|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Outlook August 2025: Key Support, Resistance, and Impact of Tariffs and Fed Rate Expectations

Gold Price Outlook August 2025: Key Support, Resistance, and Impact of Tariffs and Fed Rate Expectations

2025-08-06 @ 11:00

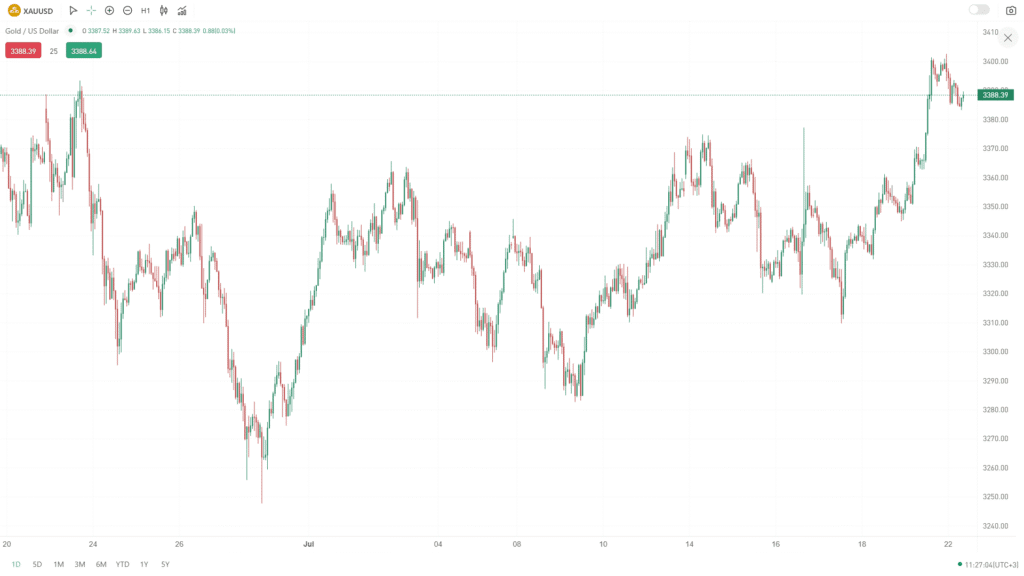

Gold prices have experienced a turbulent start to August, with bulls managing to keep the metal above its 50-day moving average even as fundamental and technical factors send mixed signals. After a strong 2.2% rally at the end of last week—the steepest daily gain since June—gold touched highs near $3,358 per ounce before pausing as investors assessed the latest economic developments.

Several factors are influencing the current gold landscape. On the macroeconomic front, newly announced trade tariffs ranging from 10% to 41% have reignited demand for safe-haven assets such as gold as market participants brace for potential disruptions in global trade. At the same time, weaker U.S. labor market data have increased expectations that the Federal Reserve could lower interest rates as soon as September, providing another tailwind for gold bulls.

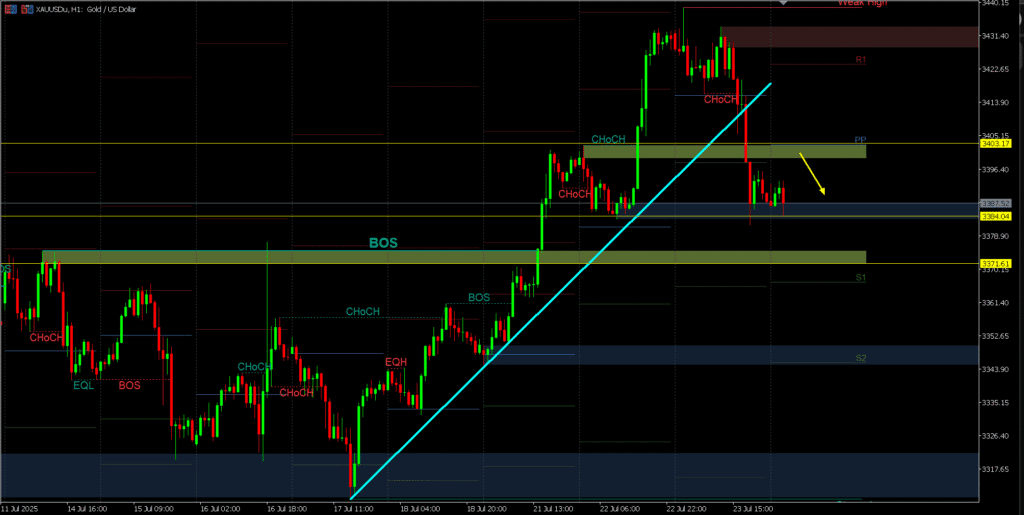

Technically, gold has shown resilience after rebounding from key support levels at $3,267, swiftly breaking through resistance at $3,281 and $3,344. The metal is currently consolidating below fresh highs, facing immediate resistance at $3,350 and $3,404. As long as prices remain above the crucial $3,285 support zone, the bullish outlook remains intact. However, a daily close above $3,300 is considered vital for renewed upward momentum.

Despite the positive undertone, the U.S. dollar’s persistent strength continues to cap gold’s rally, keeping further gains in check. Should the dollar weaken—particularly if the Fed signals an imminent rate cut—gold could experience another leg higher. Conversely, a stronger dollar or diminishing expectations for monetary easing could trigger a correction, with potential downside targets at $3,305 and $3,267.

As market volatility persists, gold traders should closely watch support and resistance levels and monitor how rate cut expectations and the U.S. dollar trend play out in the weeks ahead.