|

| Gold V.1.3.1 signal Telegram Channel (English) |

Jackson Hole 2025 and Walmart Earnings: Key Market Signals for Federal Reserve Policy and U.S. Consumer Outlook

2025-08-17 @ 21:00

The upcoming week promises to be a pivotal one for financial markets, as attention turns to the annual Jackson Hole Economic Policy Symposium and quarterly earnings from major retailers like Walmart. Investors are closely watching these events for clues about the future trajectory of U.S. monetary policy, the strength of the American consumer, and the direction of equity markets for the remainder of 2025.

Jackson Hole: Federal Reserve’s Next Move Under Spotlight

All eyes are on Federal Reserve Chair Jerome Powell’s much-anticipated speech at Jackson Hole, Wyoming, set for August 22. This central banking symposium, hosted annually by the Kansas City Fed, is renowned for shaping global monetary policy discussions and is often a forum where the Fed signals shifts in its policy stance. This year’s conference, themed “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy,” takes on added significance amid economic uncertainty.

With U.S. inflation currently at 2.7% and unemployment inching up to 4.3%, the economic environment is far from settled. The Federal Reserve faces mounting pressure from multiple fronts. Political actors, notably those aligned with the Trump administration, are calling for interest rate cuts to prop up growth as election pressures mount. Simultaneously, the Fed’s own credibility and its longstanding commitment to containing inflation remain under close scrutiny.

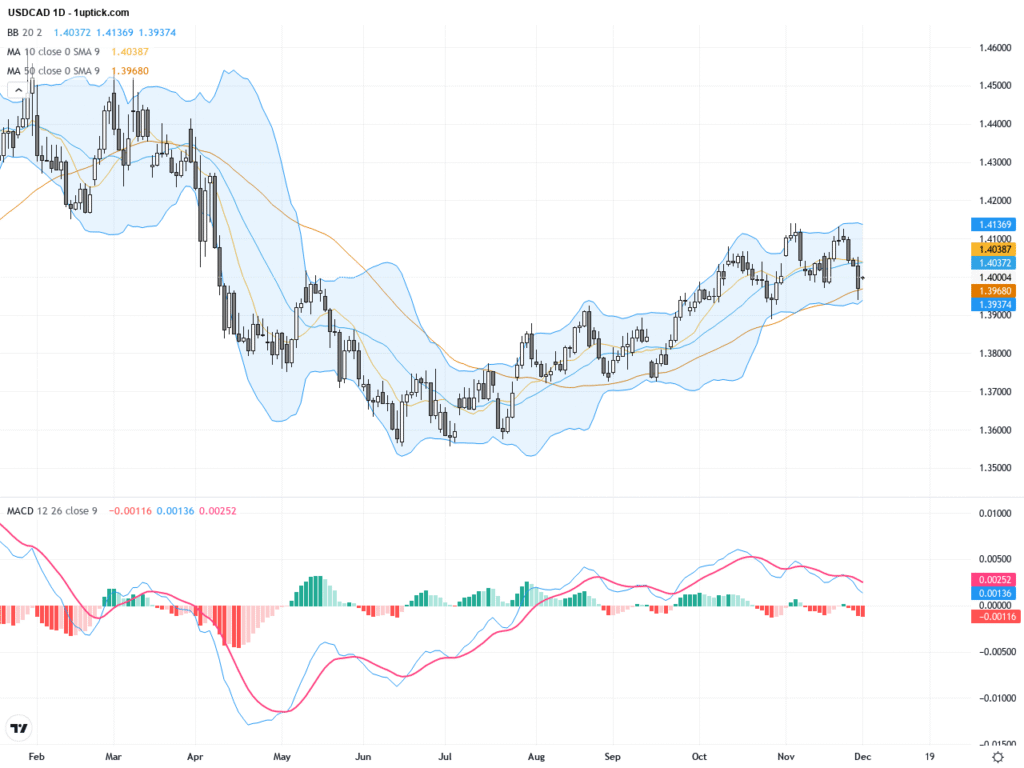

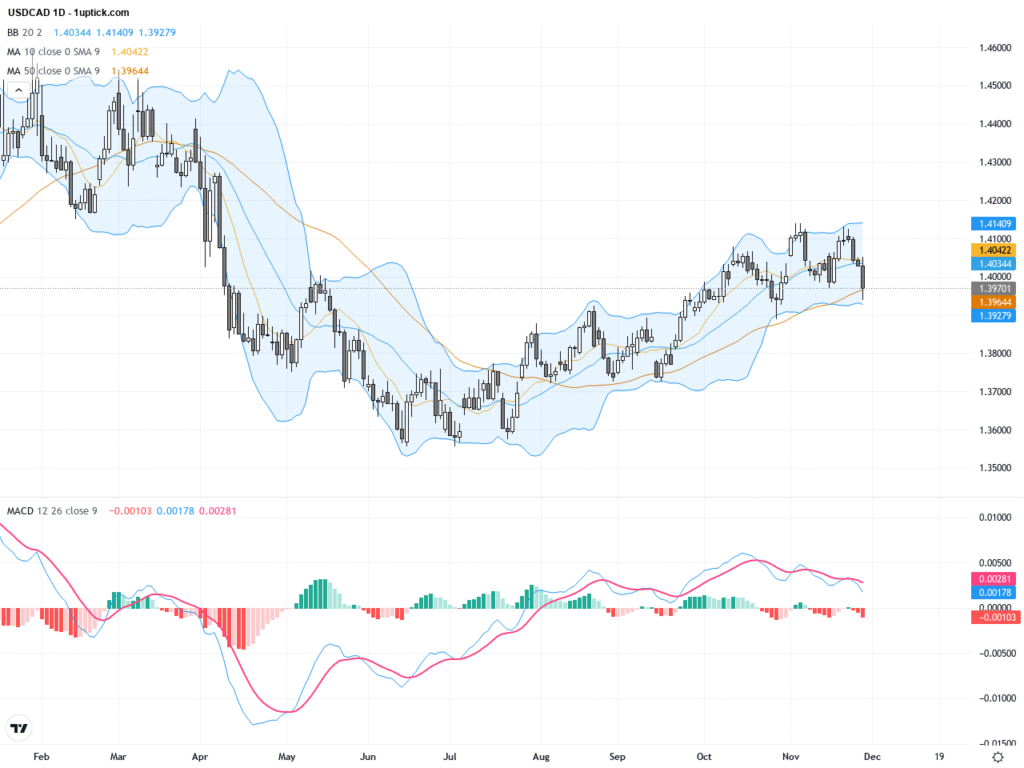

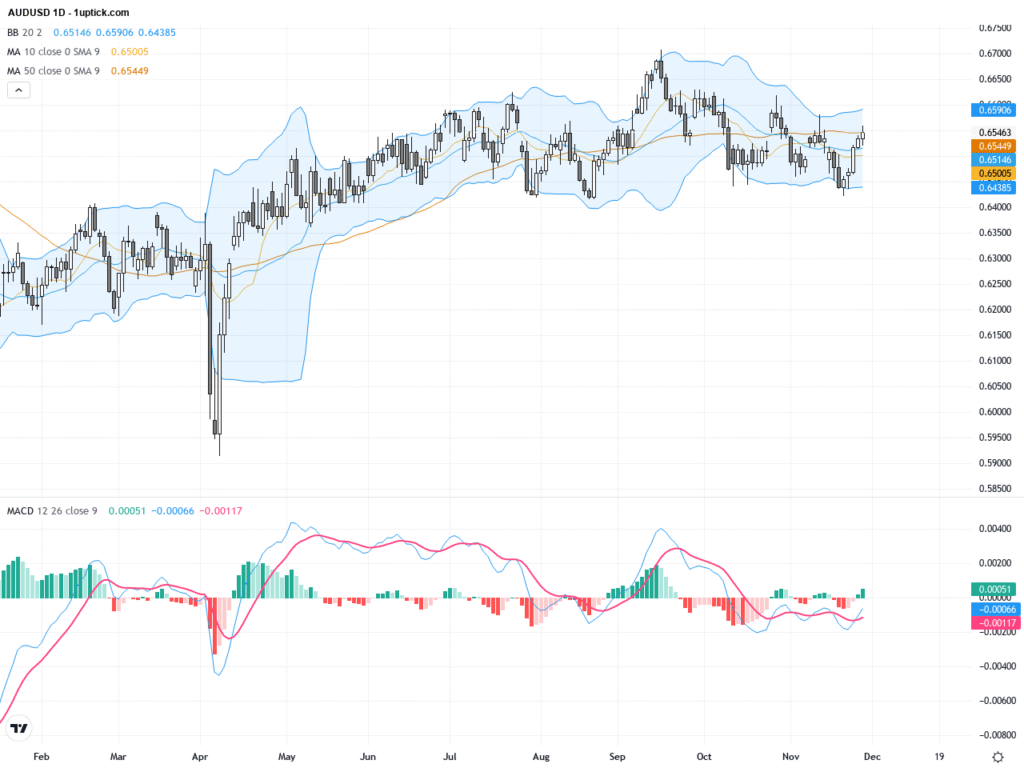

Investors are eager to see whether Powell will hint at a shift toward policy easing, such as the speculated 25-basis-point rate cut in September. Any dovish turn could trigger market volatility—especially if the pace of monetary easing does not keep up with market expectations. Conversely, a more patient approach to rate cuts could bolster the Fed’s anti-inflation credentials but risk disappointing market participants who see policy tightening as a threat to economic momentum.

Portfolio Positioning: What Investors Are Considering

Given the current landscape of slowing labor markets, persistent (though moderating) inflation, and uncertainty over the Fed’s next move, investors are reassessing portfolio strategies. Many equity strategists advise underweighting overvalued technology stocks, which have been particularly sensitive to rate expectations and macroeconomic headwinds.

Mid-cap stocks, especially those less exposed to global volatility and more attuned to the U.S. consumer, are finding favor as a relative safe haven. There is also growing interest in extending bond portfolio duration. With the potential for lower rates on the horizon, longer-term bonds could benefit from any downward shift in yields.

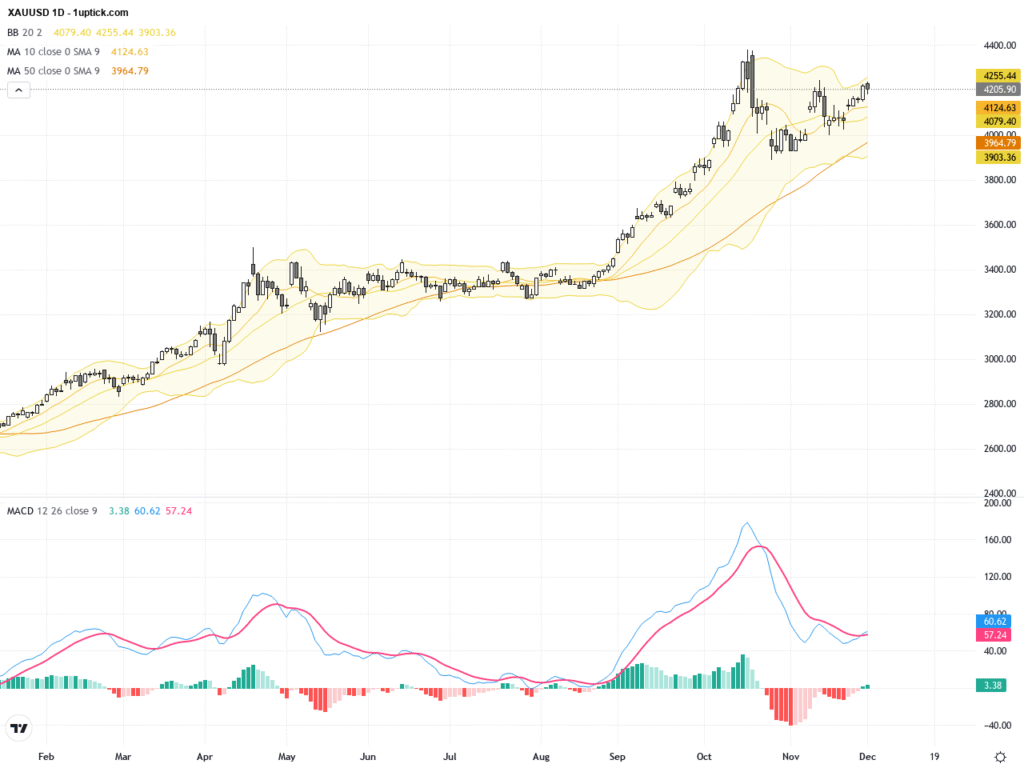

Selective hedging is at play too, with investors turning to gold and energy commodities for diversification. Gold, in particular, remains a classic hedge amid monetary policy and political uncertainty. Crude oil and other energy futures are likewise attracting interest, as supply dynamics and geopolitical factors provide potential upside.

Earnings Season: Walmart and the American Consumer

This week also brings quarterly results from Walmart, often seen as a barometer for the broader U.S. consumer. Amid persistent inflation and mixed labor market signals, Walmart’s guidance will offer crucial insights into consumer spending patterns and the resilience of Main Street Americans.

Analysts will be watching for trends in discretionary versus essential spending—whether customers are trading down to value brands, scaling back on non-essentials, or maintaining spending on groceries and household staples. Strong results might reassure investors that the consumer continues to underpin economic momentum, even as other indicators waver. Conversely, any signs of weakening demand could stoke fears of a wider slowdown.

Broader Market Implications

The interplay between Federal Reserve policy, macroeconomic data, and corporate earnings will shape market sentiment in the coming weeks. Investors must remain nimble as monetary policy expectations shift and new data emerge. The market’s next moves will hinge not only on Powell’s tone and guidance but also on the realities facing U.S. households as reflected in Walmart’s results.

While many hope for clarity from Jackson Hole, recent history reminds us that central bankers often prefer to maintain a degree of strategic ambiguity, giving themselves flexibility in the face of unforeseen shocks. As a result, expect markets to remain volatile, with heightened sensitivity to both policy signals from Wyoming and hard data from America’s heartland.

The bottom line: this week, watch for Powell’s language, follow the data, and be prepared for shifts in both policy and sentiment. The coming days could help define not just the next few months, but the arc of the U.S. economy moving into 2026.