|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Outlook August 2025: Navigating Volatility Within Key $3,250–$3,450 Range Amid Global Uncertainty and Technical Signals

2025-08-14 @ 00:00

Gold prices have experienced remarkable volatility in recent months, climbing to historic highs but still showing signs of market indecision. As we move through August 2025, gold is navigating a tight trading range, with investors closely watching key technical and fundamental signals to assess the next major move.

Gold’s Current Price Action and Range

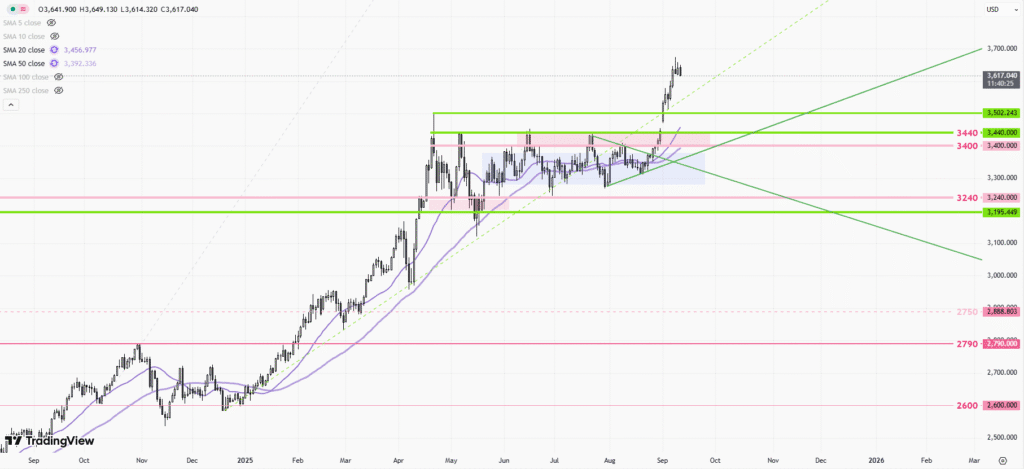

Throughout the past three months, gold has largely remained trapped within the $3,250 to $3,450 range. Despite moments of upward momentum that have briefly pushed prices towards the upper end, gold has yet to escape this consolidation phase. This trading range reflects persistent uncertainty in global markets, influenced by shifts in the US Dollar, ongoing geopolitical developments, and investor sentiment concerning interest rates and inflation.

As of mid-August, spot gold prices have oscillated between $3,341 and $3,402, with gains tempered by the recent strengthening of the US Dollar. Positive news, such as prospects of a US-China trade truce extension and discussions between the US and Russia about deescalating tensions in Ukraine, have also weighed on the traditional “safe haven” appeal of gold. Yet, broader macroeconomic risks continue to underpin demand for precious metals.

Technical Analysis: Key Levels and Indicators

Technical analysts are focusing on a handful of pivotal levels. Gold’s 20-day exponential moving average (EMA) remains a closely watched threshold. Price action near this indicator can signal underlying strength or weakness. For now, gold continues to wobble around this area, reflecting indecision among traders.

Chart patterns suggest that, while bullish momentum has paused, the market is not yet showing strong signs of reversal. The lack of a clear breakout above $3,450 or a sustained dip below $3,250 means that traders are keeping a close eye on any shift in volume or volatility for cues about the next directional move.

Medium and Long-Term Gold Price Forecasts

Looking ahead, most forecasts remain constructive on gold, though the path forward is not without potential turbulence. Some predictions anticipate gold reaching $3,500 before the end of 2025, with forecasts for 2026 edging towards $3,900 as macroeconomic and monetary dynamics continue to evolve. Factors influencing these bullish targets include expectations of persistent or resurging inflation, ongoing central bank debt accumulation, and the appeal of gold as a portfolio hedge amid global economic complexity.

However, not all signals point to unbridled bullishness. Historical comparisons to previous gold peaks—particularly the 2011 top—suggest caution. Patterns emerging now mirror behavior seen at prior market climaxes, raising the risk that gold may enter a consolidation or pullback phase before any renewed move higher. Moreover, some analysts argue that a strengthening US Dollar could cap further gold gains in the coming months, especially if global trade tensions abate and risk appetite returns to financial markets.

Key Drivers Shaping Gold’s Outlook

Investor sentiment towards gold will likely remain a product of several interconnected themes:

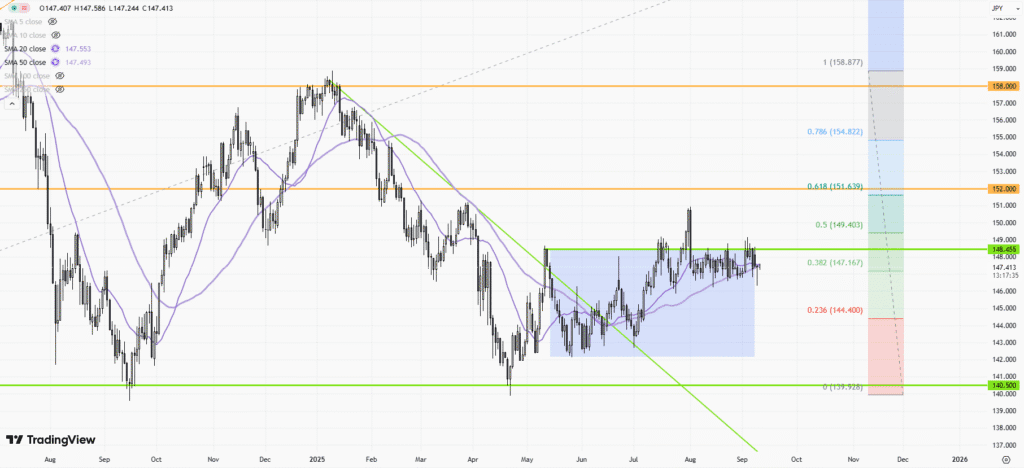

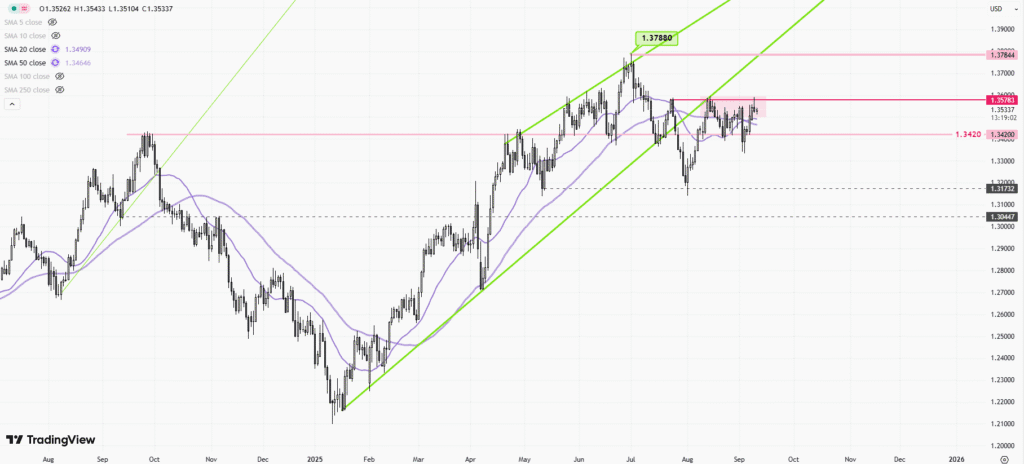

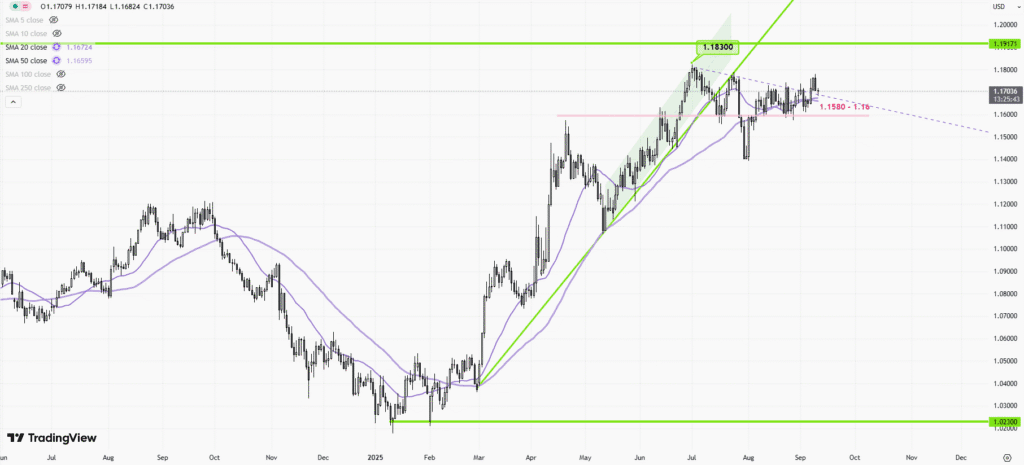

- US Dollar Strength: The direction of the Dollar often inversely correlates with gold. A stronger Dollar, driven by relative US economic resilience or geopolitical stability, tends to pressure gold prices lower, while any signs of Dollar weakness can provide upside for gold.

- Geopolitical Uncertainty: Ongoing negotiations among major world powers and flashpoints such as the Ukraine conflict or US-China trade relations will continue to influence gold, either as a hedge against uncertainty or as a brake during periods of perceived détente.

-

Inflation Expectations: Gold has historically been a favored hedge against inflation. Any signs of resurgent inflation, or central banks signaling caution rather than rate hikes, could revive support for gold.

-

Interest Rate Policy: Decisions from the Federal Reserve and other central banks will remain highly relevant. Lower rates often benefit gold, as they reduce the opportunity cost of holding non-yielding assets.

What Should Investors Watch Now?

For traders and long-term investors alike, the focus should remain on the $3,250–$3,450 price range. A convincing breakout above $3,450 could usher in a push towards new highs, while a breakdown below $3,250 may suggest a broader correction is in play. Monitoring US Dollar trends, macroeconomic announcements, central bank policies, and global geopolitics will be essential for anticipating gold’s next move.

The gold market continues its delicate balancing act. While the long-term outlook remains optimistic, short-term volatility and technical resistance warrant caution and active risk management for anyone looking to capitalize on the current environment. Gold remains a dynamic asset—both a refuge in uncertain times and a beneficiary of global shifts in economic policy, making it as relevant as ever for diversified portfolios.