|

| Gold V.1.3.1 signal Telegram Channel (English) |

Gold Prices Hover Near Record Highs: Key Factors Influencing the Next Big Move in August 2025

2025-08-22 @ 14:00

Gold prices are drawing significant attention as they hover near $3,340 per ounce, with traders closely watching for new developments that could spark the next big move. After an impressive rally earlier this August, which saw gold futures reaching fresh all-time highs, the market seems to be entering a phase of cautious consolidation. Investors are particularly mindful of several factors influencing the current landscape, from technical signals to shifting geopolitical currents and changing forecasts about the US dollar.

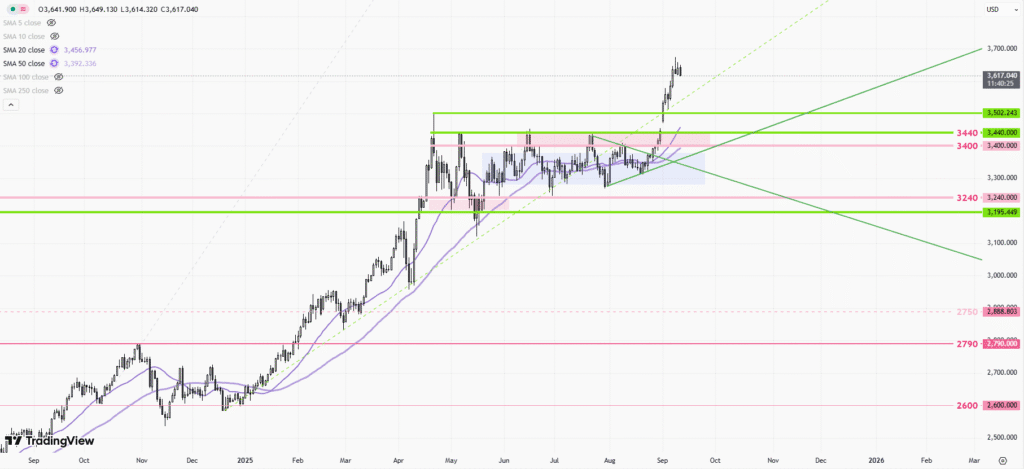

Recent price action shows gold settling into a tight range. The metal climbed sharply earlier in the month, but the momentum has stalled as gold struggled to break above the $3,350 resistance level. In fact, gold has experienced a pullback, recently hitting a three-week low around $3,311 before finding some buying support. This consolidation suggests that market participants are unwilling to commit heavily in either direction until clearer signals emerge.

From a technical analysis perspective, the near-term trend for gold is currently neutral to slightly bearish. Key support zones are located at $3,310, $3,270, and $3,220, while resistance can be found at $3,350 and $3,410. Short-term trading strategies suggest buying near support, such as $3,290, with upside targets around $3,400. Conversely, selling pressure may increase around $3,370, aiming for a retracement toward $3,280. This careful approach underscores the heightened sensitivity to any news or data that may tip the balance.

The big question for investors is: What could drive gold out of this consolidation? Several factors are being closely monitored:

- Geopolitical Events: Ongoing tensions, particularly relating to international negotiations and conflicts such as those involving Ukraine, continue to cast a shadow over risk assets. Recent high-level meetings between US and European leaders have focused on security guarantees, and any movement toward peace or escalation could quickly impact gold’s safe haven appeal.

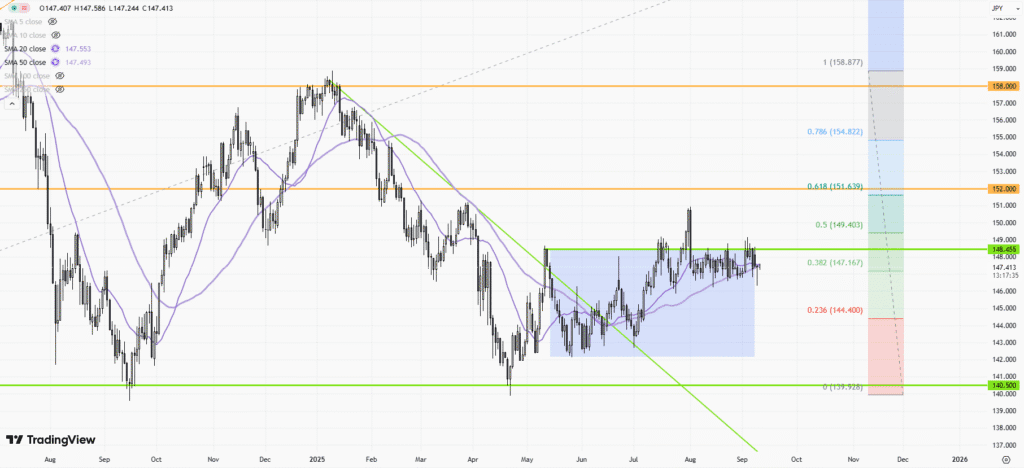

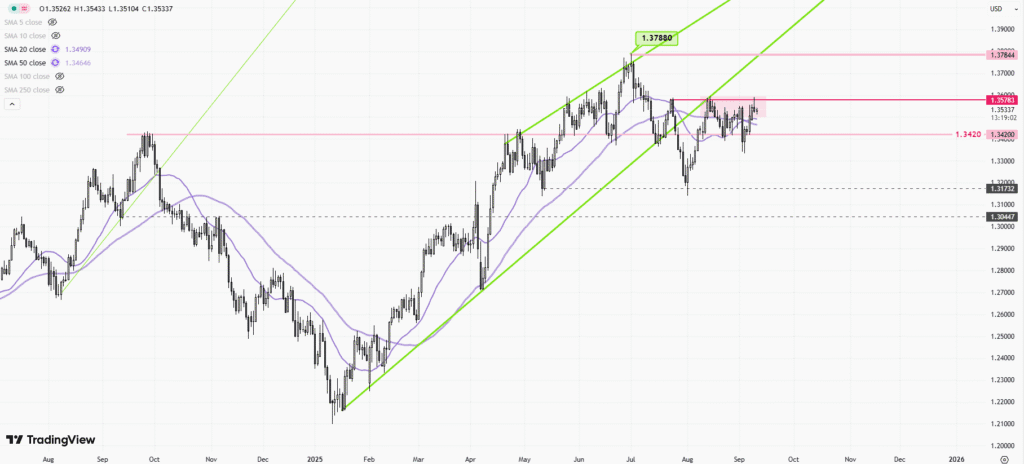

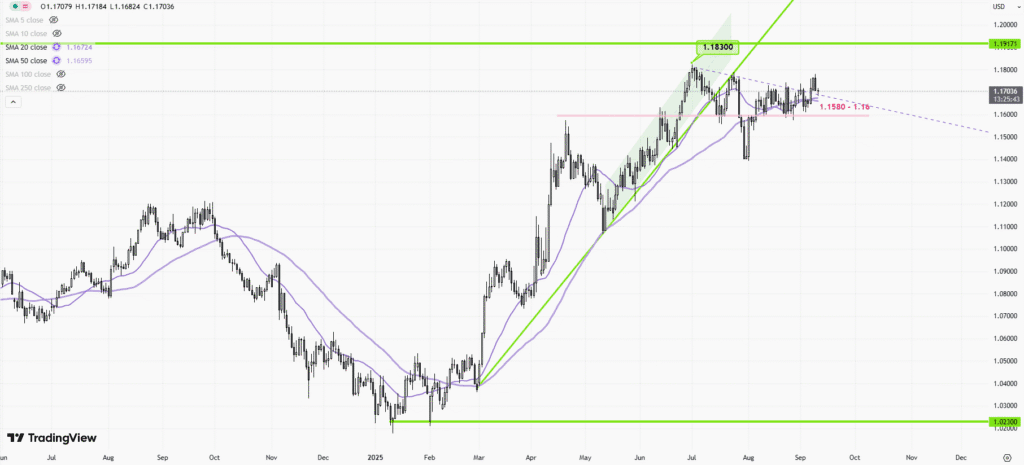

- US Dollar Dynamics: Recent months have seen the US dollar gain strength following developments in economic policy and shifting global trade dynamics. Notably, the stabilization of trade tariffs has contributed to a firmer dollar, which typically puts downward pressure on gold prices. If the dollar continues to find support, gold could face additional headwinds.

-

Inflation and Interest Rate Speculation: Although inflationary pressures and central bank policy shifts have driven gold’s uptrend earlier this year, investor focus is now on future interest rate decisions. Any dovish signals from central banks or signs of renewed inflation fears could quickly reignite demand for gold.

-

Market Sentiment and Technical Patterns: Despite the surge earlier this month, there are similarities to the conditions seen at previous market tops (most notably in 2011), where overexuberance was followed by a sharp correction. Some analysts warn that technical indicators suggest a potential cooling-off period, particularly given that gold stocks have also reached major resistance levels.

Forecasts for gold in the remainder of August and into September reflect these crosscurrents. Some models suggest a continuation of range-bound trading, with the prospect for minor gains if support holds. Projections indicate that gold could see average prices ranging from $3,320 to $3,400 over the coming weeks, with volatility expected to remain elevated in response to surprise geopolitical or economic developments.

Longer-term outlooks remain cautiously optimistic, but investors are advised to keep a close eye on evolving global events and the technical picture. With gold holding just above key support, any significant break in either direction could set the tone for the next trend.

In summary, gold is currently in a holding pattern, waiting for fresh catalysts to steer its next big move. While the medium-term backdrop remains supportive given ongoing global uncertainty, the near-term picture suggests a technical pause as markets digest recent gains and reassess risk. Traders and investors should remain nimble, prepared for swift shifts driven by news headlines or abrupt changes in sentiment. As always, keeping a disciplined approach with clear entry and exit levels remains essential in these uncertain times.