|

| Gold V.1.3.1 signal Telegram Channel (English) |

Hong Kong’s Stock Market Boom in 2025: Record IPOs, Surging Hang Seng Index, and Global Financial Leadership

2025-08-19 @ 14:00

Hong Kong’s stock market is commanding global attention in 2025, driven by an extraordinary wave of IPO activity and strong investor sentiment. The first half of this year has seen the Hang Seng Index outperform global peers and robust capital inflows, positioning Hong Kong as a key player in reshaping the global financial landscape.

A Historic Year for Hong Kong IPOs

The numbers from the first half of 2025 are nothing short of remarkable. Fundraising from IPOs reached approximately HKD 107.1 billion, which is over seven times more than the same period last year. This surge has already surpassed the total amount raised in 2024, making Hong Kong the top fundraising hub globally and achieving the second-highest half-year total in the past decade.

A total of 44 IPOs were completed, including main board listings and notable de-SPAC transactions. Retail, consumer goods, and services dominated new listings, accounting for roughly a third of the market, with industrials, materials, and healthcare each taking significant shares as well.

Market Performance and Investor Sentiment

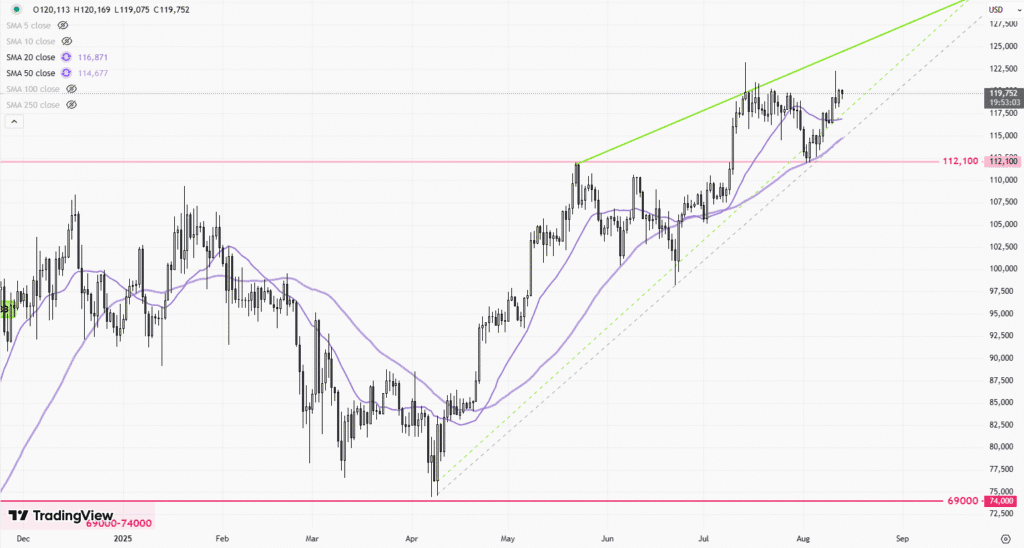

Beyond IPO activity, the Hang Seng Index returned more than 20% in the first half of 2025, maintaining its status as the best-performing major global index. Daily turnover volumes have surged to record highs, with average daily trading reaching over HKD 240 billion, an 82% increase year-on-year. At the same time, the main Hong Kong stock index climbed nearly 44% compared to the same time last year, far outpacing peers in Shanghai and Shenzhen.

Several factors are fueling this optimism. First, improved market liquidity—helped by regulatory reforms—has made Hong Kong more attractive to both institutional and international retail investors. Chinese government support and strategic initiatives by the Hong Kong Stock Exchange (HKEX) have also encouraged more A-share listed companies to seek secondary listings or dual listings in Hong Kong.

Geopolitical Shifts and Changing Fundraising Strategies

Historically, many large Chinese firms preferred to raise capital in the United States. However, rising geopolitical tensions and shifting regulatory landscapes have prompted a trend reversal. The ease of direct trading on Hong Kong’s exchange and more favorable regulatory conditions have made the region a preferred destination for capital raising, especially for companies that are also listed on mainland Chinese exchanges.

A standout example is the battery giant CATL, which led the largest global IPO this year. Heavyweights such as BYD and Xiaomi have contributed to Hong Kong securing three of the world’s top five ECM deals in the first half.

Regulatory Initiatives and Market Innovation

The success of Hong Kong’s equity markets is not just due to macro trends—it’s also about regulatory innovation. Reforms enacted in 2024 allowed issuers to employ more flexible offering structures, such as upsize options and call spread overlays. These features helped companies match the scale of their fundraising to actual investor demand and contributed to a wave of equity-linked deals and share buybacks.

In May 2025, the joint launch of the Technology Enterprises Channel (TECH) by HKEX and the Securities and Futures Commission introduced a fast-track route for Specialist Technology and Biotech firms. This measure has further accelerated the listing process and boosted market confidence, attracting high-growth, innovation-driven companies to the exchange.

Outlook for the Second Half of 2025

Market optimism remains strong as analysts project 90 to 100 IPOs for the full year, with the pace set in the first half likely to continue. Increasing international investor demand for core Chinese assets, combined with ongoing policy support and innovative financial products, suggests that Hong Kong’s momentum will extend into the foreseeable future.

The Hang Seng Index is expected to remain resilient, with substantial trading volumes and a healthy pipeline of upcoming IPOs. While some volatility persists—driven by global macroeconomic uncertainty and geopolitical risks—Hong Kong’s swift market reforms and sustained investor interest signal a positive trajectory.

In summary, Hong Kong has firmly reclaimed its status as a leading global financial center in 2025. By fostering innovation, improving market accessibility, and navigating geopolitical headwinds, it is not only redefining its role in Asia but also shaping global capital flows for years to come. For investors and issuers alike, Hong Kong’s resurgence offers both unprecedented opportunities and a testament to the power of adaptive market leadership.