|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Price Rebounds but Faces Key Resistance at 50-Day Moving Average: What Investors Need to Know

2025-08-21 @ 00:01

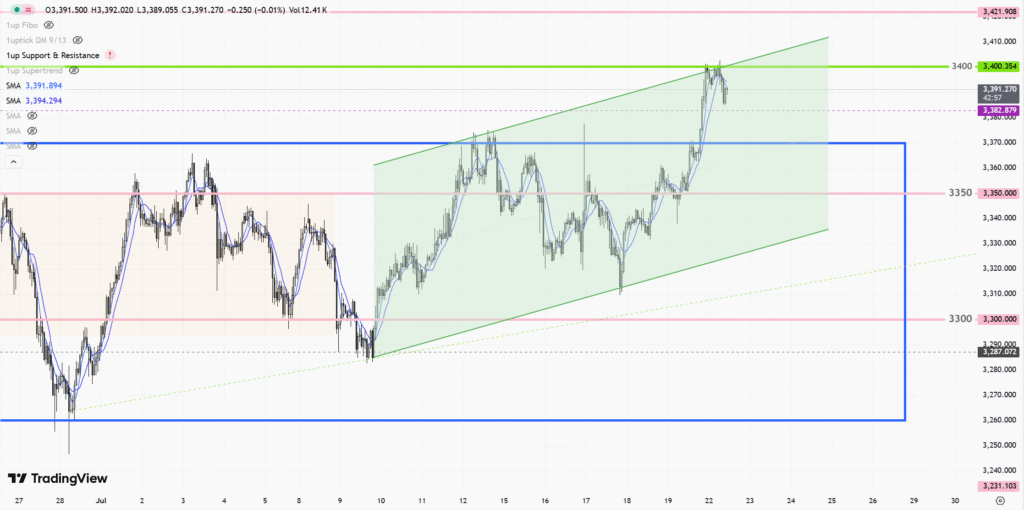

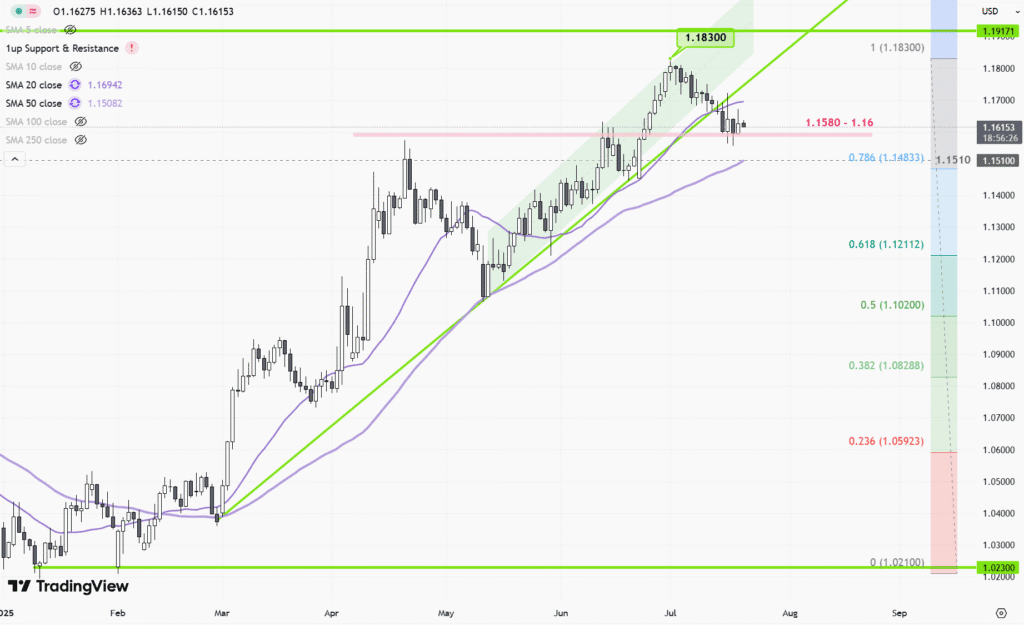

Gold prices are showing signs of recovery, rebounding from their recent lows as investors seek safe havens in a shifting financial landscape. Despite this upward movement, the 50-day moving average remains a key technical barrier that is capping the current rally, limiting gold’s ability to make a sustained breakout to new highs.

Market Context and Technical Analysis

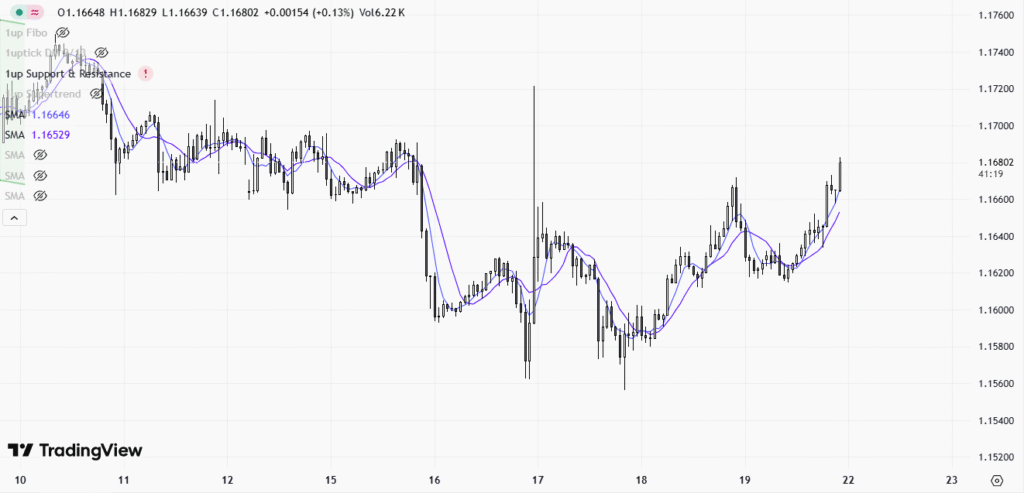

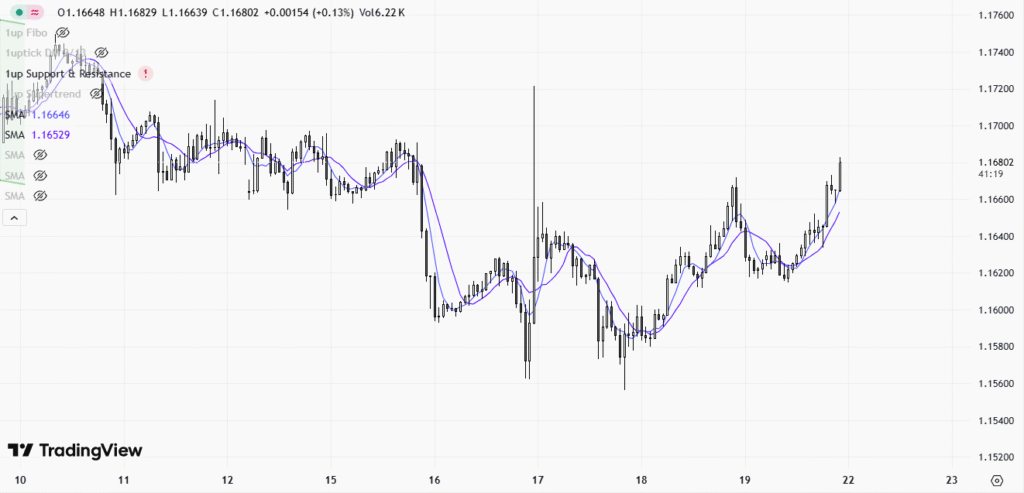

The recent price action in gold has been marked by volatility, reflecting ongoing uncertainty in global markets. After a period of decline, gold found support and reversed course, with buyers stepping in as financial conditions signaled increased risk aversion. The rebound, however, faces stiff resistance at the 50-day moving average—an important technical indicator watched by traders and analysts alike. This level has been repeatedly tested but not yet convincingly breached, suggesting that the rally’s strength is tentative.

Technically, the 50-day moving average often acts as a catalyst for market sentiment shifts. When prices are below this average, the outlook tends toward bearish; a decisive move above it can ignite fresh bullish momentum. Currently, gold’s inability to maintain gains above this line underscores the persistent cautiousness in the market. While short-term traders may look for quick momentum surges, longer-term investors will scrutinize whether gold can overcome this hurdle and build a solid base for further appreciation.

Fundamental Factors Influencing Gold

Several fundamental dynamics are playing into gold’s price trajectory:

- Interest Rates: As central banks recalibrate monetary policy amid sticky inflation and uneven economic growth, expectations for future interest rates remain pivotal. Higher rates tend to weigh on precious metals, as they increase the opportunity cost of holding non-yielding assets like gold.

- Geopolitical Risk: Rising geopolitical tensions and persistent uncertainty across global markets drive safe-haven demand, supporting gold during times of turmoil.

- Inflation: While inflationary pressures have moderated from recent peaks, they remain a tailwind for gold by eroding confidence in fiat currencies and increasing demand for tangible assets.

On balance, gold’s medium-term outlook continues to be shaped by these crosscurrents. Inflation expectations, central bank policy, and risk appetite are all likely to keep gold prices volatile for the foreseeable future.

Short-Term Scenarios

Looking ahead, the key levels for gold remain unchanged: the 50-day moving average acts as resistance, with support coming in from recent lows and psychological thresholds. If gold manages to close decisively above the 50-day moving average, momentum could favor the bulls, potentially targeting the next resistance zone near the previous swing highs. Conversely, failure to clear this barrier may invite renewed selling pressure, testing support levels below.

Traders will pay close attention to macro announcements—such as economic growth figures, central bank meetings, and geopolitical developments—that can act as catalysts for a break in either direction.

Practical Takeaways for Investors

- Monitor Technical Levels: The 50-day moving average is the immediate line in the sand. A sustained move above this level would signal renewed bullishness, while continued rejection could turn the rally into a short-lived bounce.

- Stay Alert to News Flow: Gold is highly sensitive to real-time events. Major central bank decisions or sudden geopolitical surprises can swiftly alter sentiment.

- Maintain Risk Management: Given gold’s current technical setup, prudent risk controls are essential. Quick reversals are possible if resistance holds, so traders should establish stop losses and manage positions accordingly.

Long-Term Perspective

Despite recent setbacks and the current technical resistance, gold retains its status as a strategic hedge for portfolios. The combination of macro uncertainty, inflation risks, and shifting interest rate policies ensures that gold will remain a focus for investors seeking balance and protection.

In summary, the gold market is at a crossroads: price has rebounded, but sustained upside depends on a clear break above the 50-day moving average. Until this occurs, cautious optimism is warranted, as technical and fundamental headwinds may keep gold range-bound in the near term. Investors are advised to watch for confirmation signals before making directional bets, staying nimble as new information emerges.