|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Outlook: Key $3,400 Resistance and US Inflation Data Set to Drive Market Moves

Gold Price Outlook: Key $3,400 Resistance and US Inflation Data Set to Drive Market Moves

2025-08-11 @ 12:00

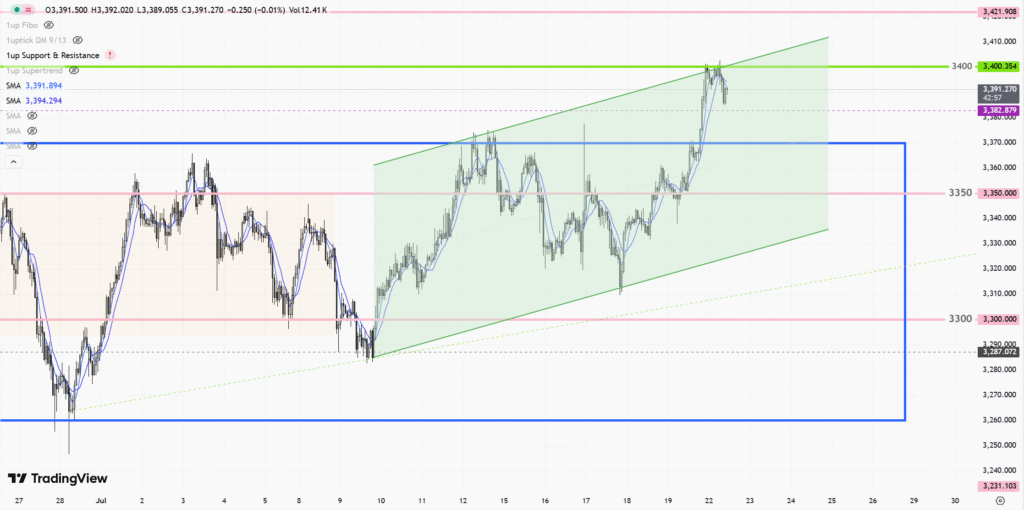

Gold prices are holding below the key $3,400 mark as traders brace for fresh US inflation data this week. After a strong multi-month run, momentum has cooled, with XAU/USD consolidating in a tight range as markets reassess the path of Federal Reserve policy and real yields.

The immediate focus is on the upcoming CPI and PPI releases. Softer inflation would likely push real yields lower and weaken the US dollar, offering a tailwind to gold. Conversely, any upside surprise could lift Treasury yields, strengthen the dollar, and keep bullion capped beneath resistance. Options markets and recent price action suggest a “wait-and-see” stance, with dip-buying interest meeting supply on rallies near $3,380–$3,400.

From a technical perspective, $3,400 remains a pivotal ceiling. A sustained daily close above this level would open the door toward $3,450–$3,500, where profit-taking could re-emerge. On the downside, initial support is clustered near $3,320–$3,300, followed by $3,250. The 50-day moving average (if nearby) will be watched as trend-defining support; a break below it could signal a deeper pullback toward the $3,200 area.

Macro drivers are mixed in the near term but still constructive over the medium term. Central bank buying, lingering geopolitical risks, and resilient investment demand continue to underpin the structural bull case. However, high real rates and a firm dollar have tempered upside in recent sessions. Positioning data show elevated but moderating speculative length—enough to fuel volatility around data releases.

Trading implications:

– Range bias into the inflation prints, with $3,300–$3,400 defining the near-term battlefield.

– Bullish continuation requires a clean break and hold above $3,400; failure keeps the risk of a pullback alive.

– Event risk is paramount: CPI/PPI outcomes will likely set the next leg, dictating whether gold resumes its uptrend or extends consolidation.

Bottom line: Gold is consolidating beneath resistance ahead of critical US inflation data. The broader uptrend remains intact, but bulls need a dovish inflation surprise—or a decisive technical breakout—to reclaim momentum above $3,400.