|

| Gold V.1.3.1 signal Telegram Channel (English) |

How Powell’s Dovish Fed Signals Are Driving Gold and Silver Prices Higher in 2025

2025-08-25 @ 19:01

Gold and Silver Price Forecast: How Powell’s Dovish Signals Shape the Precious Metals Outlook

Gold and silver have entered a new phase of momentum, fueled by changing dynamics in global monetary policy and the shifting tone at the Federal Reserve. Recent remarks from Fed Chair Jerome Powell, interpreted as dovish, have sparked a notable reaction in precious metals markets. Let’s explore how these developments affect gold and silver’s trajectory for the latter half of 2025—and what investors should watch out for.

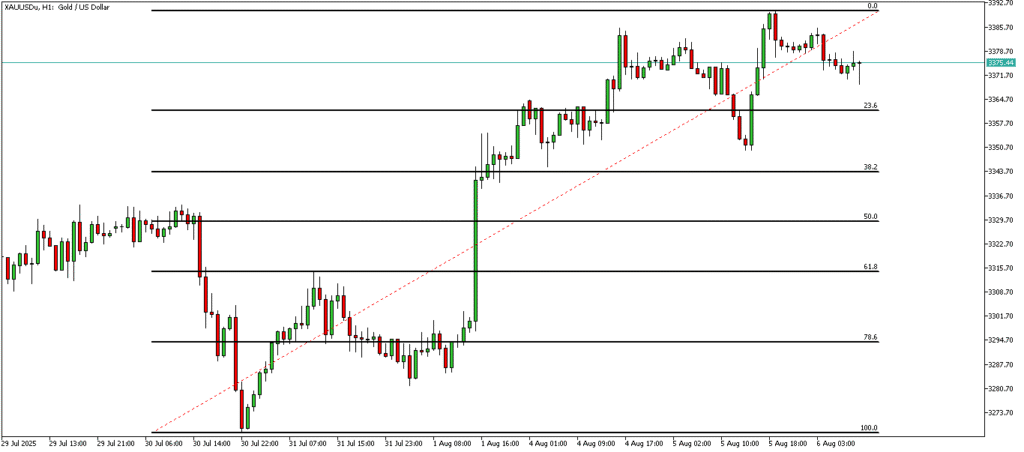

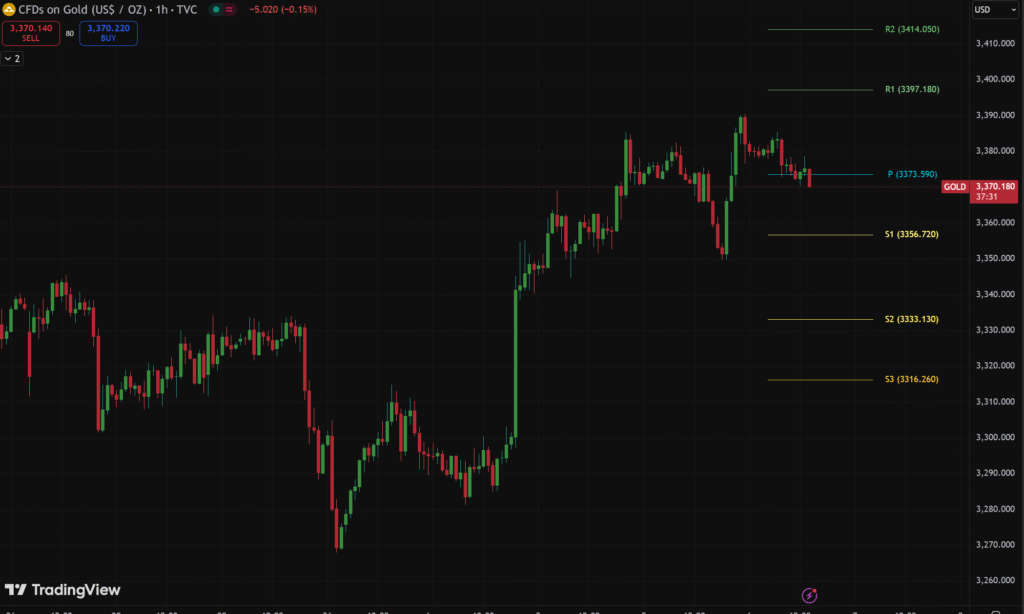

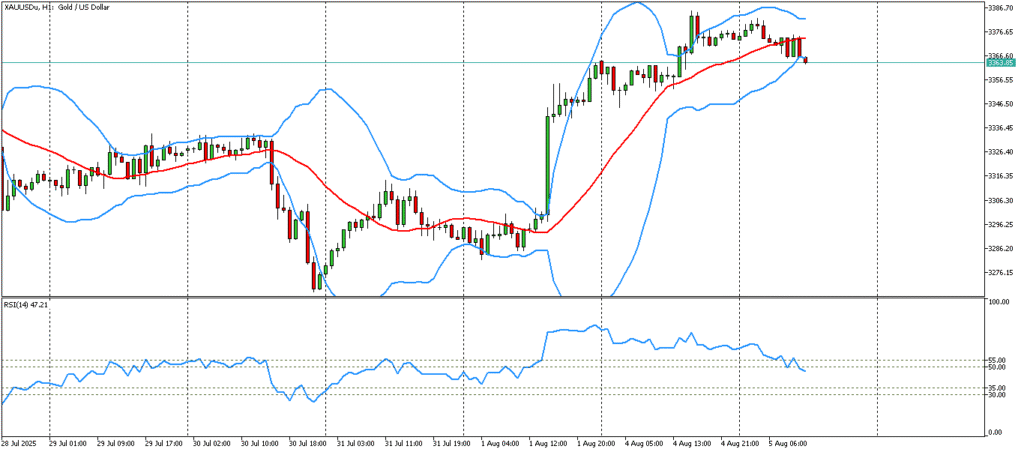

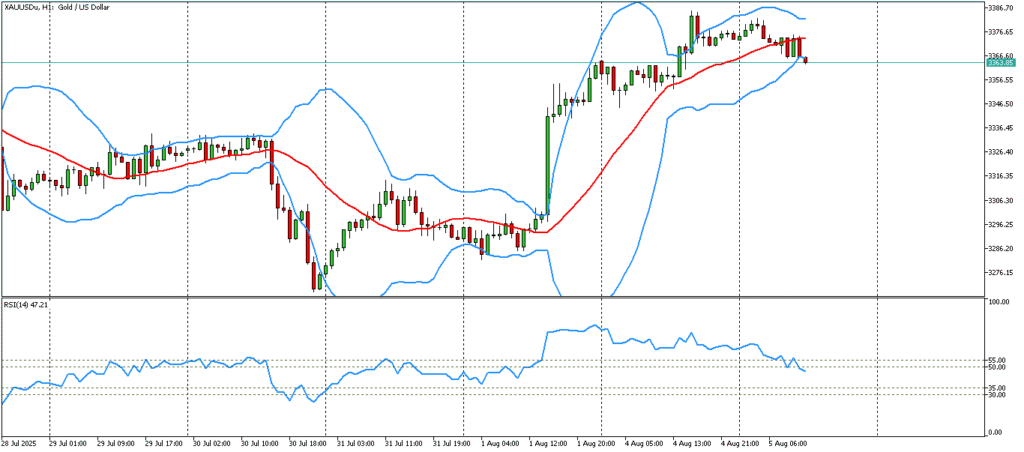

Gold Surges to New Highs, But Is a Pullback Coming?

Gold futures have recently soared to fresh all-time highs, underscoring strong investor demand amid ongoing macro uncertainty. The surge was accelerated by Powell’s dovish comments, which suggested that further rate hikes may be unlikely, keeping real yields in check and supporting non-interest-bearing assets like gold.

Despite the recent bullish surge, technical indicators and market history hint at caution. The behavior of gold, silver, and mining stocks currently mirrors their movements during the 2011 peak. Specifically, the GDX ETF—a leading benchmark for gold stocks—has reached what many consider its ultimate resistance level, reminiscent of a prior market top.

Additionally, the U.S. dollar appears positioned for renewed strength following a long-term bottom and a confirmed breakout. Stabilizing global tariff policies are adding to the dollar’s resilience, which could pose a headwind for gold prices in the coming weeks and months.

Institutional Price Targets for Gold in 2025

Financial institutions have updated their forecasts to reflect gold’s impressive run. Many now expect gold prices to remain elevated, with targets ranging from $2,700 to $3,900 per ounce:

- Goldman Sachs: $3,700

- J.P. Morgan: $3,675

- Bank of America: $3,500

- UBS: $3,500

- OCBC Bank: $3,900

- Citi Research: $2,700–$3,300

The consensus is that gold may approach $3,500 by year-end, though some analysts anticipate a spike even higher under optimal conditions. However, the risk of a technical pullback remains, especially if the U.S. dollar rallies or geopolitical tensions ease.

Silver’s Moment: Industrial Demand Meets Precious Metal Appeal

Silver has lagged gold in headline coverage, but 2025 has seen it quietly outperform, rising nearly 30% year-to-date and trading around $37.50 per ounce in mid-August. This rally is attributed both to silver’s dual status as a precious metal and its significant use in industrial applications—especially as global manufacturing, solar energy, and electronics sectors see continued expansion.

Analyst forecasts for silver in 2025 show a moderately bullish but volatile outlook:

- ING Think: About $31 per ounce through 2025 and 2026

- Scotiabank: Average of $31.86 for 2025

- UBS: Targeting $38–$40 per ounce near-term

- Macquarie: Predicts a $36 average in Q3 and Q4 2025

- JPMorgan: Expects silver to reach $38 per ounce by late 2025

- A Reuters survey: Average price of $33.10 for 2025, rising to $34.58 in 2026

Silver’s unique blend of investment appeal and industrial demand positions it for ongoing momentum, especially if economic growth continues and green energy initiatives expand.

Why Are Precious Metals Rallying Now?

The bullish case for gold and silver in 2025 rests on several pillars:

- Central Bank Policy: As the Fed shifts to a less hawkish stance, expectations for steady or lower interest rates support precious metals.

- Macro Uncertainty and Inflation Concerns: Elevated inflation, economic volatility, and geopolitical risks drive demand for safe-haven assets.

- Weakening Real Yields: Lower interest rates enhance gold and silver’s attractiveness relative to bonds and cash.

- Dollar Dynamics: Any reversal of dollar strength further boosts non-dollar denominated assets like gold and silver.

Yet, technical and fundamental signals suggest that markets could be nearing overbought conditions. If economic clarity emerges and the dollar strengthens, a correction could follow the recent rally.

What Should Investors and Traders Watch?

Precious metals remain highly sensitive to central bank guidance, inflation data, and currency fluctuations. For gold, a break above recent highs could trigger fresh demand, but watch for resistance near prior peak levels. For silver, industrial momentum could remain strong—especially with innovations in renewables and electronics—but volatility is likely to persist.

- Short-term traders: Consider the potential for both exuberance and technical retracement. Recent price action suggests mounting risks at overheated levels.

- Long-term investors: Both gold and silver retain strategic appeal as hedges against inflation and economic uncertainty, though careful monitoring of macro trends and chart patterns is essential.

Conclusion

Gold and silver’s outlook for late 2025 is shaped by the interplay between dovish Fed signals and global uncertainty. While price forecasts remain bullish in the near term, caution is warranted as markets face possible resistance and evolving dollar dynamics. Stay informed, be vigilant with your risk management, and remember that precious metals often shine brightest in times of potential transition.