|

| Gold V.1.3.1 signal Telegram Channel (English) |

How the Politicization of Official Economic Data Is Driving Investors to Alternative Market Insights

2025-08-18 @ 01:00

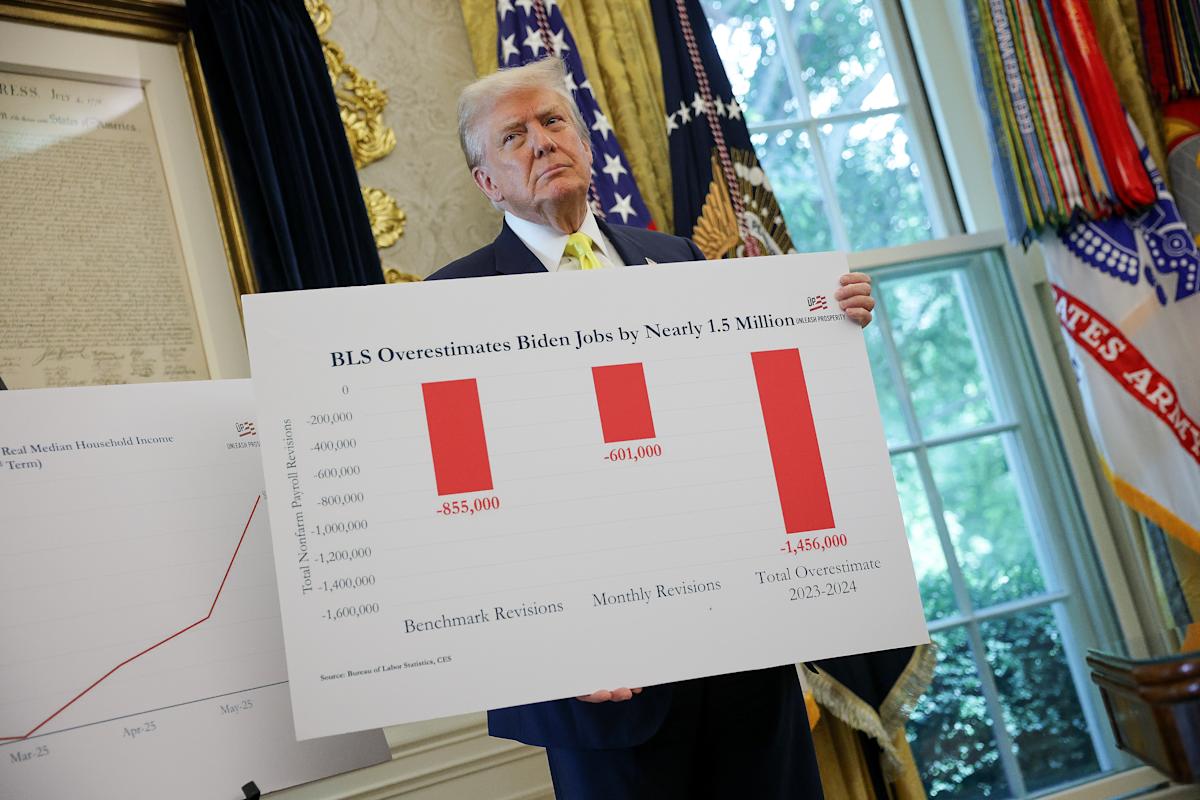

In recent weeks, the financial world has seen a flurry of discussion around the increasing intersection between official economic data and political interests. This debate was amplified when key government positions, traditionally filled by technocrats, were reassigned to individuals with stronger political affiliations, raising questions among investors and analysts about the neutrality and reliability of official statistics. As market participants grow wary of the potential politicization of data, they are actively seeking alternative sources of economic information to inform their investment decisions.

The crux of the concern lies in the shifting responsibilities within major economic agencies. When leadership transitions occur and political profiles take precedence over professional economic expertise, the risk of data being used to serve political agendas rather than objective fact increases. Investors depend on accurate, unbiased statistics to gauge the health of an economy, assess risk, and identify opportunities. If these numbers become questionable, the ripple effects are felt across portfolio allocations, market sentiment, and long-term planning.

This environment has made alternative data sources increasingly popular. Investors are turning to private sector research, international databases, and real-time market indicators to corroborate or replace official figures. Examples include using trade data from shipping companies, credit card transaction statistics, satellite imagery of industrial activity, and even energy consumption reports for an objective read on economic momentum. Such measures serve not just to confirm official data, but in some cases, they are relied upon as more trustworthy proxies for economic trends.

This shift also highlights the fundamental role that data transparency and proper governance play in financial markets. When official numbers are perceived as reliable and neutral, confidence prevails, liquidity improves, and investments flow smoothly. In contrast, any suspicion of manipulation or bias leads to greater volatility, risk premiums, and a flight to safety as investors hedge against unknowns. Policymakers and statistical agencies, therefore, have a vested interest in maintaining the integrity and professionalism of their data reporting methods.

Looking at recent market movements, one noticeable impact has been increased volatility in sectors tied closely to data-sensitive policies, such as banking, real estate, and commodities. For instance, unpredictable shifts in credit growth figures or sudden revisions to employment data can prompt rapid changes in investor behavior, sometimes causing short-term market disruptions. Meanwhile, international investors tend to exercise more caution, slowing down capital inflows and scrutinizing cross-border investments more thoroughly.

Another important dimension is the broader consequence for economic policy. Sound policy decisions rely on accurate readings of the current state of the economy. If decision makers, whether public or private, are forced to question the foundation of official statistics, the prospects for effective interventions—be it stimulus packages, interest rate adjustments, or regulatory tweaks—are severely hampered. This, in turn, can slow down growth and increase the risk of policy errors.

On a more positive note, the current environment has encouraged a wave of innovation in financial data collection and analysis. The rise of big data and fintech has enabled real-time monitoring of economic activity. Crowd-sourced data and open platforms are increasingly sophisticated, providing detailed and granular insights well beyond what traditional surveys offer. As a result, analysts and investors are equipped to make faster, more informed decisions while also reducing their reliance on any single official source.

The challenges facing the relationship between official statistics and market trust are not new, but in the current climate of global uncertainty and rapid change, they seem more acute than ever. For financial professionals and investors, the key takeaway is the importance of diversification—not just across assets, but across data sources. Relying exclusively on government figures may no longer be sufficient; instead, integrating alternative data, maintaining an independent analytical framework, and keeping abreast of global best practices have become essential tools for navigating today’s markets.

For policymakers, the path forward should focus on strengthening institutional independence, reinforcing transparency standards, and engaging openly with market participants. Only by doing so can they restore—and then sustain—the trust that drives investment, innovation, and economic growth.

Ultimately, questions surrounding the politicization or credibility of official data will continue to be a concern in global markets. Investors, analysts, and policymakers alike must remain vigilant and adaptive, embracing new tools and perspectives to ensure their decisions are informed by the most accurate and unbiased information available. This era of change offers both risks and opportunities, but with the right strategies and commitment to integrity, the foundations of market confidence can be secured for the long run.