buying remains a supportive backdrop. Conversely, a hotter CPI print would lift yields and the dollar, risking a retest of near-term supports and extending range-bound trade.

Silver’s setup looks even more asymmetric. As a high-beta precious metal with industrial demand tailwinds, silver tends to amplify gold’s directional moves. A dovish CPI read could catalyze a decisive push toward multi-month highs, particularly if risk appetite improves alongside lower yields. However, volatility cuts both ways: a sticky inflation surprise may trigger sharper pullbacks in silver than in gold.

Key catalysts to watch:

– Headline and core CPI trends, especially shelter and supercore services.

– Market-implied rate cuts and real yield trajectory across the curve.

– Dollar index direction into and after the data.

– Positioning and flows: ETF demand, CFTC net specs, and options skew.

Trading considerations:

– Breakout-follow strategies may favor gold on confirmation above resistance with tight risk controls; silver offers greater upside torque but higher drawdown risk.

– Pairs and spreads: long silver vs. gold can outperform in a soft-inflation, lower-real-yield regime; flip bias if CPI is hot.

– Risk management: respect event risk with reduced leverage, staggered entries, and predefined invalidation levels.

Bottom line: The combination of a dovish Fed narrative and a pivotal CPI print creates a high-impact window. A benign inflation surprise could unlock upside breakouts in both gold and silver, with silver poised to outperform on beta. A hot print likely defers the move and keeps metals choppy within established ranges.